I intend to make a proposal with the DHF to assist with stabilization of HBD to the peg. Over the past several months, we have seen the HBD peg restored and the price relatively stable at about $1.

However, I believe we can do even better going forward.

The most recent hard fork added the ability to send HIVE to the DHF fund (previously it was only possible to donate HBD). Using this new functionality, we can create an automated process that works to stabilize the price of HBD. The process works as follows:

- On each (hourly) HBD payment from the DHF, examine the price of HBD

- If the price is between LOW and HIGH (0.99 and 1.01 may be reasonable values for LOW and HIGH, or perhaps somewhat wider initially and narrowing over time), send the HBD immediately back to the DHF

- If the price is above HIGH, use the HBD to buy HIVE, and send the HIVE back to the DHF

- If the price is below LOW, use the HBD to convert into HIVE (takes 3.5 days). Upon completion of the conversion, use the HIVE to buy HBD and send that back to the DHF

Notice that in all cases, the HBD or HIVE is sent back to the DHF, either immediately or after a 3.5 day conversion cycle. There will not be any HBD or HIVE accumulating with the payee as a result of the proposal. Trust is minimized because in the event that the payouts are not being returned as intended, stakeholders can vote out the proposal and stop funding. (Reasonable allowance should be made for short interruptions due to technical difficulties.)

As a consequence of this process, any excess demand for HBD (per step 3) is translated into demand for HIVE. All else being equal that would likely increase the price of HIVE. I am optimistic that we can make HBD attractive enough that this may ultimately result in a large amount of demand for HBD (which is then transferred into demand for HIVE), but of course no one can predict or promise actual prices or future price movements. However, for this to happen we first need to stabilize the price and firmly establish the linkage between excess HBD demand and the HIVE price.

In addition, any profits which result from deviations in the price of HBD away from the peg would accrue to the DHF in the form of larger expected amounts of HIVE or HBD being returned (via either step 3 or step 4).

The amount of the proposal funding is TBD. It would likely start smaller and potentially ramp up over time. My initial thought would be to start with 2400 HBD per day, or 100 HBD per hour. Again, this does not represent an actual expenditure because all of the payouts will be either returned to DHF or used to stabilize the peg and then returned to DHF along with what would normally expected to be a profit.

I welcome any comments, feedback or suggestions.

Beneficiary is 100% hive.fund

HBD needs some form of upward price peg, and this is a well thought out solution. And I trust who it's coming from. I'll vote for it.

loan would work.

Price over 1$ user can lock up hive (500% to 1000%) to create HDB. Sell it on market and bring it back to 1$.

Under 1$ user can pay back the loan.

What if the user doesn't pay back the loan? 500% - 1000% of the loan hive worth is locked forever.

Would also work for a pool version user can earn some Interest with the liquid hive.

and I think many smarter things would be possible with this.

What you're arguing for may be better, it is hard to say. But what is for certain is it's much more work.

@blocktrades I agree 100%, more work.

But imagine you have 1 social media wallet in the future ( Hive). You collect there your tokens. At some point, you need the money and don't want to sell your valuable Tokens, because you love the chain, and like social media is, it's a part of your life.

So what you can do? A loan you can lock up 10x more worth Hive from to HDB. You don't pay the loan back? Doesn't matter because the hive is in this case gone.

With larger pools, people can together invest to make the "Hive stable coin"real stable and can also earn some % with their liquid Hive.

Print sell, Burn buy.

appreciate the productive ideas

Nope I think smart would it be to take loan out of Hive.

If the price of HDB is higher as 1$ (lockup 500% to 1000% to be abuse save):

I take a loan on Hive.

Is it below, I can buyback.

So it's a useful mechanic + the user could make a pooled fund.

Makes 1000x more sense.

Also, HDB is at the moment the most shitty stable coin. It will be never used to buy something with a haircut and all this bullshit.

If I want to buy something with HDB and there is only a limit available, which sense has the coin? No sense.

Btw, a Loan would give the users/community the tool to fix the price. So if Koreans go crazy and want to buy HDB for 20$ they can, More HDB printed and more hive locked up. EZ

Everything you're describing requires serious changes that may just fail completely. I've already seen mechanisms of this type pretty much destroy a chain because of one missed flaw in the design, so that first statement isn't hyperbole.

For that reason, I think a 2nd layer solution is probably best for testing such ideas, before making 1st layer changes. In the meantime, before even that's done, this could be done now with little risk and we could learn a little from it.

