Yesterday Cameco (Uranium Miner Big Player) announced that it will suspend production from its McArthur River mine and Key Lake mill because of low uranium prices.

TD Securities expects upward pressure on uranium prices in the coming days but believes other producers also will need to cut supply for sustainable price gains; the firm reiterates its Buy rating on Cameco and raises its stock price target to C$15 from C$13 in anticipation of higher uranium prices.

The most important factor impacting the uranium demand will be new reactors coming online and existing reactors being recommissioned.

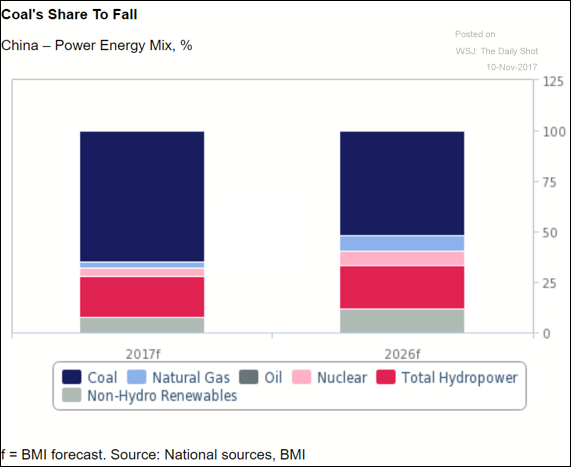

Another good news comes from China because they are going to double nuclear energy in the following years (chart below)

Source: BMI Research

In the next chart you can see how undervalued are the Uranium Miners Equities (Uranium ETF - URA US Equity)

Source: Bloomberg

Best regards

Good observation. Been holding Uranium miners for a while waiting for cycle to reverse. CCJ can definitely move price on it's own.