Many people I know, myself included, when first introduced to Crypto think that making one massive trade is the key to wealth creation. That by jumping in at the perfect time they'll be able to 1,000x their initial investment and finally be able to get that Lambo they've always wanted. While that may happen from time to time, it's usually not how massive amounts of money are created and sustained.

Stacking Sats has been a term commonly used in the Bitcoin community that describes building your holdings through small, incremental increases. The mentality of Stacking Sats isn't based around making one big break, but by building your wealth the sustainable way, slow and steady.

The issue is slow and steady isn't sexy. It isn't glorified by movies or television. Everyone is in awe of the trader who makes a massive gain on one risky investment, nobody gets excited about the trader who makes 100 smart, tiny wins. Well today I'd like to be that boring guy. Rather than tell you about the next low market cap gem that will 10,000x your investment, I'd like to share with you the 1,000 tiny things you can do to help grow your wealth and get that Lambo...Eventually.

Cut the Unnecessary Spending

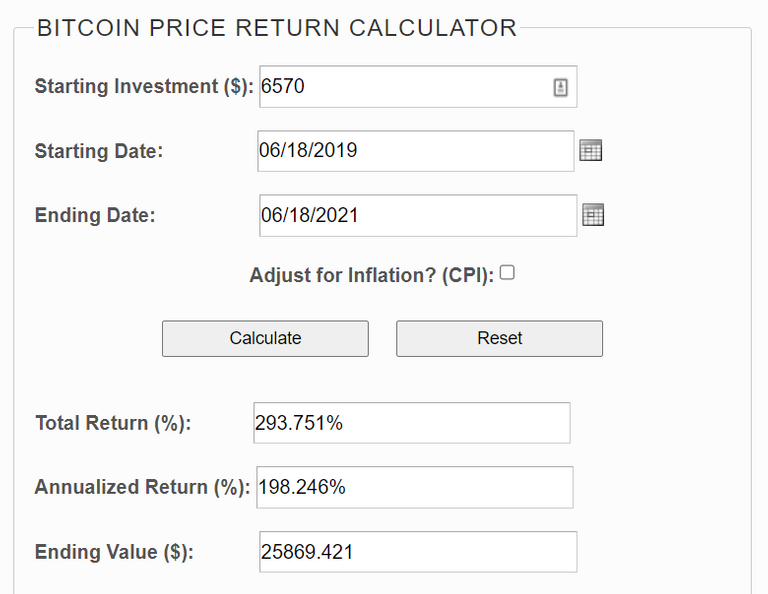

For most young people it's coffee or eating out. I see all sorts of stats come out about this, with average spending for Millennial/Gen Z'ers ranging between $18-$30/day on coffee and eating out. For me it was candy. I've got a little bit of a sweet tooth and spending can quickly get out of hand. What looks like a few dollars a day quickly adds up. $18/day = $6,570 a year. If that $6,570 was invest into BTC a couple years ago, even with deflated prices as they are now, you'd have 300x what you had initially put in.

There's a lot of really good tools out there to help you with spending. What worked well for me was to just write it down. With so many transactions today being digital I can quickly lose track of spending. So when I was forced to write down each time I spent money during the day, I got a little bit disgusted with myself. I saw very clearly why I thought I didn't have money.

Since then I've adjusted my own personal budget so I live off about 30-40% of my income and invest/save/donate the remaining 60-70%. I started with just cutting out a little and have become addicted to seeing how low I can go and still live a comfortable life. I recommend you do the same! Take a look at your budget and really find out where the money goes.

Get Cashback on Necessary Expenses

After cutting your expenses you'll be left with just what's necessary. And since you'll be spending the money anyway, you might as well earn some cashback for it! There's a lot of really good crypto cashback options that have come out recently, I'll just share what I use here -

- Lolli - Up to 30% cashback paid in BTC when you shop. Over 1,000 brands supported. I like using this for purchases I'd be making online anyway, from groceries to shoes.

- Fold - Similar to Lolli, cashback paid in BTC when you shop. You can choose to get also get their prepaid debit card which further rewards users in BTC. I like using this if what I'm looking for isn't included on Lolli.

- Credit Cards - Between 1.5%-3.5% cashback on all purchases. BlockFi and Nexo are my favorites. I use them to double dip my rewards with Lolli and for other expenses.

I've also been able to setup my monthly rent payment and all utilities to be paid via my BlockFi and Nexo credit cards. It's not a crazy amount in cashback but it's money I have to spend anyway, getting BTC back is a great benefit.

Set an Investment Plan

Another common misconception I see is a lot of crypto newbies think they need to jump in at exactly the right time. They will be rather upset if they jump into Bitcoin when it's at $40,000, then a dip happens and they could have bought at $38,000 if they'd just waited a few more minutes. This effects people in one of two ways, either they mourn the 5% they could have saved by being patient, or are frozen in fear and neverinvest again - waiting for the perfect price. Well I've got news, there's never a perfect time.

