Hefty reaction

Bitcoin took a dive yesterday, and for a brief moment BTC went to 86000 USD.

Which is not unlikely during such a bull run, drops of 30 % are not uncommon.

But it had a huge effect of the share price of Strategy. MSTR dropped 55 % compared to the top it had in November 2024. This reaction by the market is quite over the top, but that is just how markets react, emotionally and not rationally.

It is calculated that MSTR would need to start selling Bitcoin when it dips below 66K, as that is the average price of acquisition of their 499K BTC. So, markets react when they see Bitcoin take a dive and getting closer to that number. But things are way different than in the recent bear market. We can expect BTC to recover to 92 - 95K quite rapidly.

Saylor buying all BTC

Michael Saylor, the head of Strategy has already stated that he would never start liquidating BTC, despite it dipping lower than 66K. Even when it went to 1 $, he would try to buy all the Bitcoin he can get his hands on he says. The question is will his shareholders share the same vision?

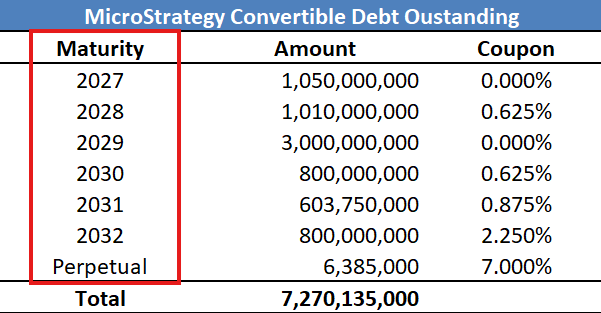

Interesting times, but with loans of MSTR maturing in 2027, 2028, 2029, etc... the price of liquidation will drop substantially, so MSTR will automatically get into safer waters.

Sincerely,

Pele23

Posted Using INLEO

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.