The Hive stablecoin, or more accurately soft pegged dollar coin, has been around for a long time. More than seven years when we include the previous version. Since the creation of the Hive chain, March 2020, it has been continuously improved and tweaked. Some core features still remain though, like the haircut, meaning there is a cap on the amount of HBD the chain can support and in extremely bad market conditions HBD can lose its dollar peg.

Lets see how is HBD doing in 2024.

HBD is being created and burned in multiple ways. Like many things on Hive, it has its nuances. The main mechanics for expanding and contracting the supply are the conversions, but there are also the author rewards, proposal payouts, interest payouts etc.

For better visibility we will be categorizing the HBD created/burned in the following manner:

- Author rewards

- Conversions

- DHF Payouts

- @hbdstabilizer

- Interest payouts

The HBD in the DHF is treated differently than the rest of the HBD. HBD in the DHF is not considered as freely available HBD on the market, so it is excluded from debt calculations and similar.

The focus here will be on freely circulating HBD, excluding the HBD in the DHF.

We will be looking at the different HBD allocations here as well.

The period that we will be looking at is 2016 – 2024, with a focus on the last year.

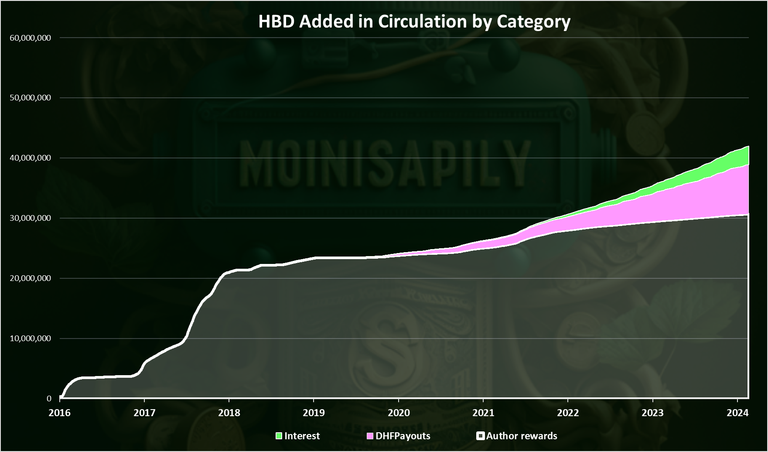

HBD Added in Circulation

HBD enters circulation via multiple ways, like author rewards, DHF payouts and interest to HBD held in savings. HBD is added in the DHF as a share of the inflation, but we will be looking at the HBD that only leaves the Decentralized Hive Fund, the DHF payouts.

Here is the chart.

The chart includes the following:

- Author rewards

- DHF Payouts

- Interest

As we can see the authors’ rewards are the number one source for HBD created, but in the last years the other ways have been growing faster.

HBD in theory can be created through conversions as well, but conversions can be both positive and negative depending on market conditions. Here we will be looking at the data for conversions under the HBD removed section.

A 30.7M HBD was created as an author rewards since the very beginning. An 8.2M as payouts from the DHF, and 3M HBD as interest. These are all cumulative numbers for multiple years.

We can notice that in the first years, all of the HBD creation was due to author rewards, but this has changed in the last years and now the DHF is at the first spot, followed by the interest rewards and then the author rewards.

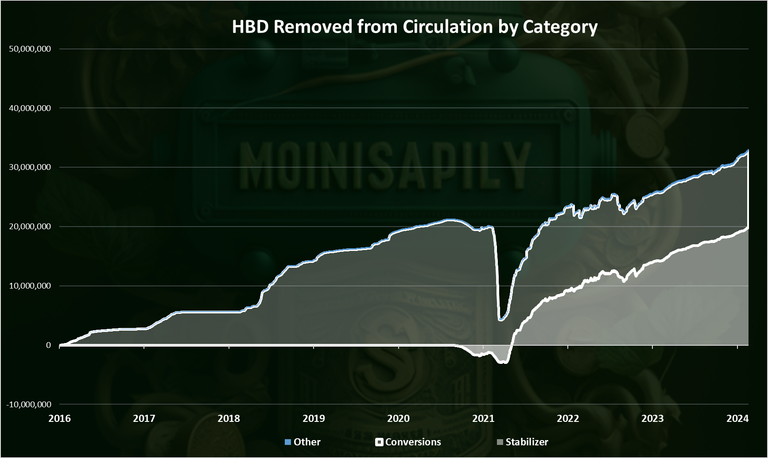

HBD Removed from Circulation

Now let’s take a look at HBD removed. Here is the chart.

