导言:上一篇文章中我分享了对初创项目FunnyChain的看法,这次我想讨论一下佐佑(aassio)

【什么是佐佑?】

根据佐佑的白皮书:

佐佑是一个便利的加密资产平台,用户可以在此用加密货币来参加区块链技术改革后的不动产交易。每一枚佐佑币都对应了佐佑生态系统中已代币化的不动产的相应价值。不动产市场从未有过的商业革新随着区块链技术的发展将在佐佑平台实现。

【佐佑解决的是什么问题】

流动性差

资本密集 和门槛⾼高

交易易成本高昂

在大多数国家,不动产投资市场确实都存在这些问题,这也是为什么只有少数人有能力参与不动产的投资。

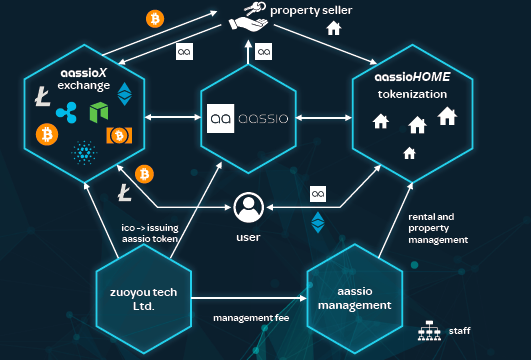

佐佑计划分两个阶段提供解决方案:

第⼀步: aassioX - 交易易中⼼

第⼆部: aassioHOME - 不动产代币化平台 (RET)

第三部: aassioLIFE - 开放式未来⽣生活⽅方式与不动产行业创新

这三个平台共同构成佐佑的生态系统,实现佐佑平台和用户的利益分离:

• 参与不动产通证化的房产所有人会得益于佐佑币(以下简称AAS)的升值

• AAS的持有人得益于佐佑币的升值

• 假定佐佑团队也会得益于佐佑币的升值

• 佐佑团队主要得益于房产升值带来的收益(用于团队激励的部分则主要得益于佐佑币的升值)

【我的观点】

实际操作中可能会遇到什么问题?

aassio X

目前中心化交易所有更成熟的模式和技术,但未来的趋势是中心化交易所还是去中心化交易所,还是未知

aassio HOME

个人住宅所有人通过通证将房产过户给房地产管理公司是否有政策支持?不同的国家可能会有不同的政策,比如在中国暂时可能行不通,因为这种模式非常类似STO,而中国对ICO和STO保持着非常审慎的态度

亮点

• aassio LIFE是佐佑生态系统的最创新的部分,比如AAS持有人拥有住宅的使用权等权利

• 佐佑生态系统的聪明设计:先发行AAS有助于AAS在交易所中并得到定价和评级,AAS得到定价和评级之后有助于aassio HOME的成功因为房产所有人将愿意使用AAS对房产所有权进行通证化

• 有助于增加加密货币市场的参与人数:佐佑将会有助于提高加密货币买卖的活跃度,因为假定参与佐佑不动产代币化AAS持有人都将会投资把AAS投资到其他加密货币

• 抗风险能力非常强的经营模式:从财务稳健性看,佐佑会有很强的举债能力因为有大量的房地产作为抵押物

竞争

佐佑主要面临交易所业务和房地产通证化领域的竞争,佐佑交易所采用的差异化的策略,因为佐佑主要面向发行通证的房地产类项目,但是不限于房地产类项目。

佐佑aassio HOME也面临一些竞争,比如以下一些比较出名的项目:

• ATLANT

除了解决房产投资难的问题外,ATLANT也试图抢占租房领域的市场份额,解决中介费用高和虚假点评的问题,被业界看好为“爱彼迎杀手”。

• LATOKEN

在LATOKEN,任何实物资产或者股票都可以发行通证,LATOKEN的目标是成为通证化资产领域的亚马逊

• Propy

Propy构建的是便捷的全球购房的平台,和佐佑不同的是,Propy的Token只用作用户奖励和交易服务费用支付,不存在增发和销毁

风险

• 佐佑模式和炒房型投资人是矛盾的存在?

因为炒房型投资人希望房产价格上升,但佐佑的模式存在让房产市场有价格下跌的可能,因为假定相信加密货币的房产持有人数量远超不相信加密货币的房产持有人,并且他们相信加密货币市场的获利水平比房地产更高,然后他们驱动了大量的房产在佐佑实现通证化,这些房产将会过户到佐佑房产管理公司。

• 佐佑模式将会对房地产一级市场造成困扰?

房地产价格将会下跌,因为房地厂一级市场将会变得非常不活跃,因为二级市场的交易占比将会越来越高,假定房地产通证化市场在二级市场的占比越来越高,得益于佐佑的这类模式成为主流。

• 佐佑是一个很脆弱的生态系统因为佐佑的模式十分依赖加密货币市场的活跃度?

佐佑解决了房地产交易的流动性问题,但背后的驱动是加密货币市场的活跃,如果加密货币投资回报下降导致加密货币市场活跃度下降,并且回报率比房地产投资要低,那么AAS存在的必要性将降低,因为投资人将会更多投资在房地产或者房地产通证是non-fungible的项目。

改进空间?

