By Crystal Stranger and Kyle Contreras of PeaCounts ON 7/15/2018 AT 9:30AM

What a valuable business looks like / Cultivated Culture

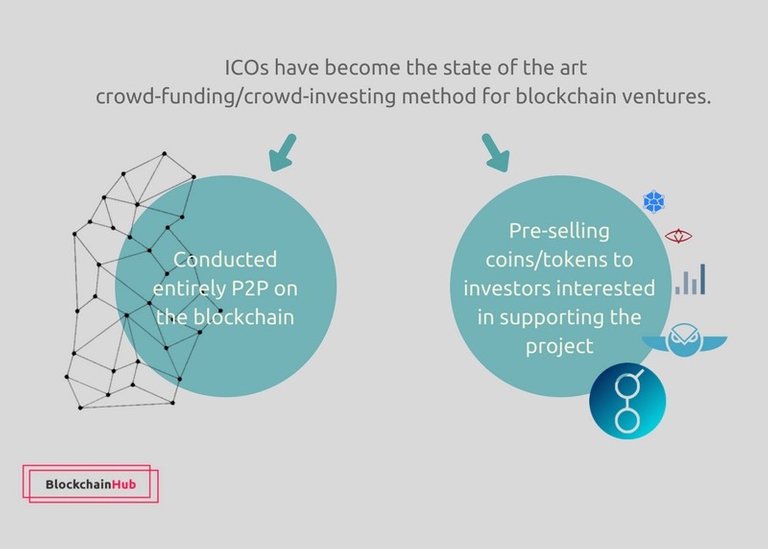

Fundraising for a startup used to be difficult. By opening the doors to legal crowdfunding for startups, the Jumpstart Our Business Startups (JOBS) Act was a game-changer. Over the past year and a half, issuance of Initial Coin or Token Offerings (ICOs) based on the Ethereum platform began to take off. Investing in a token rather than a share in a company through crowdfunding offers the investor at least one major advantage: It provides liquidity where the token can be re-sold if cash is needed. Nonetheless, the token offering world remains the Wild West, and new types of offerings keep coming out at a dizzying speed.

ICOs have come under increased scrutiny of U.S. regulators this year, and in response several new fundraising methods have been launched in addition to the standard utility tokens and cryptocurrency coin offerings: Security Token Offerings (STOs) are tokens that pay dividends based on earnings but do not offer the same rights as equity holdings and JOBS Coin Offerings (JCOs) are modeled on the JOBS Act, which enables smaller companies or startups to solicit funds.

1. Initial Coin Offerings

What is an ICO? / Blockchain Hub

The classic ICO involves offering a coin that can serve as a fungible medium of exchange similar to money. Many of the earliest cryptocurrencies such as Bitcoin and Litecoin were designed to be used purely as currency. Other tokens, such as Ethereum, were designed for other purposes but are used as a currency out of convenience.

Many of the cryptocurrency offerings to date have come under fire for creating coins that can be used for black-market transactions. The most well-known of these is Monero. Yet the popular belief that bitcoin transactions are anonymous is only partly true. The transactions are on a public digital ledger and with some effort, can be traced back to the sender. True privacy coins make this much harder to trace. But any transaction on a public ledger will always run the risk of being exposed. Still, privacy coins are one of the areas in which true cryptocurrency coins have still been more recently issued.

2. Utility Token Offerings

Many other companies have issued tokens that will have a use within their ecosystem — similar to airline loyalty reward points — but as a tradable asset. These tokens provide a utility mainly within their network. Any investment value should be a minimal consideration. Many companies issuing utility tokens violate the principle of this utility status by marketing to investors. Any utility token that guarantees investors a return should be avoided at all costs, as they will be redetermined as a security.

Utility tokens have also been used for art projects. Among the more well-organized projects on this front is Crypto Kitties, which has proven to be the most successful launch of any token on top of the Ethereum network. Actually it was too successful — when the game took off, it clogged the network and brought transaction speeds to a sluggish pace.

3. Security Token Offerings

Image of the SEC office in Washington D.C. / FMP Consulting

Are cryptocurrencies securities? Government officials have considered this question several times, with various departments giving a plethora of answers. Some companies have taken the guesswork away, by calling their offerings Security Tokens from the get-go. The STO movement is in response to a March Securities and Exchange Commission meeting during which Chairman Jay Clayton stated,

I believe every ICO I’ve seen is a security.

