Since the introduction of cryptocurrency, there has been a loss of faith in traditional money systems recently. The significant growth and confidence in the power of blockchain technology only show digital currency is here to stay, with the majority of these currencies such as Bitcoin, Ethereum, Neo, Monero etc, shows significant growth in value and are expected do more in future.

However, using cryptocurrency as payment instrument has a set back due its volatility in nature and also their growth in value has caused them to behave more like an asset than a currency . As a result, miners and investors would rather hold crypto asset than to use it as payment for goods and services. The good news is Money Token is here with a solution.

INTRODUCING MONEY TOKEN

For some time now, spending crypto asset as a means of payment for goods and services is a journey investor, users and miners don't want to embark on because, this will prevent them (Crypto Asset Holders) from gaining on any future growth in asset value. Holders would rather buy low and hold on to there investment in other to benefit from future selling high (Buy Low Sell High)

WHAT IS MONEY TOKEN?

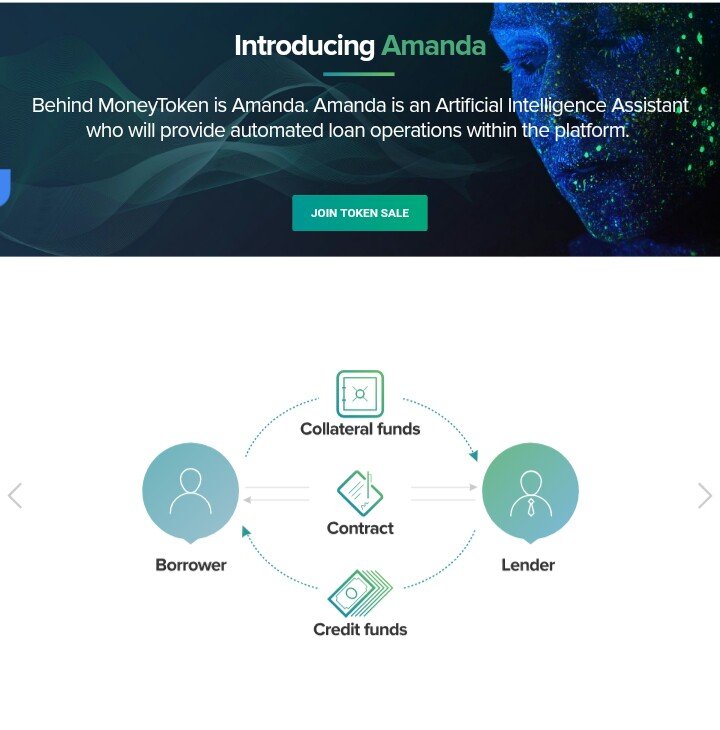

Money Token is a blockchain based platform which allows user to borrow liquid funds instantly, with the current value of the user cryptocurrency asset holdings intact.

Users can take a loan, using more volatile assets such as bitcoin or ethereum as collateral, in return user receive an agreed loan in stable currency.

WHAT IS STABLECOIN?

Stablecoins are cryptocurrencies created to be used in payments and purchases, they are designed to be stable in value (typically pegged to the value of the US Dollar) and embedded with a mechanism for self or central regulation and/or an algorithm to regulate the dificulty of mining or the release of new coins.

The only challenge is that, even if stablecoin cryptocurrency with a capitalization of several million, it’s probably not recognized by the Global fiat financial system as an asset. Even if on the governmental level the cryptocurrency has a certain status, the banking system and its loan services has no provision for cryptocurrency business or the holders of such an asset.

That is why Money Token blockchain-based credit system, provide a system in which the value of the collateral asset at any moment is public and the credit terms are transparent and fixed in a smart contract; no intermediaries are needed besides the link ensuring the completion of the transaction and the smart contract.

Under the conditions of a cryptocurrency economy, banks and contract participants’ competencies can easily be eliminated by smart contracts, with low cost of a loan and the conditions of applying for a loan can finally be made transparent to all parties.

LOAN CURRENCIES USED IN MONEY TOKEN PLATFORM

The goal of MoneyToken’s clients will be to obtain liquid funds in either fiat currencies (USD for example) or in stable cryptocurrencies that are more suitable for purchasing goods and services (stablecoins).

The most convenient option at the moment is USD Teher and MTC

USD TETHER

Tether is being accepted for deals on the majority of cryptocurrency brokers’ boards.

Tether’s market capitalization has grown from about $55 million in April 2017 to $430 million in September 2017, an

increase of 781%.

MTC

MTC is a stable ERC-20 token on the MoneyToken platform used as a credit currency for loans or exchanged for fiat

money. 1 MTC = 1 USD. The amount of issued MTC will be covered by CDP (Crypto Collateralized Debt Positions) or the

equal balance of USD on the platform’s bank accounts.

MONEY TOKEN ECOSYSTEM

The money token ecosystem and its amazing features includes:

INITIAL MONEY TOKEN (IMT)

The solution developed to minimize the risks, both for the platform itself and its users – a token with a specific

functionality.

MONEY TOKEN EXCHANGE

At the MoneyToken exchange service, users will be able to purchase and exchange cryptocurrency assets, as well as fiat funds. MoneyToken exchange will be used for automation collateral liquidation in cases of a collateral currencies price drop.

MONEY TOKEN SAFTY FUND

The credit fund regulates and influences the maximum possible amount of loans that the platform can give out.

MONEY TOKEN CREDIT FUND

MoneyToken safety fund will be created in order to level out any risks tied to a possible rapid drop of the collateral currencies’ value in comparison to the value of the loans given out, or diculties in the processing of the collateral asset.

CONCLUSION

With MoneyToken, there’s no reason to sell your BTC when you need cash or stable currency

![IMG_20180606_221752_073.JPG]

(

USEFUL LINKS

website: https://moneytoken.com/

whitepaper: https://moneytoken.com/doc/MoneyTokenWP_ENG.pdf

Writer Bitcointalk Prifile link: https://bitcointalk.org/index.php?action=profile;u=1687239

Coins mentioned in post:

Congratulations @tamaragold! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @tamaragold! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @tamaragold! You received a personal award!

Click here to view your Board