We can see that up to the start of the stabilizer, the main way to destroy HBD was conversions to HIVE. Since the launch of the stabilizer, it has played a major role in the decrease in the HBD supply. In the last years it has been the main method for removing HBD from circulation.

Cumulative, the stabilizer has removed 20M HBD from circulation, while 13M were removed trough conversions.

The stabilizer is providing support for the HBD price on the internal market, buying HBD with HIVE if the HBD price is below the dollar. The stabilizer has scaled down its operations in 2024 and lowered the funds that is receiving from the DHF but in the long run its still playing the major role.

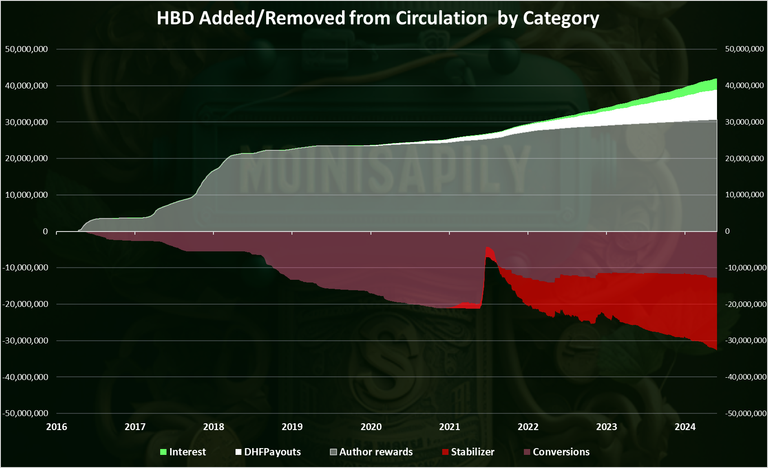

Cumulative HBD Added/Removed from Circulation

When we add the two charts above, we get this.

As mentioned already the author’s rewards are the main category in the positive, and the stabilizer is dominant in the negative.

What’s interesting is that after the introduction of the HIVE to HBD conversions, we are now seeing that the trend for the conversions has switched and now there is more HBD created from conversions than removed.

Also, while the authors’ rewards are still dominant in total, in the last years we can see the DHF is also putting more HBD in circulation, followed by the HBD interest.