Sure but HDB doesn't work well. Worst case it has the same effect like you describe here:

a longer Bullrun that prints a lot of HDB can Inflation ruin any worth of Hive or Hive power.

And the funniest point is, they don't buy Hive, if it's cheap with money and we have a supply and demand situation, they are simply creating new Hive with their HDB and make the cycle even worse.

I agree with the testing point, but a lock-up/loan mechanic can work there too. And if it would in a way like DAI, why we should have HDB?

HDB would be the ugly little brother that can burn Hive, but doesn't bring any value to it.

IMO, and I think I'm alone with that, we should try more new things out and copy things from others that work and already good. I know, Hive devs want always to reinvent the wheel.

Edit: We already can learn from DAI. It's not like we need to learn every lesson on Hive. And I would love a loan feature, would make so much more sense to Hold larger amounts of Hive.

Edit 2: To secure loans it can be also a 100 Day ( +- Timeframe) Average price for loans. IMO it would be super abuse save.

Not with the proposal I posted here, because supplying HBD from the DHF and then using it to buy HIVE, which is then returned to the DHF takes that HIVE out of circulation. That's what will happen if there is a bull run with high demand for HBD. Negative inflation.

depends on the Bullrun size and how fast can it adopt.

If the MC is 2B we can have 200M HDB. And it's not impossible it will drop under 1$ again.

If 20% convert around 1$ it will be 25% inflation on top ( and there are 150M left).

HDB is the most shitty stable coin because this coin makes crypto winter even more worse and terrible.

With a real stable coin, people can BUY hive with it. Not generate hive.

Current HDB is also not scalable. Why always people think we can not delete that shitcoin and make a better version out of it.

There will be close to no difference today if we delete it. Only we lose exchange listings for it.

That would favor an update ( a smart one).

A coin that needs HDB potatoes and burn post, sorry that's the description of a shitcoin.

BTW, it's nothing against you, I respect you, and it's my opinion about HDB.

Creating loan features is a great way to bring valuable entire HIVE Network

I'm going to revisit the original premise and put forward the most basic (and essentially important) of questions: why should HBD exist in the first place?

I can think of reasons why it shouldn't exist, in fact, between us all, I think we could make a long list. But why even bother with that until we first have an argument for why it should exist? What needs does HBD satisfy (that already aren't met by dozens of others already - only a couple of which are really successful - and by fiat itself!)? What value added does HBD give us?

The advantage is a local stable coin that doesn't require going offchain and thru exchanges, etc., with all the issues that entails.

It's still a taxable event in most places, going from HBD to HIVE, or vice versus, that is, regardless of whether it's done onchain or not. As @blocktrades says, the only advantage is internal, otherwise it's the equivalent of having fiat on the blockchain (to each his or her own I guess, but that kind of defeats the purpose of being in crypto to begin with, I would think). Was much more interesting pre-2018, but now it's only an "easy way" to calculate DAO funding (which could always be done on a theoretical basis and ultimately paid out in HIVE).

The problem I see with paying only in Hive, is that there will only be more liquid Hive and there will be more inflation which would make the price of Hive lose even more value.

you get it @encrypt3dbr0k3r 100%! DAI is better and it works because of the loan mechanic. For that reason, it is stable and works well. It can also better scale as HDB, that's the reason I think we need a loan mechanic on Hive to lock up Hive and create HDB.

That's a pretty limited "advantage", but I imagine you guys have thoroughly gone over the cost-benefits. Kind of seems like a dead-weight to me, but, again, like I always say, I'm not here to convince anyone of anything, just to share my thoughts and opinions. There must be other advantages that you haven't mentioned . . .

Hi blocktrades, Thanks for this reply

Honestly I consider this as off topic and a distraction. HBD exists and there is no consensus among stakeholders to get rid of it. It is unlikely there will be such a consensus any time soon.

I'm aware that in the past, like maybe four years ago, there was some musing by high level people involved with Steem that perhaps it should be gotten rid of, for reasons that were never persuasive broadly, which is why it didn't happen. The idea may linger on, but it is a zombie that is hard to kill, not anything that is seriously going to happen.

Since it exists, I'm proposing how to make it work better and add more value (by channeling demand to HIVE).

I highly suspected that to be the real reason. Thanks for the answer.

EDIT: On related note, great to see that you're still as committed to this project as always - I've always really respected you, all the way back to the early bitcointalk days! Good luck with this current proposal and everything else you set out to do. Cheers

Thank you for the words of support.

