Accounting for your STEEM Witness

DISCLAIMER: Please do not consider this legal tax advice. Consult an accountant or tax lawyer for the correct information in your jurisdiction.

In countries such as the US and the UK, "income" counts the second you receive it. From my interpretation of this, the second you receive SP from witness activities, it counts towards your income. Steem Power is represented as VESTS rather than STEEM, however as VESTS aren't exactly listed on any exchange, they're rather painful to calculate for, so we just assume it was earned in STEEM.

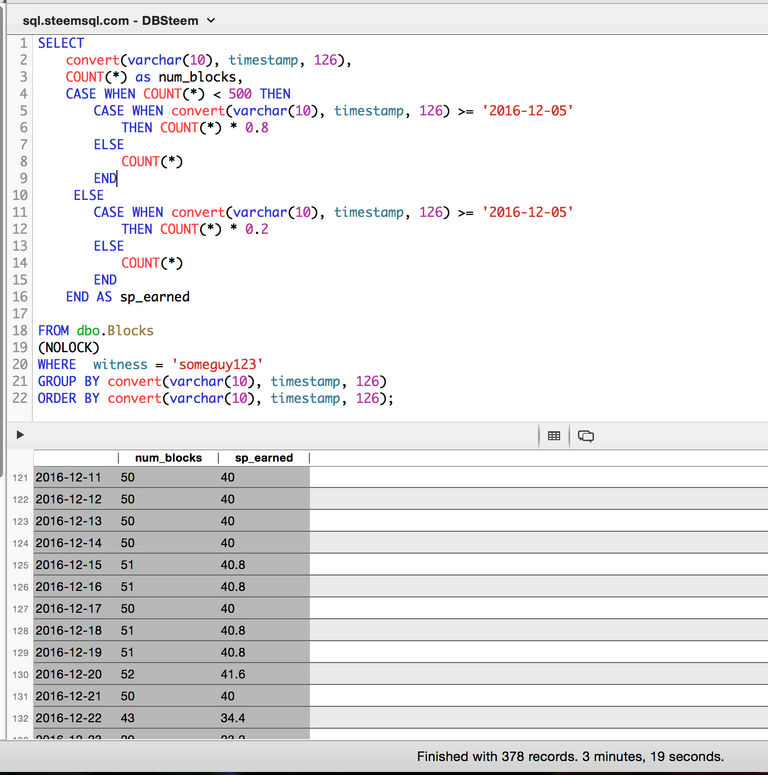

To calculate this, I use SteemSQL by @arcange. SBDS currently does not have indexing for the witness key on blocks, which makes it difficult to calculate using it, so SteemSQL works best.

Requirements

First you'll need a Microsoft SQL Server client. I would have written a website or program for it, if it wasn't for the fact MSSQL is a nightmare to connect to programmatically using non-windows systems.

I use SQLPro Studio for OSX, there are various clients available for Windows and Linux too.

Query Explanation

The following query does the following:

- If before HF16, assume the payout is 1 SP per block

- If after HF16, assume the payout is 0.8 SP for non-top-20, and 0.2 SP for top-20

As the blocks do not have the payout listed, I assume that if you get more than 500 blocks in a day, then you were in the top 20.

This groups the block payouts per day, as it is possibly the most fine grained accounting you can currently get.

Note: the payout is never exactly 0.8 or 0.2, but as I say, I haven't found a more accurate way of calculating. Tax agencies can only expect your "best effort", having some records like this is better than no records.

Use the query

Connect to SteemSQL using the details on http://steemsql.com/

Open the query section of your SQL server application, and paste the following.

Change "someguy123" to your witness name.