These tokens are tied to assets or income of the company but can have more flexible agreements such as proxy voting built into the blockchain structure, and have the arrangements in place to meet any requisite legal requirements.

Other companies are offering two layers of their ICO: a first-round STO for accredited investors that pays a dividend based on profits, then a utility token offered to the public under the crowdfunding regulations of the JOBS Act that is then used to power the underlying technology of the system.

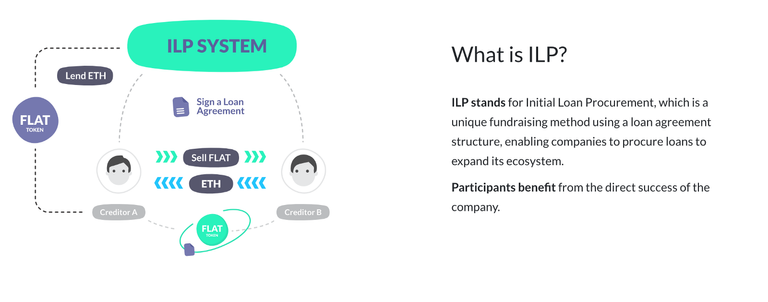

4. Initial Loan Procurements

What an Initial Loan Procurement is / Tokennote.io

A new financing opportunity for startups is the Initial Loan Procurement (ILP) pioneered by Blockhive. This is a hybrid token in which the token is essentially a marker for an underlying loan. When purchasing the loan through a secondary market, the new owner needs to sign a loan agreement online separately before they can receive the payment under third-party beneficiary law.

These tokens cannot be issued at a lower price to attract investment, otherwise they would be classified as a bond. Instead, they offer cash back to investors in the form of a consulting fee. The Hive Token issued by Blockhive is the first of these ILP arrangements. It will be interesting to watch how it is received by the cryptocurrency market.

5. JOBS Cryptocurrency Offerings

US and Canadian companies and investors in the space have launched The Institute for Blockchain Innovation (IBI), a think tank tasked with developing and promoting crypto industries. IBI chairman and co-founder Greg Keough is CEO of Finova Financial, a lending startup that uses customers’ cars as collateral that spearheaded the IBI. He has expressed the hope that the think tank will serve as an open-source community to foster blockchain innovation. Keough said, “We believe that the blockchain will be a powerful engine for bringing more people into prosperity while seeding innovation at an unprecedented level.”

The first stop on the IBI’s roadmap is to explore JCOs. A new fundraising approach conjoining Initial Coin Offerings with the more established format of Initial Public Offerings. A JCO issues securities which are later exchanged for crypto tokens by the company, while still complying with the JOBS Act regulation.

Image By Blocksafe

The primary benefits of the JOBS Act were twofold. Smaller companies with revenues under a billion dollars had reduced disclosure and accounting requirements for SEC filings. Secondly, it enabled them to raise funds from accredited and non-accredited investors, which relieved the necessity for venture capital money.

Forming a middle ground between ICOs and IPOs, a JCO has three elements. First, the startup company sets a target goal for fundraising from private investors while offering Block-SAFE purchase agreements to accredited investors in a pre-sale. Depending on the token offered, the purchase agreement may take the shape of Simple Agreement for Future Tokens (SAFT) or another form of purchase agreement without significant disclosure requirements. The relevant regulation may be Regulation D, which is used by companies claiming exemption.

After the target goal is met, the company files the documentation with the SEC and begins its public sale using Regulation A+, which has more stringent disclosure guidelines compared to Regulation D. This approach allows a company to entice funding from both accredited and non-accredited investors at the same time.

Keough stated, “This new roadmap provides liquidity in a crowdfunding model, constructs a more streamlined course to IPO, and expands funding opportunities past the traditional venture capital path.”

As blockchain technology becomes more widely adopted by the masses, only time will tell which form of offering becomes the norm, or if these both are replaced by an even more effective method. When it comes to the crypto markets, the match is meeting the fuse. The many fundraising opportunities provided by ICOs and the JOBS Act stand to fuel more innovation than any of us could predict.

PEACOUNTS

PeaCounts, a blockchain accounting software company that is building a revolutionary new payroll system using the token PEA. This new, transparent payroll will promote fair wages and eliminate the need for black market labor.