Defi, decentralized finance, is one of the hottest topics in crypto. Meltem Demirors, Chief Strategy Officer of CoinShares, an digital asset investment firm, recently posted a full breakdown of DeFi at this point in time. These are a few of the key insights:

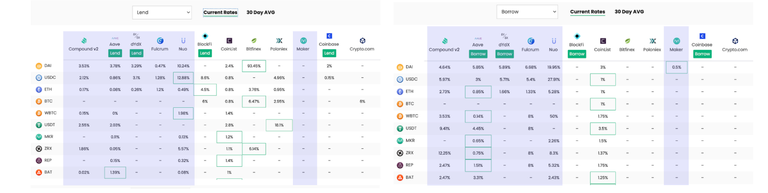

DeFi Lending and Borrowing Rates

Maker and Aave market share battle

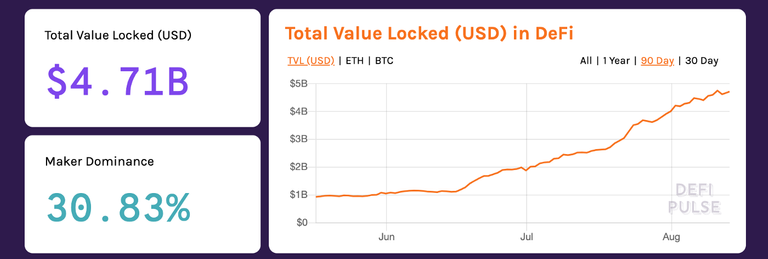

On the day the article was posted, Maker (MKR / DAI) held over 30% market dominance via Defi Pulse:

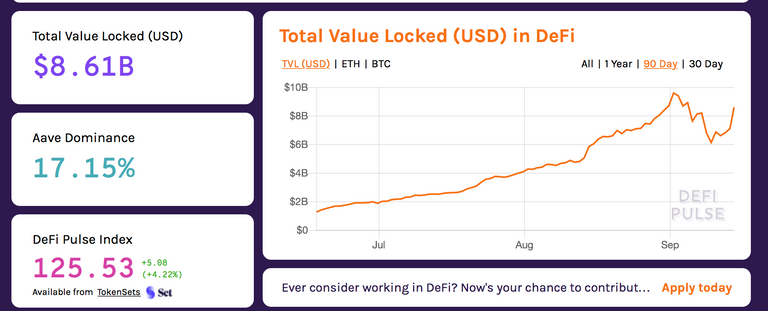

However, this has shifted in favor of Aave (LEND):

Note that the amount locked in USD has almost doubled in the last month.

Companies with which to gain leverage

- Coinshares - DGLD, Digital gold product

- Figure - Digital home equity lines of credit

- Shuttleone - Letters of Credit using Maker Dai

- Centrifuge - Platform to turn any assets into tokens, including NFTs, non-fungible tokens

What we need for the Future

- Black box credit score calculation

- New credit scoring models

- Progressive credit scoring

- Credit scoring data network

This story originally appeared on BlockchainBeach.com. You can read it at https://www.blockchainbeach.com/coinshares-outlines-the-current-state-of-defi/

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

our discord. If you believe this is an error, please chat with us in the #appeals channel in