我认为同时发行fungible佐佑币和non-fungible佐佑币会让平台有更好的发展空间:

• non-fungible的AAS投资人将会更多的得益于房地产的增值而非AAS的增值

Non-fungible的AAS将具有类似代表资产权益属性的通证,投资人成为房屋的股东之一。

• fungible的AAS将持续收益于佐佑生态的持续发展

两种代币可以共同起到分散市场风险的功能,对佐佑生态系统的规模增长有帮助,因为投资人将会更加多样化,可以至少涵盖这两类投资人:

• 认为房地产投资收益比加密货币投资收益高的投资人

• 认为加密货币投资收益比房地产投资收益高的投资人

今天先分享这么多,下期我会继续分享更多区块链/加密货币方面的看法,欢迎大家继续关注我的主页:)

Preface: In my last article, I shared some point of views regarding a new blockchain project FunnyChain, and I would like to discuss a bit about aassio.

【What is aassio?】

The business model and vision of aassio stated in the white paper are:

aassio is a blockchain-based platform providing effortless access to the real estate market to buy, sell and hold real estate in cryptocurrencies from the convenience of your own home or office. Real estate investment has never been easier or more accessible!

【What problems is aassio going to fix】

Liquidity – bad

Affordability - capital intensive

Transaction efficiency - high costs

That’s why in most countries, affordable investors are those minority engaging in the real estate investment due to the intensive capital requirement.

aassio is going to establish the aassioECO in three phases, and the solutions for the addressed problems would realize in the phase 1 and phase 2:

Phase 1: aassioX - crypto exchange

Phase 2: aassioHOME - real estate tokenization (RET)

Phase 3: aassioLIFE - future-living solutions & open source

It becomes the aassio ecosystem and it seems to have the corollary benefit related to the interest of different participants because:

• Home owners benefit from the price appreciation of aassio token (hereinafter referred to as AAS)

• AAS holders benefit from the price appreciation of AAS

• aassio team benefits from the price appreciation of AAS

• aassio will benefit from the price appreciation of the tokenized house

【My point of views】

What are the potential challenges being faced?

• aassio X

Currently when it comes to listing, the centralized exchange might come first in terms of the mature technology and operation. It is unknown if centralized exchange should give its way to decentralized exchange due to the better security.

• aassio HOME

Are there policies supporting the ownership transfer from individual to the property management company in the way of tokenization? They vary a lot among different countries. For example, in China, it might not work because property tokenization looks like security token offering but ICO and STO are still forbidden in China.

Highlights

• aassio LIFE is the most innovative part of aassio ecosystem. Features related to the utility of the property become possible, such as holders of AAS could have the rights to live in the property.

• Smart design of the aassio ecosystem: Issue of the AAS before launching the aassio HOME is crucial because property owners are motivated to tokenize the property in exchange with the AAS if AAS is public listed and graded on the exchanges.

• aassio is committed to driving the crypto investment because the transactions between AAS and other cryptos on aassio X become possible assuming that AAS holders are motivated and active to invest in other crypto.

• aassio will be financially strong because aassio will benefit from its financing capability due to the ownership of a large amount of properties.

Competition

aassio will be facing competitions in exchange and property tokenization.

aassio X will be implementing diversity strategy because aassio X is going to mainly focus on but not limited to real estate token projects.

aassio HOME will face some competitions, such as the following big players:

• ATLANTA

ATLANTA offers property tokenization and rental platform. Known as “the Airbnb killer”, ATLANTA aims at offering lowering the middleman fee and fake reviews for rentals.

• LATOKEN

LATOKEN is where any real assets or stocks could be tokenized. LATOKEN is so ambitious because its target is to become the Amazon of Tokenized Assets.

• Propy

Propy is to create a convenient cross-border property purchasing platform with the most credible legal automatic authentication. It has the different economic model from aassio because Propy only issue tokens at its first token sale which will be used to pay for the transaction fees and rewarding.

Risk

• Does aassio ecosystem represent different interest with those making profit from real estate speculations?

Real estate speculators bet on the rise of the real estate price, but aassio ecosystem will be likely pushing the price down if we assume that the property owners being bullish on crypto outnumber those who are not bullish on crypto.

• Is aassio ecosystem going to impact the primary real estate market?

Price of real estate is expected to decrease, and therefore the transaction would be probably less active. It is because the secondary market transactions would account for a higher proportion as the tokenized property market becomes more and more dominant thanks to the increasing maturity of tokenization economics.

• Will aassio ecosystem be vulnerable because it is highly dependent on the activity of the crypto investment?

aassio for sure will offer a better solution for fixing liquidity problem of property market. Assuming that the return of crypto investment becomes lower than the real estate investment, AAS would be like to be less attractive because investors would be more motivated to invest in real estate or non-fungible tokens being property specific.

Improvement?

I hold the point of view that it is better for the long-term development of aassio ecosystem to issue both the fungible and non-fungible AAS:

• Investors in the non-fungible AAS would mainly benefit from the appreciation of AAS instead of the appreciation of the property

Non-fungible AAS is token representing the property specific equity which enables the investors have part of the ownership of the property.

• Fungible AAS holders will benefit from the sustainable development of aassio ecosystem

Being coexisting, both tokens would together diversify the market risk, which would be committed to the organic development on aassio ecosystem due to the more diversity of the investors. It is therefore attractive to both the investors:

• Investors expecting higher return of property investment than crypto investment

• Investors expecting higher return of crypto investment than property investment

That’s all for today. More sharing about my findings and point of views will be followed very soon. Stay Tuned to my upcoming sharing in my channel.