Maker DAO is the No. 1 ranked dapp on State of the Dapps under Finance category across all blockchain based dapps.

One of the major industry blockchain technology is disrupting is finance and banking. Of late, we are seeing several ventures croping up to extend digital asset backed credit to investors of cryptocurrencies. Projects like Celsius, Nexo, Salt etc. are trying to serve this purpose of extending liquidity against the holdings of crypto assets. Maker DAO is striving to do this with a decentralized governance based model.

Maker DAO

Maker DAO is comprised of a decentralized stablecoin (called DAI), collateral loans, and community governance for bringing in transparency and sustainability in crypto finance.

Currently, it works for ETH holders only. A user can deposit their ETH assets as collateral in the form of WETH (wrapped ETH) and PETH (pooled ETH) is issued against that. PETH represents the proportion of your collateralized ETH vis-a-vis total pool of ETH in the system.

CDP - a portal to generate DAI

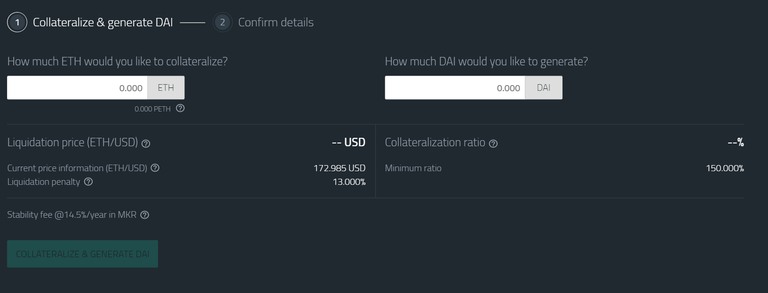

You can manage depositing and topping of your ETH deposits through Collateralized Debt Position (CDP) portal.

Maker DAO CDP is a smart contract running on Ethereum blockchain. Using this portal, you can deposit as much ETH for collateralization as you wish and then you can generate DAI tokens as debt against that deposit.

DAI - A stable currency

DAI is a stable coin soft pegged with USD and is backed by the collateralized ETH. So 1 DAI is always equal to almost 1 USD. You can generate DAI against your deposited assets as a credit and spend it wherever you wish to.

You can generate upto a maximum DAI of two-third of the market value of your CDP (collateralized ETH holdings). Thus to generate 100 DAI tokens (equalling 100 USD), you need to collateralize at least 150 USD worth of ETH. In the eventuality of ETH market prices falling below 150% of the DAI generated by you, your assets will be liquidated with a liquidation fee of 13% (at present)

To allow for market price fluctuations in ETH value, you are recommended to hold more than 150% ETH to safeguard yourself from asset liquidation. When you see your asset price falling below the 150% of the DAI generated by you, you can either deposit more ETH for collateraliztion or repay some DAI tokens.

When you re-pay DAI tokens, these tokens are burnt. When you generate DAI tokens against your assets, these are issued afresh. Thus the debt of DAI tokens is managed to provide them requisite stability and value. CDP smart contract controls the mining and burning of DAI and account for the total supply of DAI coin in proportion to the total assets leveraged at any given point in time.

Stabilization Fee

When you repay a loan, you need to pay its interest also. Here, when you deposit back your DAI issued against your CDP, a Stability Fee is charged. Stability fee is charged in MKR (Maker) tokens only. You would need to have sufficient MKR tokens to pay for your stability fee at the time of repayment of your loan.

Stability fee is calculated on the continuous compounding basis to track even the small accruals. There is no restriction on time duration for keeping your CDP open and you can keep it open as long as you want. Hence a continuous compounding is applied on the base rate.

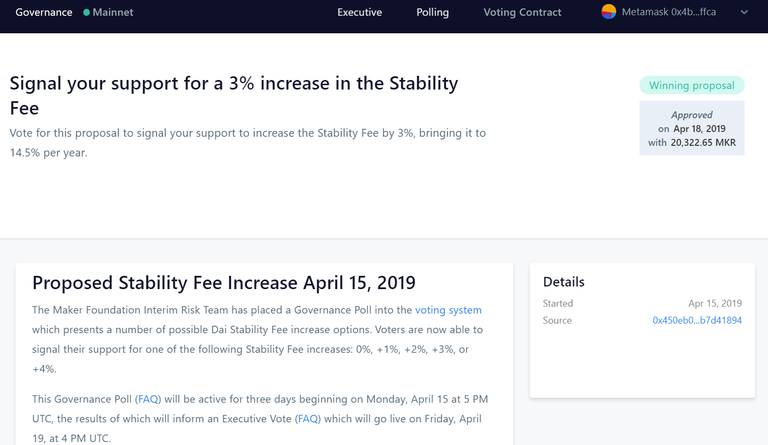

Currently Stability Fee is 14.5% p.a. (calculated continuously). Just a little over 6 weeks back, stability fee was only 1.5%. But ti has seen a drastic hike in the recent period. Community governance decide the rate for stability fee. It is done through voting by all MKR (Maker) token holders. MKR is the governance token for the DAI credit system. Every MKR holder can vote in proportion to their MKR holding to choose for the rate of Stability fee.

Here is the screenshot for the last approved proposal through voting:

All stability fee, liquidation fee or any earning go to the PETH pool and thus it is shared by all CDP owners. Similarly, if liquification of any debt incurs a loss, it is shared by the PETH pool. Thus community ownership make the system sustainable.

My opinion on Maker DAO

DAI credit system is very well thought of and immaculately designed to perfection. All community owned governance system need a flawless execution design. Maker DAO has done a great job in achieving that.

This system provides free and equal economic opportunity for everyone to participate in a fair crypto credit system. It also addresses the volatility issue through the introduction of a very stable DAI token that is helping to enhance the reach of digital money for practical day to day use.

Through this system, one can borrow on his / her own terms by setting the leverage ratio he/she is comfortable with.

Initially, the system appears to be somewhat complex and a user have to go through all the new terms like CDP, WETH, PETH, MKR, DAI, Stability Fee etc. This needs to be simplified. Introduction of two tokens DAI & MKR though essential is little confusing for the new user. An average user needs some education on managing his/her collateralized debt and to calculate on what is a more optimum leverage ratio for his/her assets considering the degree of risk he/she is willing to take. Some short and interesting tutorials are needed for this.

Implementation of Rocket Chat for communication isn't very appealing either. A user needs to create an account just for this purpose. I think a better solution can be integrated to serve this purpose.

There should be a link back to Maker DAO website from CDP portal. Many users land directly on CDP portal with no clue about main Maker DAO website.

Current Stability Fee is also too high and high volatility in Stability Feel is a big turn off for me from this credit system. I don't know what's the basis of this hike in Stability Fee by the community.The factors considered for it should be mentioned too.

But the system works flawless. I'd like such a system to work for other cryptocurrencies too and not just ETH.

I'd rate this dapp 3.8 out of 5.