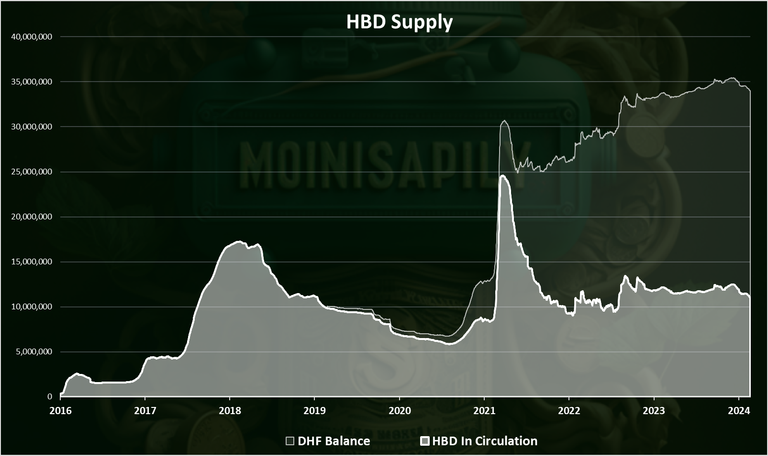

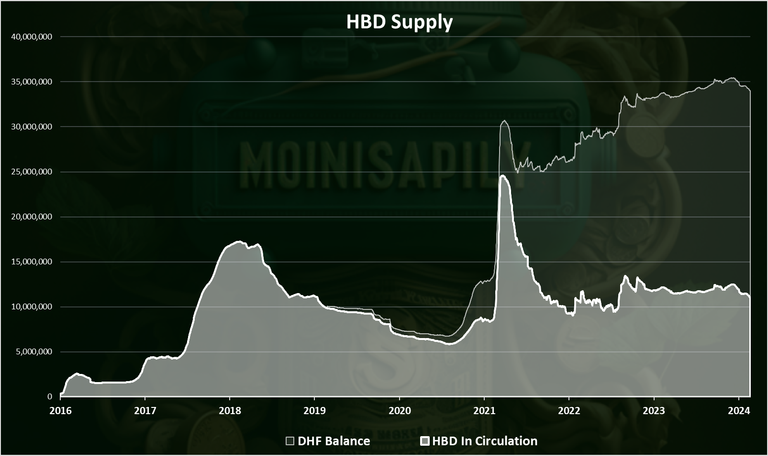

HBD Supply

Finally, the HBD supply looks like this.

The HBD in the DHF is represented with light white.

We are now at 11M HBD in circulation, while there is another 22.9M HBD in the DHF, accounting for a total of 34M.

We can notice that in the last two years the amount of HBD in circulation has been quite stable in the range of 10M to 12M HBD.

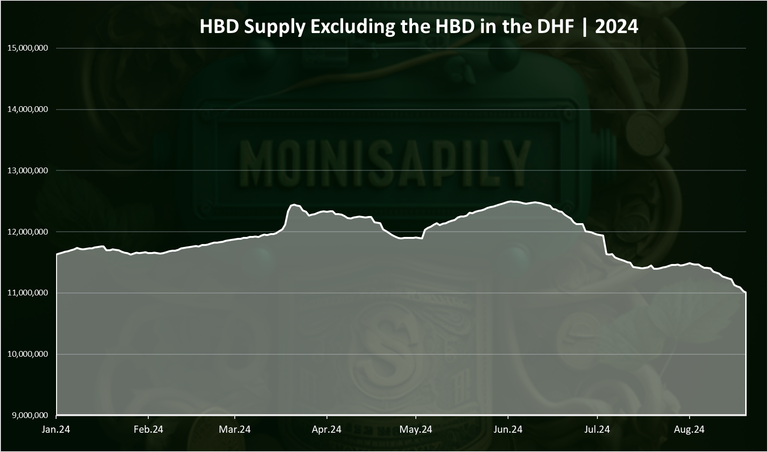

When we zoom in 2024 we get this:

The chart is zoomed so the movements are more visable.

At the beginning of 2024 the amount of HBD in circulation was at 11.6M HBD and now we are at 11M HBD. The overall supply of HBD has dropped for 600k HBD in 2024. We can see that up to June 2024 the HBD in circulation has even increased a bit to 12.5M but in the last two months it has dropped to 11M. This is due to the drop in the HIVE price in the period and the conversions in the period.

The HBD supply in the DHF has also been stable around the 23M.

HBD Liquid VS Savings Balance

The HBD in the savings give a 15% APR at the moment. It was just recently changes after been at 20% for years. When we plot the amount of HBD in the savings against the supply we get this.

We can clearly see that since the introduction of the interest for HBD, back in 2021, there is a constant growth in the amount of HBD in savings, while the liquid HBD supply went down.

We are now at 7.5M HBD in savings from the totally 11M supply, leaving 3.5M liquid HBD.

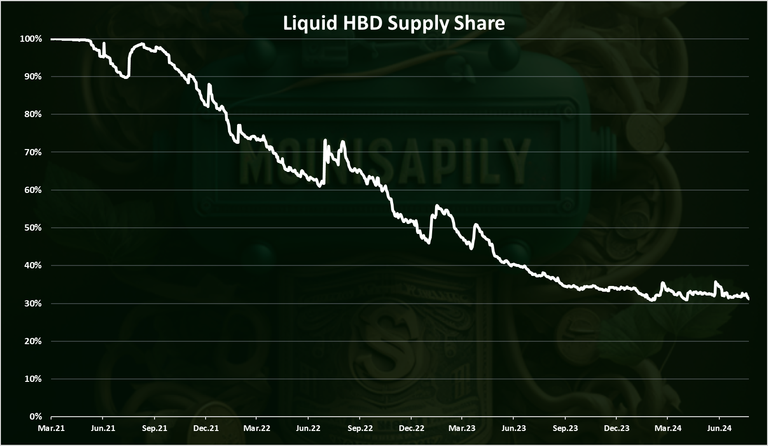

Liquid HBD Share [%]

The chart for the liquid HBD supply share in percent, excluding the HBD in DHF and in the savings looks like this.