Hbd precludes 30m usd pizzas.

It is worth 1usd in hive, regardless of if hive is a dime, or a dollar.

As long as you only use hbd to purchase things, you don't have to worry about a price spike in hive causing you to transfer those opportunity costs with the purchase.

It also allows free conversions back and forth depending on your assessment of future price rise, or fall.

No need to trust exchanges, nor tether.

I would like to see this being handled by a (layer 2) DAO. While there appears to be only $8400 of exposure there is no good reason to use a non-multi-signature mechanism if one does exist. After all getting people to change their votes on a proposal could take weeks to months depending on where the support is at the time of a misstep. Not only that, technical difficulty, as it's put here, would be mitigated from a system of peers where no one party has to perform actions.

I agree, that would be a better solution in multiple ways at some point, but we can start with this, essentially as a pilot.

I have a DAO written and functioning handling the DLUX token at dlux.io. It provided atomic swaps for DLUX to Hive/HBD by locking open orders in Escrow Transactions between collateralized nodes. This paradigm is being extended to handle partial fills by setting up a multi-sig account between the peers holding the highest amounts of collateral. This DAO paradigm which forms a consensus off the Hive blockstream could also query account parameters that are altered by virtual ops(not on the blockstream, not easily ordered currently) and then autonomously perform these actions.

I would appreciate your support for these developments that not only extend the usefulness of Hive, but the trust required to maintain operations like this that you proposed. A DAO with a multi-sig wallet would even be capable of building a market for the non-transferable Account Creation Tokens held between it's operators or maintaining a pool of cross chain assets for swaps.

Proposal 148

Proposal 152

I expect this would be functioning sometime this month, this being a perfect use for testing, and tested and ready for others to use and build on by April for the community at large.

I will consider supporting your proposals and also supporting other uses cases, but I don't want to tie the HBD stabilization proposal directly to it at this time. I believe the degree of trust necessary here (unlike other cases) is minimal and tying it to a second level dependency prior to such dependency being firmly established and stable would be a negative.

Thanks! I agree this proposal is needed regardless of the tools that could make it trustless.

I gave this a little more thought after my initial response last night.

One of the reasons I would support this would be to limit the printing of HIVE, particularly through HBD conversions. After the conversion is run, instead of sending all HIVE back to the DAO, could a portion be nulled? This could push some value into HIVE rather than creating more inflationary pressure.

If this system is then combined with an HBD "DeFi" solution that's paying out yields for holding HBD (maybe only to those who hold HBD in their savings account), then both HBD and HIVE would gain tremendous value over where they are today. Yields earned from holding HBD would also help keep at least some downward pressure on HBD prices as holders sell off those returns, so there's a little less risk of runaway prices.

The interest on HBDs, if only paid to that amount held in savings, would also limit how much would be going to exchanges that hold the tokens. On the other hand, some exchanges may want to list HBD as a "DeFi" option where customers can essentially stake HBD on their exchanges for a share of the interest payments. This brings more visibility to Hive and additional listings/pairings would help with exposure to and liquidity for HBD, which is sorely needed.

Bro, ever since you gave me that great tip on Cardano and then it went m00n, I'll believe whatever you say!

I think sending back to the DAO is fine. If stakeholders want coins from the DAO burned, they can vote a burn proposal. As you say, it is essentially de-printed and out of circulation in any case.

Sending coins back to the DAO is not inflationary pressure. It is that PLUS payouts from the DAO getting voted which could be inflationary.

The reason I'm not a huge fan of automatically burning the rewards here is that it makes a vote for this proposal into a vote to stabilize HBD and also a vote to burn funds from the DAO. To me those ought to be separate.

If the DAO contractor doesn't do the converting, someone else will, and they won't burn the resulting HIVE either. At least the DAO contractor will send them back to the DAO, getting them out of direct circulation.

Finally, your suggestion as written wouldn't actually help the peg significantly. If the price of HDB is too low, you need to buy HBD on the market and/or remove HBD from public circulation, but your suggestion does neither. It takes HBD from the DAO and effectively burns that, which doesn't affect the circulation or market price in any direct way.

I actually agree with only paying interest on savings. It makes interest into a form of staking rewards (though the stake period is short, 3 days, it is not zero). And if that encouraged exchanges to put their HBD in savings (maybe paying out to customers as "staked" returns, maybe not) that would be a positive in terms of being protective against exchange hacks.

