My mortgage is an irritant to me.

I've got a few £10s of thousands left to pay off, with eight years left on the term.

The monthly repayments are around £600, which is perfectly manageable for me on my current income, which is stable, and the APR of 3% (1% higher than when I initially took it out because I let the property last year) is low in the grand scheme of things.

Compared to my returns on especially DEFI platforms, which are 10-30% higher than that interest rate it makes NO SENSE to actually pay off the damn mortgage any time soon, so I've settled on the strategy of committing a portion of my crypto-earnings to what I'm going to call my 'mortgage-killer in waiting fund'.

I like the idea of having a fund committed to paying off the mortgage - I find being in debt, any debt, irritating, and so I want to get mentally used to the idea of having a portion of my wealth devoted to paying it off - a portion I'm mentally prepared to just use to pull the trigger and kill the mortgage at any point!

TBH if I pay off 80% of it, the amount I'd have left would be so small the repayment amount on the remainder would be pretty insignificant.

My fund isn't just crypto, I'm also committing all of my non-crypto assets to paying off the mortgage, although my non crypto assets are quite depleted since I used most of them to buy my land in Portugal a couple of months ago (I didn't touch any crypto to do that!).

My 'kill my mortgage fund' and the proportions

I'm going to devote the following assets to paying off my mortgage...

Besides all of my (now somewhat limited) non crypto wealth, I'm also staking stables for this fund AND I'm prepared to sell a small percentage of my crypto holdings, the percentages depend on how attached I am to certain coins, the amount I have and the potential I think each has for future growth, but mainly just how emotionally attached I am.

The percent figure are how much each fund gets me towards my target!

- (FIAT) My remaining Fundsmith shares - 12%

- 75% of my Premium bonds - I want to keep some! 6%

- Some of my other shares - 2%

- All my stable coins - I'm gradually stacking these and they're ALL in DEFI - 13%

- 2% of my BTC - don't want to sell too much, it's the mother! 1%

- 2% of my Hive - again, very attached to my Hive but I should use some. 1%

- 10% of my LEO - not quite as attached to this as I am Hive! 4%

- 5% of my Rune - I've got quite a lot, but I think there's massive upside potential! 1%

- 10% my AVA - basically what I've got that isn't in Smart, quite a a way off the next level up! 1%

- 10% of my BNB/ Cake/ Cub - my main defi coins, I might up this to 20% - I think DEFI on BSC is going to burst at some point! 1%

- 40% of my LTC - I find this easy to sell, but not all! 1%

- 15% of my other al coins - I've got small holdings in around 20 coins, I'd happily sell 1/6th! 2%

Total = 46% of the way to my target!

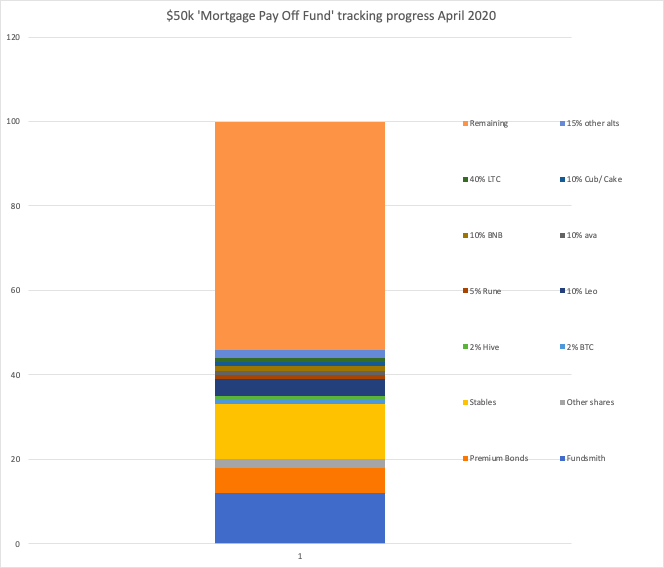

Progress towards paying off my mortgage, April 2021

So as to maintain some discretion - here are the percentages, NOT the actual amounts....

As it stands I'm about 46% of the way to my goal: orange is 'remaining'.

Apologies for the small legend size, but I've given the percentages above!

I imagine MOST of my fund will consist of stables eventually

I'm sticking firm to gradually using my DEFI earnings to stack stables, and I imagine this will make up at least 40% of the total fund eventually.

HOWEVER, thinking about using 2-15% of my crypto assets does make me more inclined to hold crypto more and ease off on my stable coin stacking project, something I've been thinking about recently!

When I hit my target, I may not PAY all of my mortgage off!

The goal is to know that I CAN pay off the mortgage at any time, and have some clarity over what assets I'm prepared to sell to make this move, so paying it off isn't a shock.

However, I imagine once I reach this target, I probably won't pay off the mortgage, rather I'll cash out a small portion, say 10% of what's left and pay that off, and then do the same a few months or a year down the line, and aim to pay it off gradually over a further 4-6 years rather than in one whack.

I mean, it would be silly to cash out stables that are earning me more than 10 times the interest payments on the mortgage, but it's worth sacrificing some of those earnings in the short term to get rid of this damned irritation!

Posted Using LeoFinance Beta

Great strategy and best of luck with it, it's given me some inspiration. I too find the mortgage irritating as hell and can't wait for the day to come when it's paid 😁💵💸🏡

8 years. Thats not bad. I get what you mean, a parallel account that has the money to pay it off but not necessarily doing it just knowing you can. Thats what I am doing. I have a tad more than 8 years on mine though!

Posted Using LeoFinance Beta

I guess how long you have left doesn't matter too much, as long you have the funds to pay it off earning elsewhere!

I might have to overpay for the next couple of years, my rate goes up in 2023 and I'm probably not going to be able to remortgage to a better one being abroad now!

I think my rate is going up soon. I cant believe i got a 5 year fixed rate and the actual rate never did anything that my doomsayer mind thought it would!

Posted Using LeoFinance Beta

I think this is a good plan. I'm in the Suze Orman camp of "debt is bondage." I mean, what good is wealth if your home isn't secure, right? I would want to do the same if I was in this position.

Maybe one day I'll be able to do the same with student loans...

Oh I don't envy you those student loans.

I guess it depends what the debt is for - if it's for needs yes, but borrowing speculatively, I don't think it applies there!

debt is an arse id defo recommend getting rid of it as soon as possible even if it strategically makes no sense. The first thing i did was pay my student loan off (about 7k) just because for the last 8 years id been paying 500 a year off on it, 200 serviced the interest, 100 serviced a 'fee' and the other 200 off the balance. Ridiculous id have been paying it off for the rest of my life with money that at the time i could have used for an annual holiday. It annoyed me more than anything just having it hanging around like the reaper over me. Any money i felt like i did have saved up felt like i was really at 0 if i thought about the debt i had. The next one was my mortgage after that and i can defo recommend it. When money comes fast and easy the best thing you can do is put a line through some debt.

It is an irritation having it, I agree, but what I'll probably do is pay it off in stages and speed up the process rather than killing it in one go. I'd rather keep a larger stake of stables in defi projects earning for me!

That student loan situation sounds crazy, I thought they were supposed to be more or less interest free?!?

They pretty much are, 200 pound of interest on 7k is not that bad per year really. But when your on a average salary of 18k per year your paying an extra 500 per year in 'tax' to chip 200 off the balance. Its a stealth tax and something that in someways id wished id just maxed it out and let it get written off but at same time im really glad crypto paid it off. I made that money in a week in 2017.

Congratulations @revisesociology! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

This is a whole lot...

Really hope your plan comes as perfect.