We can see that the liquid HBD supply share keeps going down. In the last two years. It has dropped to 30% liquid HBD and 70$ staked HBD, and it is around that spot in 2024 with short fluctuations from time to time.

As the liquid HBD supply drops, the demand for new HBD should trigger conversions from HIVE to HBD, driving demand for HIVE as well.

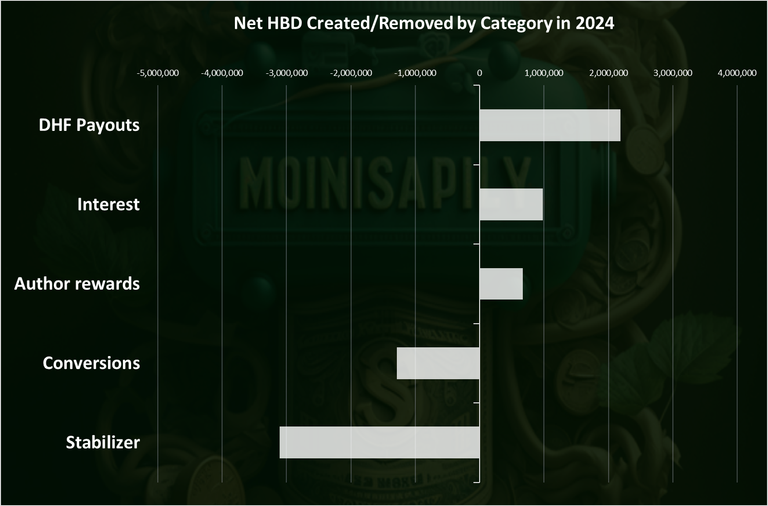

Summary for HBD Added and Removed By Category in 2024

When we sum it up, all the above, and check what has caused the HBD supply to expand or contract we have this.

The DHF payouts are the number one way for HBD entering in circulation in 2024 up to now August 2024. A 2.2M HBD was put in circulation in this way. Next is the interest payouts with 1M and then comes author rewards.

When it comes to removing HBD from circulation the stabilizer is the one doing most of this and has removed 3.1M HBD from circulation in 2024. Conversions are next in removing HBD from circulation with 1.3M HBD removed in 2024. There are alos around 50k HBD that has been sent to null or burnt as post beneficiary. In summuary for 2024 a total of 3.8M HBD was added and 4.4M HBD removed from circulation.

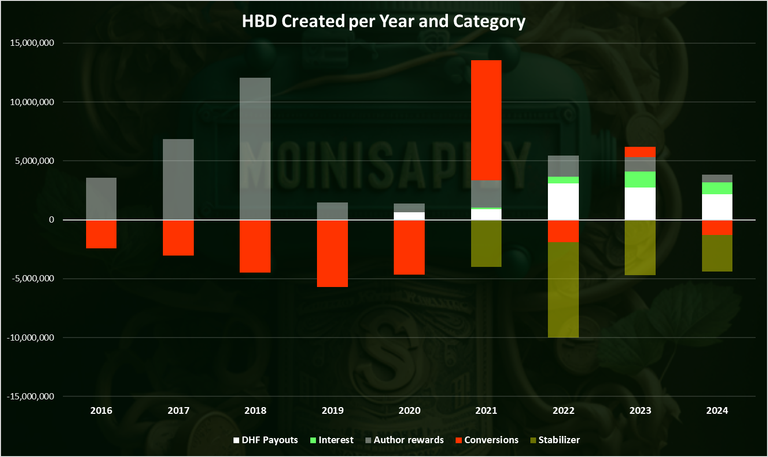

Historicly the creation/removal of HBD per caterory trought the years looks like this.

We are seing that there is now a shift in the way HBD enters circulation. In the past the majority of it was put in circulation from the authors rewards (grey), and cumulative this is still the bigesst position. But in the last years the shift is more towards proposal payouts from the DHF (white) and then HBD interest (green). It should be noted that this is just half of the author rewards, the other half is paid in HIVE.

The stabilizer(orange) has been the main way to remove HBD from circulation for third year in arow, in 2022, 2023 and 2024. Conversions (red) are negative this year, last year was positive and in 2022 are negative again. In all of the HIVE history, for the nine years, conversions have been positive only in two, massively back in 2021 and a samller amount in 2023.

