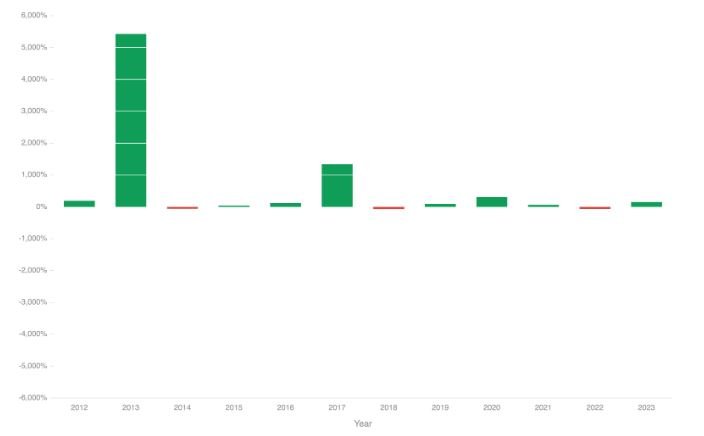

In a somewhat shaky and at the same time confusing time in terms of Bitcoin's price action performance, encouraging data appears such as, “Since its stock market debut in 2011, Bitcoin has delivered an impressive average annual return of approximately 104%, outperforming Warren Buffett's portfolio and the U.S. stock markets.”

In information recently uploaded by Yashu Gola, “If we compare Bitcoin's Compound Annual Growth Rate (CAGR) with the returns earned by Warren Buffett's portfolio - whose main holdings are Apple, Bank of America, American Express, Coca-Cola and Chevron Corp - we observe very different risk-reward profiles and returns over different timeframes”

To wit, “according to the Lazy Portfolio ETF data resource, Warren Buffett's portfolio has earned a CAGR of 10.03% with a standard deviation of 13.67% over the past 30 years. By comparison, portfolios of U.S. company stocks have offered roughly similar returns, but with a higher standard deviation"

It has been mentioned that, “Bitcoin's performance has been extraordinary. Since its market debut in 2011, Bitcoin has delivered an impressive average annual return of around 104%. This figure easily exceeds the returns of Warren Buffett and U.S. stock portfolios each year, on average, for the past 13 years."

An interesting fact is that, “Bitcoin remains highly volatile, with its price subject to extreme fluctuations, compared to the stable returns of Warren Buffett's portfolio. In recent years, however, Bitcoin has shown lower volatility than many S&P 500 stocks, such as Tesla, Meta and Nvidia"

SOURCES CONSULTED

Cointelegraph. Bitcoin vs. Buffett: BTC holders’ 104% CAGR dwarfs ‘steady growth’ portfolio. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph