Darknet markets — which let participants conduct anonymized transactions using software like Tor and I2P — have continued to see a rise in the use of bitcoin, despite the plunging prices.

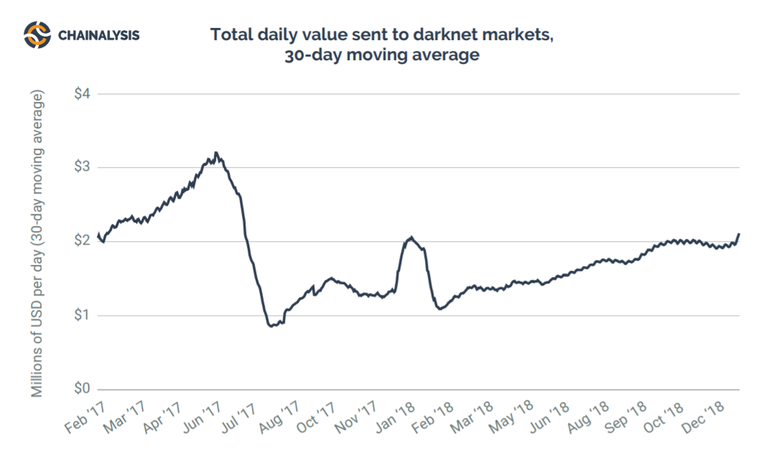

In fact, the value transacted in bitcoin on darknet markets increased by 70 percent in 2018. This is revealed in a Chainalysis report that promises to "decode" the role of cryptocurrency in hacks, scams, and darknet markets.

CipherTrace, a competing crypto intelligence firm, has also released a report on crypto crime, and CEO David Jevans told BNC that the growth of bitcoin use in these areas is being driven by rising awareness, as criminals, terrorists and sanctioned nations wake up to the possibilities offered by cryptocurrency: "The increased media attention and prices of cryptocurrencies has directly attracted the global cybercrime communities," he says. "These are criminals who have spent the last 2-10 years phishing banks, developing ransomware, creating malware and viruses. These cyber criminals now know that cryptocurrencies are the area to attack in 2018 and 2019."

To help explain the phenomena, Jevans draws parallels with the first wave of online banks and payment services, which suffered similar attacks before the industry developed sophisticated security measures.

Whack-a-mole markets

One of the most difficult illicit uses of cryptocurrency to curtail is darknet markets, which are continually shifting in response to enforcement efforts. As one platform is shutdown, participants simply move business elsewhere, switching platforms and technologies to evade the authorities.

After the closure of Alphabay in 2017, which was thought to be the largest darknet marketplace, bitcoin transaction volume in this segment dropped significantly. But since then, transaction volume has been climbing as activity has been redirected into alternatives like Hydra, a competing Russian darknet market that Chainalysis claim has now received over $780 million in bitcoin, an increase of 14 percent from AlphaBay's $690 million total.

According to Chainalysis, darknet sellers are also now peddling their wares using a new "distributed" model, which relies on encrypted messaging apps like Telegram and WhatsApp to execute illegal transactions without the need for a third party.

But even as marketplaces retreat into the darker corners of the web, the same cryptocurrency is coming out on top: bitcoin. Jevans suggests this is because "it's difficult for the typical lay-person to acquire privacy coins", and also because bitcoin can be "tumbled and laundered" to help make it anonymous.

However, despite its ready availability, and claims of anonymity through tumbling, Jevans suggests that the practice offers varying levels of privacy to those wanting to obscure transactions: "Tumbled transactions are detectable, but there are challenges to deanonymizing them. Some are easily de-anonymized. Others are very difficult. Getting a picture of the amount of anonymized/tumbled transactions can be done with a fairly certain measure of accuracy." said Jevans.

Despite this, bitcoin remains the most popular crypto on the darknet, with anonymous coins representing only a very small proportion of all transactions — and with the most popular privacy coin Monero sitting at "5 percent or less" of darknet transactions according to Jevans.

A shrinking proportion

Across all the scams, hacks, and darknet market transactions surveyed by Chainalysis, the total number comprised less than 1 percent of all economic bitcoin activity in 2018, down from 7% in 2012.

These findings match comments made by the U.S. Drug Enforcement Agency in mid-2018, which stated that criminal activity was behind only around 10 percent of bitcoin transactions, having shrunk from 90 percent in 2013 after the dark web marketplace Silk Road shutdown.

Since then, bitcoin has become more popular with speculators, and the number of transactions has continued to grow. At the same time, the proportion of darknet activity has shrunk, shifting the ratio in favour of legal uses of bitcoin. "In terms of gross volume," says Jevans, "darknet is growing but not nearly as fast as the rest of crypto — so darknet transactions are a shrinking percentage of the overall."

At $2 million daily, the 1 percent of total transactions that takes place on darknet markets represents a tiny proportion of the bitcoin used for speculative purposes. And, as economist Alex Kruger points out, represents a tiny proportion, couldn't compete with even the smallest crypto exchanges: "If darknet markets were a single exchange, it would not even make it to Coinmarketcap's Top 100 Cryptocurrency Exchanges by Volume." tweeted Kruger.

Subscribe to BNC's newsletters for insights and forecasts direct to your inbox