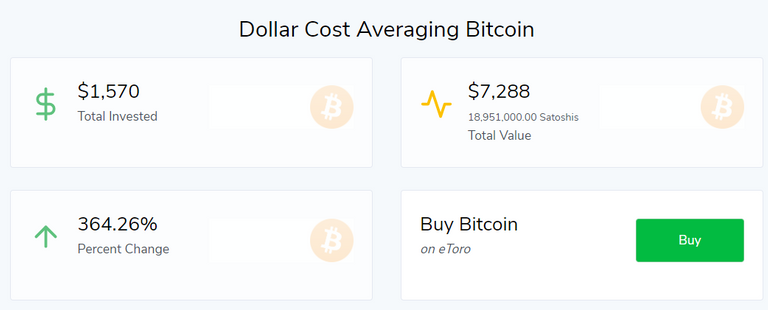

For me the way I was able to overcome this paralysis by analysis was to set a daily/weekly/monthly investment plan. Where no matter the price of my favorite projects I was going to invest money. There's a term for this, it's called Dollar Cost Averaging (DCA) and the premise is, by investing a set amount each day/week/month, with a volatile asset such as crypto, you'll get a price that's on average lower than just throwing your money in at one price point.

DCA is a common long-term investment strategy outside of crypto, it's been commonly used in the stock market for decades and has proven results. I personally like to use a DCA bot for this to make sure I get the best price and don't forget to do it, there's a lot of great ones out there but I prefer DeltaBadger. Since they work on most exchanges and support all coin types I'm able to spread out what I buy and where, so my funds aren't subject to any one exchange getting hacked.

The Power of Compound Interest

Compound interest is one of the most important principles in the world when it comes to wealth creation. Albert Einstein called it the "eight wonder of the world" and Warren Buffet once confessed his wealth came from "Lucky genes, living in America and Compound interest". Once you've cut unnecessary expenses, started earning cashback on what you do spend and set a solid investment plan, putting your crypto to work is the next step. Crypto has generally been an appreciating asset since it's inception, but if you want to do more than just reap the benefits of price appreciation, putting compound interest to work in your favor is vital.

Today there's many different ways to utilize compound interest in crypto. I like to break them down into two categories, Decentralized and Centralized. I use both some I'm not going to make a case that one is better than the other. Each inherently hold their own benefits. A quick breakdown would be:

- Decentralized - Any platform where the power does not lie with a single individual or entity, but throughout a distributed network.

- Centralized - A platform where power/control is maintained by a single entity.

As far as decentralized options go I'm a big fan of Harvest.Finance for anything that isn't Bitcoin. The whole premise behind Harvest is to make farming simple and easy for the average person and they do a great job of that. Yields can vary between 3%-600%+ APY, but have recently made a move for more blue chip style yield farming, releasing Uniswap V3 and updated Curve/Convex stablecoin strategies. For Bitcoin related needs Badger.Finance is great. They're a yield aggregator similar to Harvest but their main focus is on maximizing returns on Bitcoin. They have a built in bridge where you can deposit BTC and get an interest bearing token in return as well as a few other nifty features for Bitcoin maxis looking to put their holdings to work.

For centralized I like BlockFi and Nexo. I used to enjoy Celsius but some of their rate cutting has been quite painful. Both offer interest rates from 4%-12% depending on the type of crypto deposited. There are some benefits to using them over a decentralized option, mostly that there's a level of "security" for your funds. Although I'm not sure how much security there actually is, nothing in crypto is truly safe. I like using them as a way to spread my funds out, so if an exploit or hack were to hit one platform or even two platforms I'm earning interest on it hopefully wouldn't take all my funds.

In the end the platform(s) you choose are up to you. I use all the platforms I described above but I'd highly recommend you do your own research before jumping into any of them.

Bonus: Earn Sats for Free

From faucets to play to earn games to crypto based work there's a plethora of ways to earn free crypto in this day and age. While I usually think faucets are a waste of time during a bull market, they can pay off in dividends during a market downturn. Some of my faucet earnings from the crypto winter are worth thousands of dollars today. Some of my favorites are Pipeflare and GetZen. Both are 24hr timers and support instant payouts with a robust referral program. So I don't have to spend all day clicking a button every 5-10 minutes. I've also done a few articles on Play-to-Earn games, you can read about them here.

For crypto based work there's a ton of options here. I personally enjoy writing and reading crypto-based content so Publish0x/Read.cash/LeoFinance are all great platforms to do so. If you're into art there's a clear need for graphic artists out there on a variety of platforms, all you have to do is ask (usually in their Discord or by checking GitCoin). In my opinion though creating some type of valuable content that pays in crypto during bear markets is one of the best ways to supplement your investments as that payment will grow when the market does.

Closing Thoughts

During volatile times in the market I like to re-evaluate my investment strategies so this is as much for me as it is for you. Many people I know that got involved with crypto near the top have since dropped out, likely to only return when crypto hits it's next peak. This allows quite the opportunity for us to become mini-whales in our own right, but only if we stay persistent and continue to Stack Sats.

I hope you enjoyed reading. If you did don't forget to like/follow so I know to create more content. As a reminder the above is not meant to be investment advice, simply a laundry list of my own opinion of things I've learned. Thanks and happy earnings!

Also follow me on Twitter, where I'm regularly shilling my favorite crypto projects:

Posted Using LeoFinance Beta