Instead of burning HBD from the DAO, wouldn't it be better to sort of recycle it into the daily reward pool thereby decreasing the amount of new Hive/HBD created by the blockchain.

Please note that I'm a bit rusty here. I've not really read in details the proposal so my suggestion could be a bit off but I will hope you are able to get the idea.

There isn't any mechanism to access the reward pool.

What value do you think HBD has at this point? Even with interest, I doubt we will be able to hold the peg well. Maybe doing a bulk of the time (like we do now with little to no tooling), but in the end has HBD lost it's way?

It's suppose to provide a stable currency for commerce and activities that need it, but it does that very poorly. Even a small 5-10% fluctuation which is a daily occurrence is huge to business.

It is suppose to help buffer the price of Hive, but when most people are selling does it really?

I'm kind of jaded at this point over HBD and I think it overcomplicates a over complicated system with little advantage left. I was always heavily supportive of a pegged asset and what value it could potentially provide, but is it really worth trying to put a round peg in a square hole?

Maybe I'm losing my mind at this point.

I think there's plenty of uses of a stable coin (it doesn't seem like you're arguing against that). This is an attempt to make it more stable, and it requires no change to core protocol to do it. Seems like an easy/reasonable thing to try.

Can we just use existing stable coins that actually hold their pegs instead?

No one is forcing you to use HBD.

They don't, not all the time nor perfectly. It's all a work in progress.

I agree with this; there are lots of stable coins out there. Hive is complex enough as it is. The inflationary hangover from the SBD spikes in the last bull run drove steem price into the ground for a long time. Nothing but trouble in the long run.

Agree with you.

Add features to HDB and make it Cool and scaleable ( like loans or whatever)

remove and add some things on it to make it better

or delete it and fuck the stable coin and there will be one second layer at some time.

I think that are the paths we can go.

Ah and wait, the

" Try to fix the system with the proven broken mechanic".

I think stable HBD has value if Hive coin itself is striving. Since that hasn't been the case, HBD hasn't really served its purpose.

I would suggest either removing HBD completely, or removing haircut on HBD.

Ultimately, best case for Hive and HBD would be moving the rewards for content to a different coin like Layer 2 or SMT/HMTs. That would perhaps remove the sell pressure.

@smooth, what are your thoughts on this?

I don't buy the argument that it is "complicated" and I never did.

I think we really could do well to leave the "let's get rid of SBD and have one token" trope back in 2016 like all of Ned's other "great" ideas.

The code for it is extremely simple (adds basically no cost to operating the blockchain or maintaining the blockchain code), and it serves a clear and obvious purpose.

It just wasn't that well designed from the start, but subsequent developments to the blockchain overall (mostly involving DHF) have changed the situation such that we can make it work a lot better with very little effort.

There is no question Hive is complicated, new users are overwhelmed with RC, voting power, powering up, curation, and all the nuances of Hive. I know people who have been here for 2+ years and still don't understand it.

You don't just buy the token for speculation and wait for a good time to sell. You have to be an author, curator, downvote abuse, to maintain your relative stake or you investment dilutes against those who are doing the same. I don't know of any other chain that has these many rules and actions required to "protect your investment".

While HBD isn't complicated, everything on Hive is as a whole. That is what I was saying. We are not exactly signing up people in droves and when we do we generally lose them fairly quickly due to it being complicated, drama, or they feel like they are not getting their fair share. We can certainly work on complicated, and it is really something we should address.

I'm personally on the fence, like I said earlier I was a big supporter of SBD/HBD and saw value in it, but now I don't know, we just can't seem to keep it stable, Hive is more of a stable coin than HBD has been. I understand this proposal would potentially help stabilize it more, but I also think having only one token could be much simpler for getting people interested. I'm not really 100% for either one at this point and why I was curious how you felt. I feel if we can't keep it stable, it just gets in the way. If we can, it offers significant value. Even 5% fluctuation which is fairly normal on a good day is a lot as a business.

I agree Hive is complicated. I don't think HBD (or SBD) before it has anything to do with that. Compared with the list of things you mentioned and probably others, in terms of complication, it's just nothing.

I agree that really isn't the goal, its more that it was originally quite flawed and it will take some steps to get it working better.

Sounds good, Better than the sbdpotato.

Could make multiple proposals so the amount can be increased in a more granular way.

2400HBD seems good enough given current small market size.

