Remember when you first heard the term Amazon? Books online? That’s an innovative and cool concept. Now, forget the books. The Amazon Marketplace has turned into a monolithic hub for well… Everything! Jeff Bezos, who is the current CEO and founder of Amazon has amassed a fortune worth over $120 Billion Dollars.

Jeff Bezos is the richest man in the world. (1) And to think he surpassed Bill Gates, and his fortune from introducing the PC into the home, in less than half the time. If you had invested in Amazon just 10 years ago, you would have approximately $12,000. (2)

Here are some more statistics to put Amazon's rate of growth into perspective.

Not to rain on his parade, I love entrepreneurial pursuits, and believe they are the backbone of innovation. However, there comes a point where you have to question the moral motives of the complete disruption of industries. At it's basic function, disruption is good for business. It results in better competition and lower prices for consumers.

But we need to look at the bigger picture here. It all boils down to.. how big is too big? Here's the catch: no one can compete with Amazon's supply chain and E-Commerce/warehouse intellectual property.

Amazon is dipping their coveted Intellectual Property and Ecommerce monopoly into a multitude of industries. Here are a few that are already taking place:

Grocer Industry

In 2017, Amazon announced a deal to acquire Whole Foods. A high-end grocer worth a little over $75 Billion. Now, I don't know if you've ever been into a WholeFoods, but the prices are absurd. $6 for a carton of organic eggs? I don't think so.

Whole Foods had been hurting financially for some time, they couldn't keep their finances above water. In swoops Amazon, in which they offer $14 Billion for Whole Foods. Amazon's goal is to leverage Prime membership to make Whole Foods Groceries cheaper.

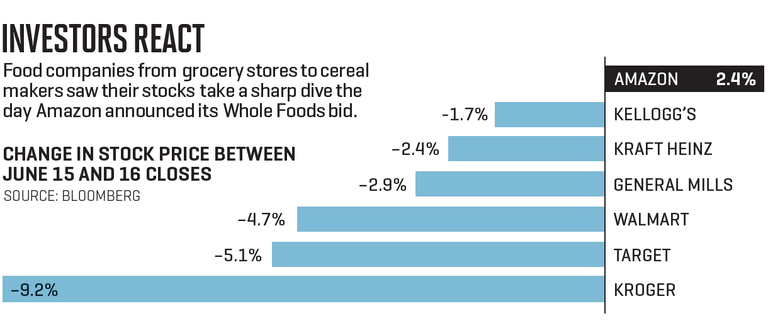

Now, the only company who could probably pull this off, is Amazon. However, let's take a look at the impact it has/will continue to have on other grocers in the industry, and more importantly, restaurants. With the decrease in overall foot traffic, restaurants have fared poorly against the up and coming competition. From Uber Eats and Blue Apron to Amazon Fresh, restaurants have been suffering. Now, with the Amazon acquisition of Whole Foods, they will suffer even more.

As Amazon capitalizes on this emerging opportunity, they are instilling fear and uncertainty into the other grocer's.

Don't get me wrong, I'm all for cheaper groceries and favor competition; but not when one of the competitors has a distinct, irreplaceable competitive advantage. Supermarket food services account for over $32 Billion in consumer spending.(6)

Amazon Health Care

In 2018, Amazon is hungry enough to take on the Healthcare industries. Amazon, JPMorgan, and Warren Buffet are up to something. The joint statement they issued about the new company were very vague.

"The initial focus of the new company will be on technology solutions that will provide U.S. employees and their families with simplified, high-quality and transparent healthcare at a reasonable cost."

Ok.. so what does that actually mean? It sounds like companies will self-fund health insurance. Perhaps the middlemen who contract health plans may be taken out of the equation. Self-insured employee plans.

The more they threaten third-party administrators, the more disruptive it could be. If Amazon is able to create a new working, efficient Health Care model with good interface; they could immediately start marketing it to large organizations.

Amazon has acquired wholesale drug distributors in 14 states..(7)Their end goal is in mail-order pharmaceutical distribution. They already have the supply chain distribution infrastructure in place, why not deliver drugs at half the cost? Whether they buy or build pharmacy capabilities is up for debate.

Where Are We Headed?

Amazon dominates E-commerce, and their online sales are 6 times greater than Walmart, Target, and other major players.(8).

When it comes to a digital economy, Amazon sure has gotten a strong foothold in it when it comes to supply chains and logistics. They are bulldozing the retail industry like it's child's play. But this train has already taken off, and it doesn't seem to be slowing down any time soon. By the FTC's definition, Amazon doesn't qualify as being a monopoly.

As long as consumers benefit, a company can control as much of the market as it possibly can.

1 in 4 U.S. Adults are Prime members.. what will happen in another 5 years.. 10 years?(9).

The problem is that the rate at which Amazon is developing is hard to quantify, analyze, and predict. The truth is, we don't know. Only time, and a free market, will decide the fate Amazon has on the world. The grocer, pharmacy, and restaurant industries have all taken hits from Big Brother Amazon. Who's next? And speaking of Big Brother, Jeff Bezos has been seen having meetings with the Pentagon. Why would a commercial company be meeting with the Pentagon?

Perhaps the NSA and Amazon "echo" and other "smart" products are working out a deal. All I know is that, as consumers, we should be more wary of Amazon and their true intentions.

It's a valid point about what is too big. Between Apple, Microsoft, Facebook, Google and Amazon, the disruptors are now the establishment, and they're all multinational conglomerates, collecting data from us in one way or another. Who needs a surveillance agency when you can just commandeer private enterprise?

Eventually, though, these giants get too big and they implode from within. I think we've been seeing that from GE for a while, and now they could lose their listing on the Dow to, guess what, Amazon. 40-50 years ago GE was the brand.

Personally, I hope the breakups of these huge corporations comes sooner than later. We need more smaller and mid-size disruptors, but if they're being squeezed out, or bought out, by the big guys, then it makes it that more difficult. And the last thing I want is to be dependent on the federal government to come in and hold anti-trust hearings because ultimately, it gives them favorable press, goodwill and clout that I don't really feel they deserve. One potentially positive action vs. a plethora of negative ones is still a bad net effect.

'Who needs a surveillance agency when you can just commandeer private enterprise?'

You're exactly right. And the GE scenario holds credence - in similar fashion, Amazon reminds me much of what Sears used to be, the one-stop shop for American families.

I too am hopeful there will be more disruption by smaller organizations, but as you state we live in the age of mergers and acquisitions. Always boiling down to money.

This platform, Steemit is a great working prototype, and gives me hope about future decentralization. Away from conglomerates and the archaic banking institutions.

Steemazon!

Congratulations @toddoto! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP