Ah well... that sucks I guess.

But also sometimes it's better to just jump into the pool outright rather than trying to wade in slowly. Again I'm pretty good at guessing when volatility is coming... and my guess was FEB 22. Of course the forever permabull inside me made lofty claims that the alt-market would happen on this day (assuming up rather than down), but alas, the exact opposite has occurred. I can't say I'm surprised.

I was like 1 day off with the FEB 22 prediction, but it came more and more obvious as the day drew closer that this was a bearish event. The big death cross was fully locked in and we got a hard rejection at both the uptrend line, the downtrend channel resistance, and crab-trend resistance.

It was painfully obvious what was coming for us at this point... and I really should have started betting bearish but I just couldn't bring myself to do it. Missed opportunity I suppose. I really need to work on my short-game because this one was so obvious it's actually kind of stupid that I didn't make like $1000 on the trade. Live and learn! I'll figure it out eventually.

Bitcoin Dominance

Last time we had a good dip on Bitcoin at absolutely crushed the alt market. Everyone was freaking out. "OMG what happens if alts get crushed every time Bitcoin dips!?!" Yeah, that's not how it works, as can be seen today. Dominance actually went down a little. Some of the alts seem to be very much done bleeding out and catching supports where BTC is not. This is pretty typical behavior for when alts already had a severe bleed-out event.

Hive?

Looking at our own coin I'm ready to make a big buy around 25 cents, but also I like to measure against Bitcoin rather than USD.

HIVE/BTC

Our strength against BTC is looking solid and extremely bottomed out. If we were to crash back to the low around 250 sats I'd be willing to make a decent sized rotation. Realistically this is "only" a 23% discount with a current valuation of 327 sats, so really DCA might be the smartest way to go here.

Good bets on Bitcoin itself?

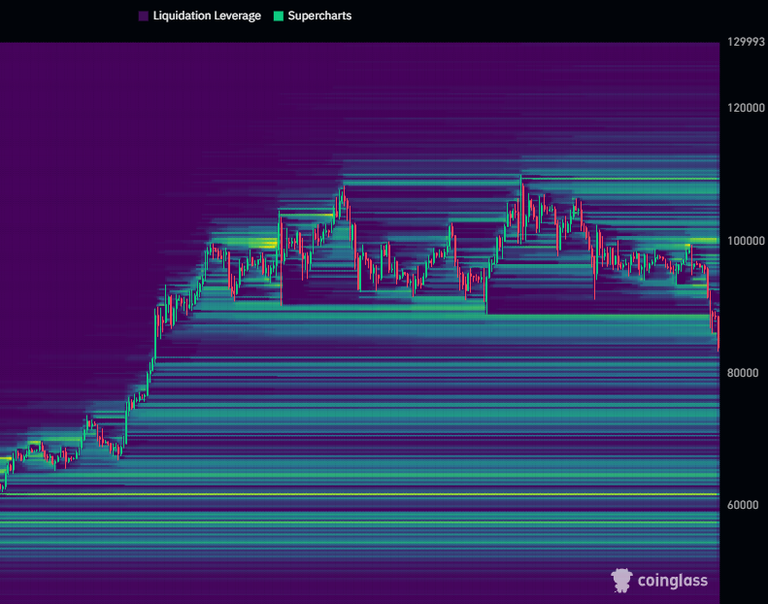

I focus pretty much all my effort on trading Bitcoin because it's way more predictable than anything else. However while we trade inside of the liquidity void there are very little lines to be drawn; there's no data here because we skyrocketed past this zone so quickly (creating the void).

The most obvious place to look is the 200 daily moving average which currently sits around $81700. I've placed a bid to go long at $82k and will keep it open for a couple days. Seeing as I don't believe we are going under $77k an x10 might be appropriate... although the bottom bottom (underneath the void) is $72k. I don't think we'll go that low though because $77k is already the perfect 30% retrace, but you never know.

For anyone buying spot it doesn't even matter where you buy at this point. $84k? $82k? $77k? They're all the same if you're not trading on leverage. Again DCA might be the way to go, not because you'll make money doing it but because it is psychologically less stressful to balance out the day to day volatility. If you buy at every price you always get to tell yourself you bought the bottom, even if just a little bit, it's good for the vibes.

MSTR?

I asked AI a couple of questions about MSTR getting "liquidated" to understand the theory better. It doesn't really make sense that people say they'll be forced to sell Bitcoin when convertible bonds convert into the underlying stock. Some are even trying to spout nonsense like if BTC retraces to $70k MSTR is screwed, which is obviously false.

I might do a full post of this later but the gist of it was that Bitcoin needs to fall back to like $20k before MSTR has to make some hard decisions. And even then a lot of these convertible bonds don't even mature until 2028. Something tells me BTC will be higher than $20k in 2028; call me crazy. More on this some other time.

The liquidation heatmap... which is usually pretty useful for determining the weak points of the market... is also fairly useless right now. The short-term data shows nothing because we haven't been in this price for a while, and the long term data is old, stale, and doesn't really give any indication of how far down it can squeeze the bulls.

I'd say the worse-case scenario for the heatmap is something like $71k, but again I just don't think it will get that low. How long will we have to wait to find out? Probably April at the latest and mid-March at the earliest. I still think summer can pull out a win especially now that we're in underperforming-mode.

Conclusion

Ripping off the bandaid is never a pleasant experience, but it can be the preferable option; the lesser of two evils as it were. Had Bitcoin not revisited this null-zone it would have been a very bad omen going forward. I'd rather see $77k now than be doomed to return to this vacuum in 2027. In retrospect this downtrend will be nothing than a blip on the radar and we'll forget all about it.

So what happens if this four year cycle doesn't get the parabolic action that we were expecting? Then... it doesn't. I think a lot of degens wrongfully assume that if we don't spike up exponentially then we can still crash down exponentially. That's not how it works. It's the volatility up that creates the volatility down. Stability is a good thing and it would be nice if we could actually get some once and a while. Dream big; not gonna happen.

You might get that today.

I had a big bid at $82150 that already hit.

Congrats! What leverage?

technically x10 but the stop-loss jacks that up to more like x30

nice

My expectations are that as BTC's market cap grows so will/does stability. Supply and demand should then continue BTC on its upward growth, even if not on such a steep curve. It seems a natural evolution as BTC reaches wider acceptance.

This is a pretty common expectation and it makes sense,

but it also makes sense that it will continue to be explosive.

Computers and the Internet continue to make exponential gains even after being 50 years old.

AI is on a rampage, and AI can further develop crypto.

On a very real level we don't expect Bitcoin to do the same because we've never seen what money can do as a technology. We've only seen what money can do as a captured asset within a walled garden controlled by bankers and the elite.

You make a good case for number go up. :)

This is pretty disappointing. It doesn't change how I plan on doing things, but I was really banking on some big gains with my alts so I could do better this time around. I really wanted to avoid the mistakes I made last time and now it looks like I might not even get that chance.

If you don't get the chance then you didn't make the mistake.

I think the mistake you're making now is thinking you won't get the chance.

That's not a good headspace to be in.

It increases the chance of failure.

I honestly don't care. This is all free money for me for the most part. It's not like I am depending on it to pay my bills. I was just hoping to put myself in a better position to have a little more fun in the second half of my life.

I guess what I'm trying to say is that you definitely will care if you let what's happening right now put you on tilt and then you fishtail into even more tilt later on the winning side. I've seen gamblers rationalize losing what they've earned countless times, especially at the poker table.

It even has a name: "easy come easy go".

Winners tilt is even worse than losers tilt.

I'll be working very hard to stay ever vigilant this year.

Ah, okay. 😀 I still have my targets in mind, both soft and hard. I might need to adjust them if it looks like we aren't even going to hit the soft targets or the soft targets need to become the hard ones.

It's been proven that almost all gains occur within less than 20 days out of the year.

There haven't been any indications that "this time is different".

Everything we are seeing is perfectly normal.

Seriously man crypto keeps everyone involved on their toes. One minute, we're very hyped for a breakout and the next it's a damn freefall 🤦 but at least you called the volatility, even if it didn’t go the way you hoped 👍

So much pain!! How will we survive! 😭

One day at a marklar.

This is needed

I see more down side if stocks keep this up. Now that the money managers are in the space we are no better than a stock IMO.