Yes I was thinking of multiple proposals as well, including that they have different custodians which reduces risk without the complications of multisig. In any case, as you say we can start small for the current market cap and then potentially scale up.

I personally think we should go ahead with this just cause it's @smooth and I like having him around. Go vote the proposal guys, or else

Proposal isn't open yet, I'll make another post when it is ready. I wanted to get feedback before doing the actual proposal.

Yeah, was just kidding around. I'd be for it, though, a bit nostalgic as well... been a while since HBD holders got interest. Would be cool also if the interest occurred often so people could track it in real-time and make the most out of our feeless blockchain.

I think the UI could display pending unpaid interest (could even tick up in real time as you watch it). However that is a bit tricky because of how the interest works. If the rate is reduced then pending interest applies at the new rate not the old rate. So any such UI would have to carefully label this unpaid interest accordingly to not mislead.

Yeah, just UI would be fine, was thinking like how hive-now.com refreshes HP inflation every 2 seconds.

Yup, definitely could be done for HBD as well. If HBD gets interest then I would imagine some UIs will do just that.

I guess this could work. Id rather see more robust changes to the system but ... dev time and good ideas dont fall from the sky

Mature answer and attitude appreciated. Too many "just do this other thing instead" ideas being thrown out with no contribution of effort or resources to actually implement.

Voting bots were the killer app that brought in demand, when those were gotten rid of, so went the buying pressure.

First of all, great to see you back. If such proposal would be made I would approve just because I would trust knowledge, expertise, and experience of someone like yourself. And it does makes sense to make HBD work as it was supposed to.

However, I have few reservations that go beyond HBD being pegged. I like it to be pegged at a lower end and guarantee $1 USD but not too convinced about it being capped at $1 USD. Let me explain why.

If HBD is meant to be pegged to $1 USD in the first place, free market should decided that, and we shouldn't be scared of it and intervene with haircuts. 1 HBD should be worth of $1 of Hive coins. It sounds simple. But with interventions like haircuts we try to secure and preserve the Hive and the chain. I have heard the arguments for it. But still, as a stakeholder I wouldn't mind my Hive stakes diminish to make HBD work as it is supposed to.

Next, unreasonable price hikes of HBD or previously steem did prove to be helpful in making Hive(previously steem) more attractive for engagement and being more active. It simply paid more. Over the years I have come to understating that crypto is unreasonable. Perhaps these unreasonable spikes in HBD price are good for Hive ecosystem?

Bottomline, I would like to see 1 HBD to be worth at least 1 USD. But I wouldn't go as far as limiting its move upwards. Because eventually free market will do its work to balance things out and higher HBD prices will lead to higher Hive prices. That has been proven with historic price movements.

Lastly, perhaps it would serve better for Hive if content rewards are finally moved to a layer 2 or different token. That has also been proven to be more efficient and successful (eg LEO). This would remove the sell pressure from Hive, I believe.

GREAT TO SEE YOU BACK!

P.S. I wouldn't even mind removing HDB completely at this point.

Thank you and I'm not familiar with LEO but I would be in favor of moving content rewards to a second layer as well. To me that is the clear thing that should be moved out of core blockchain because it is far too complicated (risks crashing the chain given so many possibilities for bugs in complicated logic, which has happened before), it adds too much bloat to the chain for the value added (particularly when there is spam and mass vote bots), and putting it in the blockchain where it can't be changed without a hard fork is very limiting.

Wouldn't it make much more sense to code this at the blockchain level? Then it becomes a feature of the blockchain and a reason for other people to come and build here.

The proposal as described can't be implemented easily onchain, because it involves interaction with exchanges. An onchain solution would involve some kind of way to create new HBD (either via conversion or collateral). Both of the latter have been suggested before, and might be implemented in the future. But the proposal would make a useful test, if handled competently, before doing anything more drastic involving real economic changes to the blockchain rules.

We already have the hbdpotato creating a sizeable amount of inflation by converting HBD. I don't see why we need a second operation that does the same.

I would rather see this method used where trust is minimized and all funds are immediately returned to the DHF. Also, potato IIRC does not address overvaluation, which is actually the bigger challenge IMO. Conversions for undervaluation could and would (and have been in the past) done by individuals without any organized effort, since there is a direct profit motive when you can buy HBD for less than a dollar and convert into a dollar worth of a liquid asset. But again it is better that any profits be returned to the DHF.

HBD Potato could be trustless, I proposed a solution (using multisig) a few weeks ago (and wrote the code for it), but it seems the current project owner is not interested and prefers to keep full control over the funds.

Thanks for letting us know

Appreciate the effort!Thanks for taking the time to do that @fbslo !

You should be much higher in witness rankings. Very excited for HF25 and vote decay.

Okay, in that case let's compete with him and send the profits back to the DAO instead.

Welcome back to posting :)

Out of curiosity, what would likely happen and is it possible to not have HBD on exchanges at all, so that is only used natively to speculate on HIVE.

It seems silly that a pump of a small supply in Korea can affect the tokenomics of the entire Hive platform.

If it doesn't exist on exchanges it should still work fine with the internal market. Even if your goal is to buy HDB using funds from an exchange or external fiat, you can buy HIVE and then trade that for HDB using the internal market. There really only needs to be one path to external value for it to work, the rest is gravy.

As for Korean pumps, I see it as a stress test. The stronger the stabilization mechanism, the less successful pumps will be and that in turn reduces the appeal of trying to pump it at all.

One should not expect perfect stability though. Even the granddaddy asset of them all, USD, has value fluctuations due to market disruptions and speculation, sudden large ones at times. That's inevitable. What is important is that relative stability is maintained.

Would it be better if it was a platform only token, rather than on exchanges at all? I have no idea if it can be taken off exchanges.

Also, wouldn't it work better to have a second layer token act as the stable coin, instead of one integrated into the blockchain itself?

Could be advantages to a second layer token, but also disadvantages. One being HDB is extremely simple at the blockchain level. The risks of errors in complicated smart contracts are significant in practice. I'd be more comfortable holding something like HBD than any complicated second layer token that isn't extremely well audited and proven out (DAI, itself, is probably okay, but many others trying to do this are likely not).

I don't see any advantage to not being on exchanges, nor can you prevent it. Just have to deal with it.

The real question. Why is there even HBD when it doesn't do what it's suppose to do. Just make it one token Hive and be done with it.

