I'm in the process of gradually hedging into stable coins - I find the current yield farming returns for staking appealing and I like the stability this brings to my portfolio.

I've only really just started this process, and I started off by just buying equal amounts of BUSD, USDT and USDC and staking them on autofarm for what was initially a 100% return, but has now reduced to a very reasonable 50%.

I've been digging around looking at different stable coin options trying to find out which is the most secure, or trustworthy, or actually 'stable' if you like!

I think I've hit on the following order of 'trustworthiness' for the five I've looked at...

- DAI - decentrally collateralised with crypto on ETH

- USDC - centrally collateralised with FIAT by Circle and Coinbase

- BUSD - the Binance Coin - so I guess collateralised by Binance's ability to mint billions of dollars worth of Defi tokens

- VAI - Collateralised with crypto on the Binance Smart Chain

- USDT - Maybe actually collateralised after all, but proof still pending!

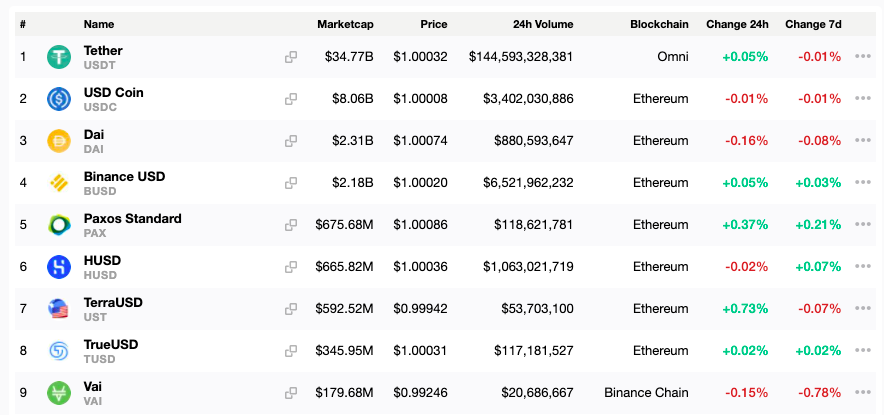

These are all top 10 Stable Coins by market cap

DAI looks like the best bet to me, given it's 'crypto purity' and the security of the ETH network - and there are a few options available to vault it and pool it for a 20% return. Not bad for a decent coin!

USDC is the complete opposite of DAI - It's centrally controlled, but given the 'public respectability' of Coinbase I can be reasonably certain they'll actually have the money to back this coin in the bank, they are very 'up front' with the authorities when it comes to crypto.

BUSD - Given that hedging into stables partly as a counter to having bought more crazy DEFI tokens on Binance Smart Chain it seems a bit futile to hedge with yet another Binance Product. However, some of the staking returns are good so I will continue to hold some.

VAI - You can mint this on Venus.io and then received a currently 30% return for staking it on the Venus platform - or you can pair it with various tokens on Pancake for a slightly higher return.

Finally USDT - I don't know why I don't trust it - too much historical bad press? But it is on Omni, so it's another chain, spreading the risk out more broadly, so I will carry on holding some.

I think for my ratios I'll look for the following:

- DAI 30%

- USDC - 30%

- BUSD - 15%

- USDT - 15%

- VAI - 10%

I will look to spread out my stablecoin holdings even wider as I find out more about alternatives.

Any ideas about other stables I can hedge into would be great!

Posted Using LeoFinance Beta

Nice one!

If we check Uniswap, USDC has the most volume there .... So USDC no.1 on Uni

DAI is great, but it comes with risks to ... I have dig in their whitepaper recently and it has a lot of mechanics

The greatest treat is if no one is willing to buy BAD DEBT during a flash crash, what happened back in March 2020 .... they have since then improved and implemented a reserve fund in case of a Black Swan event ....

Also DAI is lead by MKR holders .... and if you look at the voting, around 30 wallets approve most of the decisions .... so not that decentralized :)

Posted Using LeoFinance Beta

Hmmm that's all pretty off putting TBH.