All the best

@dalz

Massive Interest and DHF funding during the time hive sank like a rock. Coincidence?

No. "Progress"

Ultimately Hive Power holders on Hive pay for everything, including the DAO funding. We pay via inflation, or dilution or debt. But it is we who pay at the end of the day. What’s being paid for needs to be good, as there needs to be incredible reasons to hold hive power with all of these burdens it currently entails with the current state of play. Things need to change. We are NOT in a bull market

I wasn't saying progress, sarcastically. We're learning.

The reality is, everything we do here pushes and pulls on everything else, regardless of whatever market conditions we find ourselves in. My vote for your comment sends vibrations down the same line that individual we never heard of uses to dump that value in the exact same moment.

No pain, no gain. Pure chaos. Finding any semblance of order out of this madness is progress.

I saw a proposal for a streaming platform. Brilliant idea. Damn cheap, but only if the hundreds of millions of dollars those platforms typically generate annually actually make it inside the door. Potential I've been yapping about damn near the entire time I've been here. Ask your bro. He knows.

Perhaps it's time to pay for results, rather than promises. Prove your work, get your money. That's what I had to do. I didn't just promise a post with new art is coming in three months, then get paid to produce the outcome, only to disappoint.

"This wasn't in the brochure..."

If people know money is sitting on the table, waiting for results, they'll work for it. Flip the switch.

Why pay for a cloudy future when the past is clear?

This is correct and I would submit that the majority of what we are paying for in the form of posts, is not that good. But I have been saying for years, no one wants to hear it.

Everyone, even many major stakeholders who are paying for it all, believe they can end up better off than everyone else by getting a fat share of the post rewards, even as the overall pie continues to stagnate or shrink. DHF is more debatable as most of the payouts are at least directly for infrastructure development and marketing, but I'm sure there is some waste in there as well.

I have been in agreement with this for years. I guess we just never crossed paths on it.

Supporting initiatives that cause people / users directly to buy HBD directly in order to get some benefit / discount is a good thing to focus on IMO.

Regards DHF, its proportionately larger as hive price drops. so ATM its a huge pressure. it seems about 15 devs are getting about 12-15% of all rewards from the chain at these Hive prices. Completely unsustainable.

Im going to see how many of them will consider resubmitting their proposals without the nice to have stuff, so we can do what we can to collectively cut costs for at least 6 months, and then re review

I agree the issue of DHF becoming proportionately larger is worthy of direct stakeholder voting attention. At least with the post rewards, while high and not that good, they decline automatically in proportion with the HIVE price.

ATM posting rewards are being used to instantly incentivize the rewarding of spending of HBD at legitimate businesses with liquid HBD cash back payouts. Two photos are taken during the purchase process and posted to chain. Beneficiaries are then recycled to replenish the instant HBD payouts.

It’s a pretty good way to spread HBD to people who are using it to buy products in legit businesses

It’s also a good way to send HBD to people spending BTC and other crypto currencies (this is not yet built)

Soon it will also be adapted to incentivize e-commerce payments during the moment of unboxing.

Potential to spread HBD to many chains is huge.

To do this, need to create an account on the spending chain (say eth) and then take the hash of a signature and include it in the header of a hive account. This proves that both accounts are owned by the same person. From there we can send hbd to ppl spending eth in legit shops and taking two photos.

ATM this uses the hive blogging rewards mechanism and rewards pool for content creators. There is no reason this can’t be put into the chain directly on the base layer later apart from the work needed.

Using this method we can also reward blogs instantly and daily based on stats such as views and comments instead of subjective whale votes.

The discount method causes a direct demand for hbd. On small purchases, can give 25-60% cash back discounts on hbd purchases and say 10-15% for other coins

No other chain as far as I know can distribute a stable coin from its inflation in this way while also being non KYC, non custodial and premissionless.

But as far as I can see, we are about to go into the age of #spendtoearn #spendtomine distribution of crypto via legitimate spending instead of only sending fresh crypto to miners

It's a participation award so people don't leave. The business model is, "Here! Come! Free money! We need you!"

They leave anyway, or get locked into a comfort zone knowing they're getting paid regardless of effort. People that aren't even here, pay them.

Just picture a talented street performer with a bucket of money in front of them, and no crowd. They'll move if they care about their work, no matter how heavy that bucket is.