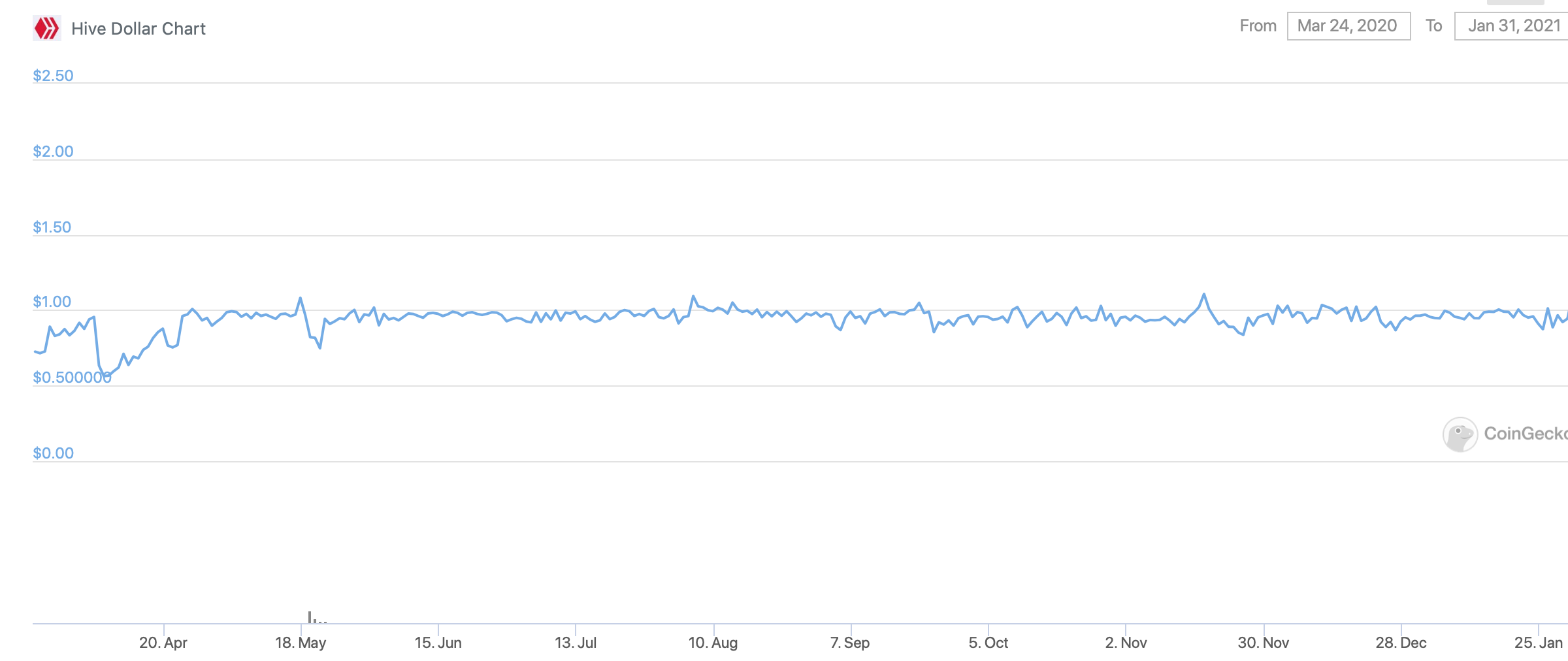

How does it not? Do you see the graph at the top of the post? That's the last year more or less (I think since the Hive fork).

It already mostly works, and can be improved. That's the point of this post.

ironic that HBD is going to 2$ now

The point of this post is to fix that type of problem.

Easy fix, remove it and award just HIVE. Unless someone can tell me what the point of having a stable coin that doesn't really stay all that stable. I'm sure there has to be a viable reason for having HBD just don't have a clue as to what it would be.

Hbd solves the 35m usd pizza problem.

Hbd is worth one usd in hive whether hive is a dollar, or a dime.

Without hbd, one is stuck with passing those opportunity costs with the purchase.

Better to spend a dollars worth of hive, than than to spend 1 hive potentially worth 1 dollar, iyam.

Hbd protects against upside, and downside, risk.

Seems like this mostly had or has to do with exchange wallets being offline.

There is a project sbdpotato/hbdpotato that does something similar with a few hundred Hive run by @thecryptodrive. He has long since abandoned Hive though and only cares about his fork Blurt.

Yet he has 350K Steem (@sbdpotato) he started using for his dlease project on Steem and over 200,000 Hive which runs as @hbdpotato. Neither of which he will return back to the DAO.

I'm aware. It is unfortunate that this has been the outcome, at least if it does turn out that he never returns it.

In practice, this proposal will compete with hbdpotato in terms of the lower peg and the profits earned there should be reduced as a result. The profits earned here will be returned to the DHF.

retarded to fund this project. A private wallet gets donations from the community to do nothing. I was against it at the start and now we see.

On the Internet and special inc crypto why build a system on trust...

I'm not so sure that this kind of internal mechanism can actually help keep the price pegged when these issues usually arise due to pumps on exchanges that lack liquidity. The recent price increase appears to have begun on Upbit, one of only a few exchanges that even offer HBD pairs. The other major listing is Bittrex, which currently has wallets offline again.

The small market for HBDs is too easy to manipulate in either direction, especially when the pairings at the exchanges that carry it are seldom traded. So while this might help with the internal pricing mechanism, it doesn't do much for the more visible external exchange pairings and prices.

Correct. In fact this proposal wasn't intended in response to the current pump at all. I started some private discussions of it prior to the pump even happening. The timing is a bit of a strange coincidence. The original concept goes back to last year with this post of mine, which was then implemented in the last Hive hard fork (AFAIK it was never implemented in Steem).

This is more of a longer term proposal to stabilize the price over time, and create a clear linkage between demand for HBD and demand for HIVE.

Shorter term pumps and liquidity issues need to be addressed different ways, including by improving the number of platforms where the assets can be traded. That's obviously also a longer term challenge and effort.

Oh, gotcha. Yeah, it's something that can certainly be used for our own purposes to help stabilize the internal pricing and to outwardly demonstrate both the intent of the token and the ability of our own network to handle its stability. So that would make sense to me.

I think we're just back to the same old issue of simply not having a large enough ecosystem and user base to have things like this properly functioning. Low distribution, low volume, and low liquidity always make the economic and pricing aspects more difficult to manage. We need more growth, we need more commerce, and we need more trading options, as you said.

Stability internally would cause the Asset to be more desirable and cascade to increased liquidity elsewhere. Ultimately HBD as a stable coin is the goal, and it would be even better if witnesses started offering HBD interest for savings again. More reasons to hold Hive... and to hedge against ever increasing transaction fees on competing ecosystems.

