Binance gets a lot of attention, praises and generally hype for being the largest centralized cryptocurrency exchange in terms of users and trading volume.

This perceived position of value is expected to trickle down to assets listed on the exchange and today we'd be looking specifically at projects that go through Binance launchpool before they are listed on the exchange.

A lot of factors determine the performance of tokens on the open market. Binance, to some extent, has its own merits, but do they outweigh the disadvantages?

One thing is consistent in the cryptocurrency ecosystem, and that is the fact that hype moves prices, but it doesn't sustain it. It is an assessment that should be obvious to many people but people are mostly inclined to focus on early performances and not look at stretched realities.

It's like the Solana memecoin madness. Everybody focuses on the random 4 to 7 addresses(which are often insiders) that turn a few hundred dollars into millions. Nobody looks at the remaining thousands, if not millions of traders who are now trapped holding a shit bag with no guarantee of any future positive performance.

Similarly, when Binance announces that a project will offer incentives on its launchpool, there always comes hype. You'll openly see reports covering how much is locked up to farm these tokens as if that locked amount are real liquidity in any way.

It's basically free money, why won't any holder of BNB or FUSD stake their assets to farm it?

It shouldn't be a factor on future price performance but let's give room for market data to reveal the trend of past Binance launchpool projects.

Performance analysis of 5 recent Binance launchpool projects

For those who don't know, Binance Launchpool is a solution within Binance exchange that allows users to stake their crypto — often BNB and FDUSD — in order to farm new tokens for free. It is designed to promote new blockchain projects by distributing their tokens to Binance users before they officially list on the exchange.

This performance analysis is based on market data gathered from 5 recent Binance launchpool projects launches.

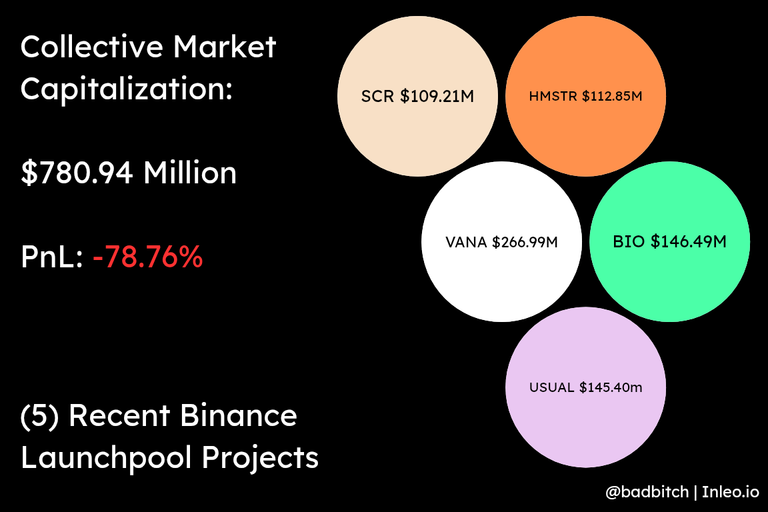

Specifically, we are looking at BIO, VANA, USUAL, SCR and HMSTR.

As seen in the above infographic, the most recent 5 projects offered on Binance launchpool collectively have a market capitalization of $780.94 million, at the time of writing.

Certainly, if you asked any random crypto enthusiast what he or she thinks the market value capture of most recent 5 projects on Binance launchpool is, most would think its above $1 billion, in the worst case scenario.

The reality is that none of these projects are even in the top 150 projects in terms of market capitalization and collectively, they are not even in the top 80, even a memecoin — FLOKI — is worth more than all 5.

If you bought the ATH of these projects, investing $10,000 each, you'd be down -78.76% or -$39,382 on your $50,000 investment.

But who's that unlucky to buy the absolute top always right?

Let's assume you're a smart investor, and wait the hype out for 3 days, what would your portfolio look like?

Let's focus on VANA, which is the most valuable token on the list based on marketcap.

VANA launched at $1(almost nobody got it at that price by the way) on Binance, rose to a high of $35.8 and closed the day trading at $34.401 this was impressive, but given VANA’s limited supply and the hype around AI-related chains, it wasn't entirely surprising.

That said, 3 days after launch, the price crashed by 52.85% closing the day at $16.222, surely that's a good enough entry, right?

For non-greedy short-term traders, yes, because the market presented different opportunities to sell with a little bit of profits within the first week. After the second week, it all week downhill as seen in the chart below.

One thing that checks out with all the tokens on the list except USUAL is that shorting every one of them with low leverage 1.8x to 5x, after 2 weeks, proves profitable as they all crashed significantly after 2 weeks of being publicly traded.

Now, I wanted to know why USUAL performed differently, when the rest followed an almost identical trend despite being all launched at different times.

The first thing I looked up was initial supply of each token on the list and the closing value of the first 15mins of trading on Binance.

Why 15mins?

I simply consider the closing value within 15mins to be the real "launch price" and essentially what determines what the initial marketcap of any token is. This is because market makers will heavily influence the first 15-30mins to force the tokens to move in the direction they wish.

On looking at this data, I figured that USUAL launched at the lowest initial market capitalization of approximately $175 million.

For comparison:

VANA — $790M

BIO — $989M

HMSTR — $638M

SCR — $222M

I also looked at initial token supply and the amount allocated to Binance launchpool.

This is what I found:

USUAL: 494,600,000 initial supply which is 12.37% of 4B max supply. 300,000,000(7.5% of max supply) allocated to Binance launchpool.

BIO: 1,296,529,168 initial supply which is 39.05% of max supply of 3.32B. 99,600,000(3% of max supply) allocated to Binance launchpool.

VANA: 30,084,000 initial supply which is 25.07% of max supply of 120M. 4,800,000(4% of max supply) allocated to Binance launchpool.

SCR: 190,000,000 initial supply which is 19% of max supply of 1B. 55,000,000(5.5% of max supply) is allocated to Binance launchpool.

HMSTR: 64,375,000,000 initial supply which is 64.37% of max supply. 3,000,000,000(3% of max supply) allocated to Binance launchpool.

Judging by this data, USUAL had the largest percentage allocation to Binance launchpool. It gets even worse if you judge it by initial supply rather than max supply, so evidently, it was more about the total initial supply, which USUAL had the lowest and the initial launch marketcap.

By this data, this is what the value of the launchpool allocation looks like:

USUAL: $106.47M

BIO: $75.98M

VANA: $125.22M

HMSTR: $29.76M

SCR: $64.29M

Evidently, USUAL is second only to VANA in terms of token value allocated to Binance launchpool, despite launching at the lowest initial marketcap.

This data would suggest that most initial selling pressure may not be coming from launchpool farmers despite it being essentially free money to them.

Initial market performance appears to be heavily influenced by internal players and network users, in cases of airdrop tokens availability being a factor at launch.

This is for informational purposes only and not financial advice. All data contained in this article are based on reported values from multiple sources including Binance.com and Coinmarketcap.com, at the time of writing. DYOR

Posted Using INLEO

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.