SELECT

convert(varchar(10), timestamp, 126),

COUNT(*) as num_blocks,

CASE WHEN COUNT(*) < 500 THEN

CASE WHEN convert(varchar(10), timestamp, 126) >= '2016-12-05'

THEN COUNT(*) * 0.8

ELSE

COUNT(*)

END

ELSE

CASE WHEN convert(varchar(10), timestamp, 126) >= '2016-12-05'

THEN COUNT(*) * 0.2

ELSE

COUNT(*)

END

END AS sp_earned

FROM dbo.Blocks

(NOLOCK)

WHERE witness = 'someguy123'

GROUP BY convert(varchar(10), timestamp, 126)

ORDER BY convert(varchar(10), timestamp, 126);

You'll see something like the below image:

Now the next part is calculating this in USD, GBP or whatever currency you use.

Calculating the USD/GBP earnings

I use Bitcoin Taxes to convert my STEEM earnings into a fiat format. They support the United States, the United Kingdom, Canada, and a few others.

Bitcoin Taxes

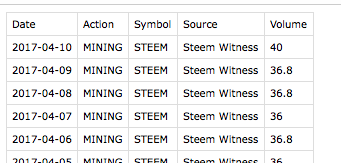

To make your witness earnings into Bitcoin Taxes format, go to your SQL query and find something like "Export to CSV".

Open the CSV file in whatever Excel-like software you have, e.g. Google Docs, Apple Numbers, Microsoft Excel and LibreOffice.

Take the sp_earned column and change it to "Volume". Add a column after the date called "Action" with "MINING" as the content. Add another column called "Symbol" and with "STEEM" as the content. Add a "Source" column and put in "Steem Witness".

It should look something like this:

Now, in your excel-like application, find "Export to CSV" (it might be a file type option when you save).

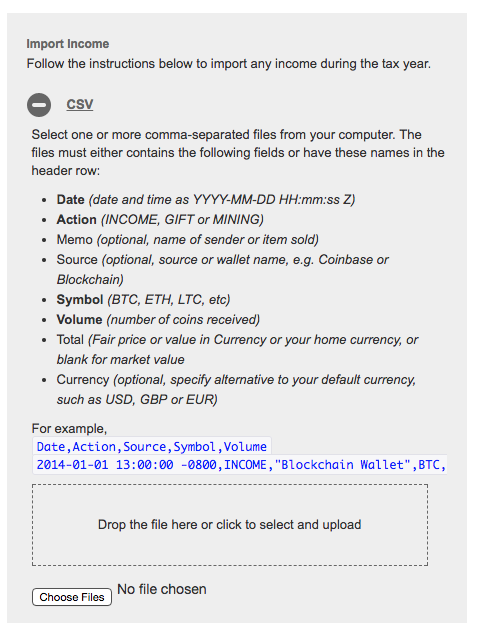

Go to Bitcoin Taxes - sign up if you haven't already, and buy Premium which is only $20/yr for more than 100 records.

Now go to the "Income" tab for your tax year you're reporting for, and scroll to "Import Income". Open the "CSV" box.

It looks like this:

Now, drag your CSV in there... and you're done!

Load in your spends under spending and it will automatically calculate capital gains based on your STEEM income, and you'll see your income tax report under "Reports & Export". You can automatically import from exchanges such as Bittrex, Coinbase, Poloniex etc.

Now just talk to your accountant, show them BitcoinTaxes and they'll be able to easily help you with your tax filing :)

In my next post, I'll be covering how to calculate your post earnings and import them into BitcoinTaxes. Follow me for updates!

Bitcoin Taxes

GIF Avatar by @stellabelle

Do you like what I'm doing for STEEM/Steemit?

Vote for me to be a witness - every vote counts.

Don't forget to follow me for more like this.

Have you ever thought about being a witness yourself? Join the witness channel. We're happy to guide you! Join in shaping the STEEM economy.

Are you looking for a new server provider? My company @privex offers highly-reliable and affordable dedicated and virtual servers for STEEM, LTC, and BTC! Check out our website at https://www.privex.io

Interesting. Is there a method in place for normal users?

In my next post I'll be writing about how to calculate the taxes on post rewards :)

I'll definitely follow this one. I'm having a hard time figuring out how to report my crypto earnings for taxes. Still learning things slowly.

waiting for next article

ok, what we are do?

This year Belarus has introduced a new law about crypto.

