tl:dr; blockchain-based protocols can reward individuals who contribute in meaningful, indirectly financial ways to the growth of the network. This represents a wide-open space for marketers to create highly engaged communities that both generate high ROI relative to spend and high loyalty rates. The end result could yield very strong competitive advantages, if done correctly.

One of the core ideas in the The Decentralized Marketing Organization: How Crypto-Marketers Can Increase Token Value By Empowering Community Members was the idea that decentralized, crypto-based protocols could gain a material marketing advantage by embedding desirable community behavior directly into the tokens that support the network.

In other words, there could be a direct economic incentive for token holders to execute marketing activities on behalf of the network.

This might include activities such as driving awareness, building brand (aka network perception) and facilitating the acquisition of tokens by new members.

At a very different scale and a very different time, think Tupperware parties.

Easy to knock them, but ridiculously effective because people trust the recommendations of their friends and buy things for that reason. If the friend makes money, that’s ok, as long as there’s value there for the buyers.

The question then is: how do you do this type of activity at scale, across the entire customer journey (from awareness to interest to decision to action) and use crypto-tokens to do it?

I’ve thought a lot about this, but I want to call your attention to a fantastic article by David Truong and Adriana Truong, which I saw via Token Economy (one of the best newsletters in crypto).

It is entitled Incentivising participation and growth in communities (using crypto-economics).

I highly recommend reading it.

I was doubly excited because David is a almunus of our Crypto Explorers trip (in his case, CVT2) and I’ve chatted with him on a few occasions. In my opinion, David is one of the leading thinkers out there on the topic of influence marketing, community marketing, and how they interact with crypto-tokens.

I’ve been on the soapbox of “double down on your ‘Raving Fans'” for a long time now (going all the way back to 2008 with this e-Book), but David/Adriana have taken it to the next level.

They starts off by asking the key question:

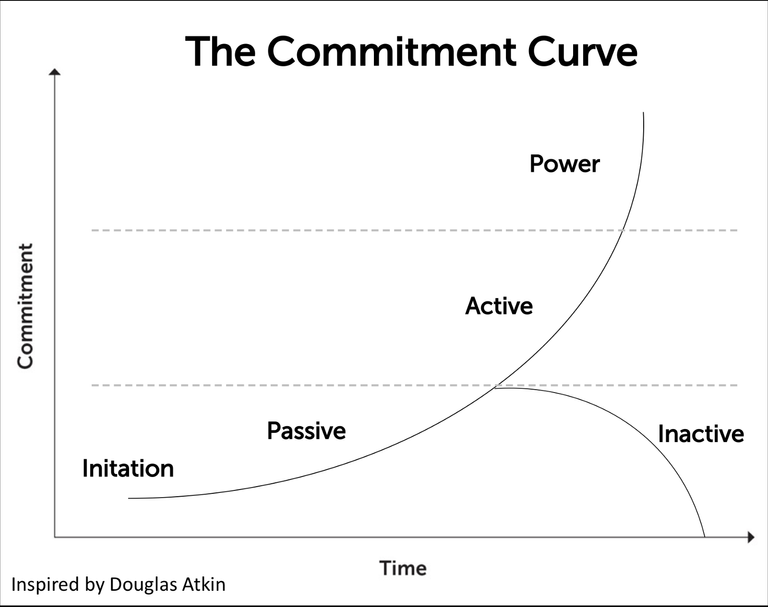

What if we could apply the game theoretic and crypto-economic principals inherent in cryptocurrencies to improve the design of the ‘Commitment Curve’, making it more objective?

The ‘commitment curve,’ as they call it, is something I used to term “The Raving Fan Index.”

Basically, we were looking for a way to objectively measure the relative level of passion that an individual has for a project or brand.

So, for example, if you and your best friend both love the Patriots or Yankees or Real Madrid or the LA Lakers, how would an independent third-party observer be able to tell which one of you actually cared more?

Call it a Passion-o-meter.

The framework, which they call “Khana,” relies on something called “dynamic bonding curves” (there’s a technical explanation of it here).

The basic idea, as I understand it, is that you earn tokens in the network as a function of how much you engage with the network.

You spend more time in the clubhouse being a good club member and you earn points (but in this case tokens) that can prove that you are passionate.

As they write:

**the number of tokens a member has in proportion to the token supply is a good proxy for a member’s community engagement. **

What I think is pretty cool about this is that, whereas in a Proof-of-Work system (like Bitcoin) or Delegated or regular Proof-of-Stake (like Ark.io– disclosure: former advisor), there exists the possibility of centralization because of concentration of power/wealth.

Theoretically, at least, a system that rewards people based on their relative contributions to the network has the opportunity to be more equitable.

They highlight a few key problems that this type of approach could potentially mitigate or solve for emerging crypto-protocols.

Lack of participation or engagement in community– motivate people to “jump in” via tokens (both non-economic “street cred” tokens, as well as economic tokens tradable for goods or services on open marketplaces)

Incentivizing people to reveal their talents to the network. For example, if you are a great copywriter, we need you to write copy, but if you don’t have a clear incentive (i.e. ‘way to monetize your skills that is obvious to you’), then the rest of us won’t know you’re really good at it. We’re leaving money (that is, talent) on the table. That’s a wasted resource.

Dealing with under-resource in the early days. This is akin to getting options in a company when you join. You get a token today as ‘payment’ for your early contributions to the network when the value is low. [This may make it a security token, as I’m not sure how this would be viewed vis a vis the Howey Test. If you want to go really deep on this topic, Peter van Valkenburgh is the best

Finding early adopters. I think of this one as a combination of #1 and #3, but it’s worth calling out.As they write,“alignment with the core value proposition of the community, or how much they feel they belong to the community” is very important. To me, this is about having a strong brand platform so it’s clear who should be a member of the tribe and who, well, shouldn’t be.”

Community Succession Planning…often times, communities are driven by a few really key passionate people, but eventually, they have other things they want or have to do. Succession planning is challenging (just ask GE).However, if token incentives for long-term planning were created so that leadership would be economically rewarded for picking great successors, that would place a higher emphasis on this critical activity. Imagine if Jack Welch couldn’t cash out his stock for 3-10 years (or whatever) after he left. Perhaps the Immelt time would have been different…or never even happened in the first place.

As if that is not enough, they point out that there may be a way to programmatically move people up the commitment curve (increase the Raving Fan-dom) using tokens.

It’s like “Nudge” all the way to the point where you get a tattoo of the brand on your arm and paint your face at home games.

If a protocol could bake that in so that it is automatic, that is the kind of thing that creates sustainable, defensible advantage.

This kind of marketing innovation is the kind of thing that gets me really excited and I’m thrilled that David and Adriana have contributed so much to the discussion on this.

Maybe we should give them some NSM tokens….

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

our discord. If you believe this is an error, please chat with us in the #cheetah-appeals channel in