Especially when it's not worth moving figures under $1000, maybe even $2000 given the gas fees.

Posted Using LeoFinance Beta

Lol, why do most people don't find USDT appealing and many don't just trust it lol.

Looks like we did the same research today.

I was also researching and looking for stable coins today but it wasn't really about making a post but just to have a flair knowledge about them.

I saw a couple of which few you have mentioned here.

Thanks for giving an insight into this.

Posted Using LeoFinance Beta

Useful research!

I use USDT for intra-day or short term transactions, but on the longer term, like you said, it's been too much bad press to trust them with important percents of my portfolio.

I'd prefer in these cases USDC, bacause without a proper research I believe it's available on more platforms which I use, and then DAI, because of its decentralized nature.

I'd hold some BUSD only because there are benefits to having it, just like BNB on Binance (and BSC).

Posted Using LeoFinance Beta

I pretty much agree with you, although what Dalz says below about DAI puts me off !

Posted Using LeoFinance Beta

Thanks for pointing out dalz's comment.

I read once about all the pegging mechanisms DAI has, but wasn't aware it had issues during the flash crash of March 2020.

Posted Using LeoFinance Beta

what benefits does the busd have? do you need some special wallet?

On Binance Smart Chain I'm sure you have plenty of pairs which have BUSD on one side, but I haven't used BSC for defi yet.

On Binance there are launchpools, and all of them have BNB and BUSD and a 3rd coins which is different from project to project. They even have a sort of "defi" on Binance and BUSD can be used there.

But to be honest, on Binance is convenient. On BSC is likely to have much better APY.

Posted Using LeoFinance Beta

I think DAI is the best, but what about the Ethereum gas fees though?

Posted Using LeoFinance Beta

I Know what you mean - but check out what Dalz says below.

Posted Using LeoFinance Beta

There definitely comes a point where stable coins start to look more attractive... like the other day when BTC went down by more than 10k in a day 😂

Although, I think that the volatility and potential gains are what make crypto more attractive. but then again the losses can be as astronomical as the gains. I reckon stable coins are a great tool for when you've made those gains to hedge to and stake in various places. I've got a decent bag/bet on swissborg, but when it went from $0.03 all the way to a $1 I took 50% out into USDC which I can stake for passive returns on their platform anyway.

Stable coins makes a lot of sense once you've made your bank 😉

I'm looking to get a fair whack out into Stables ATM - just gradually though. USDC is my first choice, I just learned that there's going to be a USDr - or Rune stable coin, so that's something I'll probably go for too.

Just a mix i think is best, then stake.

I still think this platform is one of the best for staking for a return. (Hoping the price is now going to hold about 20 cents.

Nice return on that Swissborg!

I'm also going to look at BASE - it's pegged to the market cap of all cryptos.

Yeah, me too. I think I get about 26% annual return on swissborg staking USDC. The convenience is that it is super quick and easy to withdraw straight into my bank to fiat if needed. I'm sure there is much better returns on USDC messing with DEFI etc

Sounds interesting, I shall check that out :)

I was reading from past couple of years that they might be created out of thin air without having equivalent Dollar backing.

Posted Using LeoFinance Beta

I think they might be!

TRON.USD

There must be stablecoin sentiment in the air - got a post brewing for later on talking about another stable coin network called TrustToken which mints the TrueUSD stable coin in your screenshot, as well as other fiat backed (I guess you call it centrally collateralised) stablecoins by the pound, euro, AUD, HKD and USD too. Going to start earning interest on those through Celsius.

Posted Using LeoFinance Beta

I hadn't looked at Trust Token yet, I'd be interested to see what you have to say about it, I haven't ruled it out for sure!

Posted Using LeoFinance Beta

Great minds think alike (but so do weak ones too, so?). But I was thinking the exact thing when I started looking at farming. Hmm... 130% return... on something with low risk (basically all crypto dies). What is not to like? It doesn't take many years of 120% return to become a very big number.

Posted Using LeoFinance Beta

I can't imagine the returns are going to last for that long!