Governments rely on control of the money supply in order to control the global economy and maintain power.

They printed a third of it in the last two years, aka Quantitative Easing, and clearly a lot of that got spent on or leveraged into Bitcoin.

And then, probably just because of fortunate/ unfortunate timing meaning the golden age of DEFI coinciding with all that free money being printed, BTC and crypto more generally offered some great returns.

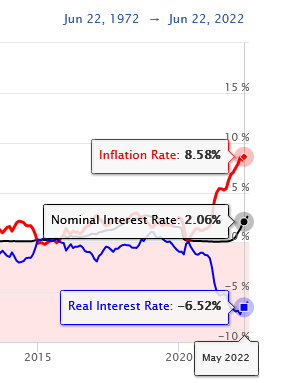

And then the bubble burst (surprise!), and now that governments are putting up interest rates and squeezing the money supply, people are selling out of higher risk assets and Bitcoin as the returns don't look so great anymore.... so the sell off accelerates...

But let's not forget that one massive advantage Bitcoin has over FIAT currencies is its fixed supply, and it's fixed and now VERY limited rate of inflation, with < 3M out of a total supply of 21M yet to be printed.

This means that holding BTC is basically a hedge against the value of FIAT money, which, let's not forget has genuinely gone down in value over the last couple years.

And, frankly, there's little sign of the global economy picking up anytime soon, the global capitalist system was already fit to burst before Covid and now with normalisation of three nations happy to be involved in overt military imperialism - Russia, the US and China will probably wade in soon.

And Bitcoin is a stand against all of that - it's a currency which just works outside of the banking system, a currency that no one can devalue by just printing more of it.

However Clearly People Haven't seen it Like that!

Of course Bitcoin is more than just an anti-government hedge, it's also an asset class which people speculate on - and OBVIOUSLY that's how MOST investors see it - hence why it's an easy sell...

More and more people see there as being more potential to make money elsewhere (stocks/ art/ whatever) or at the very least, they see selling it into stables as a means to not LOSE more, and I imagine there's a fair bit of shorting going on ATM.

And in terms of seeing BTC as an investment vehicle, there is a slight problem - it doesn't, like stocks, represent a share in anything tangible - unless you count 'anti-government-fiat-sentiment' as have a value (which I think it does, but valuing it is pretty much impossible) - hence why it's an easy sell, faster than stocks which do tend to represent something tangible...

But I don't think comparing it to stocks is fair, it was never designed to have that function.

Bitcoin as Gold/ Art/ A Status Asset...?

This is something to think about... now that the crazy DEFI bubble has burst, and the 100% yields are over, what is the 'underlying' status value of BTC...?

How many people, for example, will hold 1 BITCOIN or 10 or 100 or 1000 BTC just because of status - and what price will they want to hold it at...?

There are plenty people who are rich enough to hold onto 1 BTC at $10 000 just for the sake of holding BTC for example, even if it doesn't offer much of a return and is a risk, and once it hits that point, it probably isn't going to go down much more....

And I can't help but have this feeling that a lot of people are shorting BTC to try and either pick up more or skim off a few dollars on the way down, I mean I am, so surely many other people are!

The Bitcoin Price - Final Thoughts

The last 12 months has maybe seen mainstream money come into BTC and pump the price, much of which has now left, it will be extremely interesting to see where the die-hard hodlers' floor is... that average value at which hodlers just say 'NO' not selling at less than this thank you very much...?!?

Posted Using LeoFinance Beta

Bitcoin is a highly risky speculative asset nothing more. It has never been in an environment like we are going into ie inflation and higher interest rates on top of recession, cost of living crisis, war etc. The table is going to turn i feel, i been saying it for a while now. Bitcoin only surprises. It has sucked in a massive amount of get rich hopers thinking its a sure thing. They are all going to get wrecked, crypto is in for its .COM moment. Unless your time horizon is 10 years and you dont need that money for anything your going to get liquidated one way or another.

Quite possibly, I'm glad I've been able to take something out over the last year at least!

Can we hope on five :)

Srlsy 10 is a bit to much

Nope :D

I suspect many people who bought BTC didn't really care what it was. They just wanted in on something that was predicted to gain value. Many may have lost money recently, so they will move on to the next trendy thing.

Speculators gonna speculate :)

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

This bear market season has just revealed to me that Bitcoin is not ponzi that is a get rich quick scheme. It has also enlightened me never to invest in what I do not understand.

Thanks for sharing

Cheers 🍻

Hi @revisesociology

As you rightly put it the fixed supply, and it's fixed inflation rate is our biggest advantage over the chaotic traditional economic and financial system, things may get very difficult within the cryptocurrency market in the following months in terms of price action, more however, statistics reflect that more than 50% of the large holders would not go into losses and this is extremely encouraging for the health of the market.

Best regards, be well.

I know what you mean - I'm sure there's a psychological limit below which people just won't sell - it's not as if any of those large holders need the money anyway.

To be fair, you can still get 10% on your BTC at CubFinance lol:

As shit as the price dump for long term HODLers has been, Cub still offers one of the best ways to earn yield on Bitcoin.

Posted Using LeoFinance Beta

How do I know Cubfinance is not Celsius 2.0. Where are those yield coming from? sus

Posted Using LeoFinance Beta

I'm certainly not saying that CUB's model is sustainable as is (just look at price...), but to compare it to Celsius is unfair.

They each run completely different business models and as such have unique sustainability issues.

If you're genuinely interested in where the yields come from, I'd encourage you to dig a bit deeper.

There is a pathway to sustainability for both if things are done right.

Posted Using LeoFinance Beta

I am in that Kingdom in fact, it's a good place to be.

I imagine Cub will pick up again at some point - when the Leo folks get bored of waiting for PolyCub to do something!

Instead of betting against us morons, why wouldn't you just short BTC on leverage?

You'll make a shitload more money and won't have to hold 500 HIVE all the way down to pennies.

Posted Using LeoFinance Beta

Well that's just sad...

Posted Using LeoFinance Beta

Totally agree.

A baby 75 basis point was enough to send BTC to below 20k, now imagine....

Posted Using LeoFinance Beta

with the current downturn trends in the market , one just wonders if bitcoin might break through the resistance or not .