I would love to have HBD interest and have witnesses actually using their parameters again. That's something I've called for many times in the past to no avail. And then I realized that many of our witnesses aren't that versed in economics/finance anyway, so it might be better that they didn't use the parameters. (That's also one of the reasons why I have continually called for new/better witnesses to fill the most important slots.)

In the past, one of the arguments made for not paying interest was that exchanges were the largest holders of tokens and the rewards would be going to them. But many exchanges now have the ability to stake with them, especially with DeFi tokens, so in my opinion, this is something that could encourage more holding and spark new/more interest in HBDs and the Hive chain.

Why not give it a shot?

One problem with interest would be the potential overvaluation, so...

What do you think about interest on savings accounts?

Maybe bring some of that hive back from the exchanges and lock it for 3 days?

Interest on 'almost liquid' funds (3 days lock) is not something my bank would offer me.

The alternative might be to introduce the option 'to stake' HBD in the same manner we stake Hive ( for 3 month)

Both 'staked Hive' and 'staked HBD' should be taken into account for calculating 'vesting shares' then.

I think your bank would call it a cd, and require a longer lock.

Interest on locked liquid hive brings the hive back from the exchanges, gets diluted a little less, and still rewards authors by inflating the inflation.

HBD was designed to be a currency, not a store of value, though it does that, too.

It primarily gives us a way of avoiding 10k hive pizzas being worth 350m usd at some point in the future.

Hold your hive, spend your hbd.

What benefit does staking hbd give the chain?

HBD is 'Hive But Disguised', there's no reason to give any special preference to the Hive holders over the HBD holders.

Let's say Alice spent $100 to buy 1000 Hive and Bob spent $100 to buy 100 HBD.

I can't see why Alice should have more 'rights' than Bob.

Upbit was also the one responsible for the great SBD spike.

HBD in general is acting as a stablecoin with Hive as collateral on a blockchain level (1000% collateral).

Meaning there is no individual responsibility for maintaining the collateral and the peg.

Can we provide a solution for HBD where each account will be individually responsible for the collateral and at the same time incentivized to maintain the peg trough buy and sell orders around the 1$?

For me these shared (systemic) solution always lead to someone abusing the system.

Agree, not your bill, not your problem. Makes no reason to pay out Author rewards in HDB. Why?

I don't get it. There is not enough HDB to support e-commerce, Not enough to make it possible to use it "like a bank". So why we have this coin?

A loan system would be smarter.

Congratulations @smooth! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPKill HBD all together - is there a necessity to have that ? What value it adds to community or chain ?

HBD is mostly optional. If you don't want to interact with it, just ask for your posts to be paid in Hive instead. It has use for those who want an onchain stable coin.

Can you describe who they are and how HBD is helping ?

As a simple example, any voter for Hive proposals that would like to pay a stable pay rate to proposers. And vice-versa, anyone making a proposal that needs steady predictable payments to execute on their proposal.

This will result in you receiving less value of reward paid out to your account as HIVE does it not? (in case of HBD being overvalued by open market)

Seems to be true - More ever, you also earn interest on HBD 😜

3% a year is better than nothing but still not worth buying at multiples of it's intended price. lol

Seems entirely optional then. I guess not if you want to use the DAO but I know of at least one DAO recipient who always immediately converts the payouts. Seems good enough for those who don't want HBD.

I think we should just scrap HBD and simplify hive's core token systems.

If you wanted to simplify the core code, I sure as hell would not start with HBD. HBD is probably 1% at most of the complexity and code of the social content and social rewards functionality.

One of the things that is clever about HDB is how it implements a stable coin with almost no code and very simple logic. A lot of the stabilizing is shifted off chain through incentives.

Welcome back!

The more trustless and automated the better in light of the HBD Potato becoming rotten.

Would it be possible to get HBD added to ETH too and added to dapps like Curve where they pool it with other stable coins to help maintain the peg or is this a purely a chain issue that can't be assigned with off-chain arbitraging?

Cross chain swaps are likely possible.

Such genius this man

So when the crazy interest rates, was 20% now 15%, allows a whale to have even a crazier amount of HBD, and for whatever real life situation forces them, or their estate, to dump presumably at exchanges, this proposal would lead to trading hive to accumulate HBD causing hive [even more on top of any hive they liquidated] to fall to correct HBD prices? Is my understanding of the mechanics wrong?

Is there an easy mechanism to gauge how much hive is being sold/purchased/converted to artificially maintain the stability of this coin?

There isn't an easy mechanism but @dalz has quite a few posts which analyze it.