But if you get a quality platform, attracting quality acts, and consistent actual support rolling in from the outside, the crowd can pull all that money off the junk and put it where it belongs. Plus there's buy pressure and the incentive to hold is in the hands of the majority. If someone earning steady for content that isn't an attraction doesn't like the pay cut, well, now there's a massive audience lurking about so maybe try harder.

That organic approach in my mind is the only way to get the ball rolling. Treat it like a fresh start and slowly but surely the wasteful practices fall off the edge.

People not having to throw their money away in order to support content is the only thing that sets this platform apart from anything else. That has the potential to attract a lot of money. And talented, capable individuals do things, for money, and a crowd.

If you look under that VIMM proposal, you'll see where I suggested rebranding "curation reward" into something more suitable for their market. I've been talking about how people support content online with their own money since before it was so commonplace because I picked up on the trend early. Often met by blank stares or opposition stemming from individuals attempting to protect their vision of what should happen here.

Attracting that crowd interested in supporting content, with proper execution, would make a "bull market" look like peanuts. And the momentum would continue as more content people want to support is created. Each individual creating things people actually want to support creates a decentralized revenue stream for themselves. Altogether, a decentralized revenue stream for Hive that's hard to stop.

Instead, we do it the way we do it since day one. We don't want people to bring their money and support things they enjoy with votes. We want to attract "crypto investors" looking for a return, and tell them to automate everything and walk away. So any tokens purchased end up in the pockets of creators not causing much of a stir. That money is eventually on its way out or recycled into support not stemming from the outside. The "investors" wait for the mystical bull run, kill the momentum by selling "curation rewards" and put us, here.

Round and round we go. Look what we have. All these tools, benefits, and products meant to improve the lives of regular people go to waste, so we can attract crypto people and pray to the bull market gods for miracles. And working towards being successful daily doesn't stop the bull market from happening, but it does remove the trampled earth in its wake.

Based on my observations stemming from reality, we have the ability to offer legit products people are interested in supporting, year round, regardless of market conditions. And we don't even try unless throwing a wrench in the works is still considered to be an effort these days.

And now it's starting to look like a situation where if that ball did get rolling, the acceleration would slow due to friction caused by the forever accelerating HBD interest. Sickens me to think all that momentum would be destroyed just to pad a few wallets.

I'm just jotting down notes, don't mind me. But I think it's important to point out once again just how cheap the cost of something like VIMM proposal is when compared to potential income. But we'll never reach anything close to that potential by doing things the same way they've been done since day one.

And I'll throw this comment in just to tie a few thoughts together:

https://peakd.com/hive-13323/@nonameslefttouse/re-azircon-sin5st

The HBD interest rate which has recently been decreased to %15 might accelerate HBD to HIVE conversion.

Interesting...

Thank you very much for this valuable information.

Transparency and prompt information is much appreciated among Hive and HBD users and investors and can really make a difference, I think.

A reference for the rest of us!

I have a small request :

out of SPS stakeholders who holds 200K SPS or more, how many have 10K hive or more

Trying to get some SL investors to get into hive, I mentioned it here:

I saw the post and have a to do note on that.... will come back with data in a day or two

many thanks!

I have looked at the top SPS holders from the API richlist that Splinterlands provides, compared it against HIVE holders and out of the top 200 total SPS holders there is around 50 accounts that holds more than 10k total HIVE.

The top richlist of 200 starts somewhere at 500k SPS, so the data is cut out, if I manage to provide a longer list of SPS holders that will go down to 200k SPS I will update you.

Here is a screenshot for the top holders:

Many thanks for doing it.

For some reason my hive number doesn’t match. It should be 1M plus. Also perhaps it should be (hive + HP) which I think you did anyways otherwise mine would be like 300 :)

It is HIVE plus HP, the results are a bit of becouse of the conversions from VESTS to HP, in a hury I put a 0.00057 factor, it is probably a bit higher now.. yea just checked its 0.000585

Congratulations @dalz! Your post has been a top performer on the Hive blockchain and you have been rewarded with this rare badge

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPGreat breakdown of how HBD has evolved over the years!

Hmm…🤔 It's fascinating to see the shift in HBD's creation and removal mechanisms, especially with the stabilizer playing such a crucial role in maintaining its stability.