Since 2018 and until 2026 there will not be any taxes on cryptocurrency (mining, selling, and buying) and all crypto is 100% legal from now on.@someguy123, 100% useful information as always. @someguy123 has helped me with all my witness questions.

I'm amazed that Belarus did that, that's awesome! I expected with their rather iffy government to never pass such a thing.

Yeah, me too. Could never even imagine that such country would pass such a non-totalitarian law. I have even read an article with an official government letter attached that stated that once a Nuclear Power Plant is finished in Belarus, National Information Institute is planning on mining crypto with that energy.

I'm not that familiar with many of the terms in this post but I'll resteem for followers who may not have seen this post yet.

Thank you :)

The UK tax deadline is in 3 weeks, so for all the british witnesses out there it's pretty urgent to see.

Hey @someguy123. Great article, just caught sight of it. I was wondering if you know whether the payouts received via our blogging efforts, are considered income tax or capital gains in the UK? Thank you in advance... :)

There is a virtual operation comes with every block, called

producer_rewards, that would give exact numbers. I don't know if it's acessible via SQL, tho... :)It looks like there's a table called VOProducerRewards, however the payout is in VESTS, which means I'd need a way to get the VEST->STEEM price at the time.

Oh, yes, it's in VESTS. I haven't heard of any price history service for STEEM per VEST :/

Let me know if you found one :)

Witness rewards should not be taxable until you power them down. It's a grey area, but everyone I have talked to feels SP is not a taxable property until it is powered down to Steem.

I agree!

Great post! Thanks for sharing such a wonderful legal tax advice, I personally appreciate your good job. I follow and upvote you.

@someguy123 As you already mentioned @sametravel that you will be discussing this with an accountant in the UK, I would advise placing a call on the internet for more European accountants, to make a more flexible European app, being a frontrunner in this could really make life easier for us all. And a nice business opportunity for you. Up, if you agree :)

I played with Bitcoin Taxes a few weeks ago and found it wasn't pulling through all the data I needed. I also used cointracking.info which supports more exchanges, but that also wasn't straightforward. Maybe I just need to put more time into it....

Awesome tool... Seems a lot of research and effort has been put into creating the thing.... Really appreciate the effort.

i thought the reason why anybody wants to use crypto currencies is to avoid taxes.

Interesting! I'll have a look to this. Thanks for sharing!

@someguy123,nice post and great information breakdown

Keep sharing thank you for sharing ❤️if you get in trouble with HMRC but you used an accountant, it can end up being the accountants fault rather than yours, which is a huge safeguard.

Great tool. Thanks for sharing. I'll resteem it. I know there more Steemians who can use this tool

I am following up immediately

You have posted too much education, Actually, there's a lot to learn from this post,,

I'm very kind to you, Please you visit my account @shakirchy

You've posted pretty well

Great and valuable information.

Your post helps me a lot.

Thanks @someguy123 for sharing this post.😊

Have a great day!!

do you make acountation aplication right ?

Yes, I will be discussing this with an accountant, as any sensible person should do. I've done my best at collecting records, and an accountant can make sure I'm not doing anything wrong.

In the UK, if you get in trouble with HMRC but you used an accountant, it can end up being the accountants fault rather than yours, which is a huge safeguard.

I will consider being the first witness in my country Uganda.I have had some friends in Uganda tell me to do it,but i do not know exactly how everything works!

I will check out that witness channel

What a brilliant analysis.....i would surely resteem this...i am looking forward to your next post concerning how to calculate post earnings.

I'm not so sure about this. Does the UK government recognize Bitcoin or any crypto as cash, a valuable asset or as a security? Because unless they do you are not required to pay tax on it.

If not I would consider it to be taxable the moment you convert to fiat.

Many people misunderstand the income tax laws in their country. In the UK it's considered a currency, in the US it's considered an asset but income tax still applies.

In the US and the UK you're required to pay income tax on assets that you receive, they still count as income whether the asset is bananas, or STEEM.

Oh I understand, but it must be recognized. I assume that it was but wasn't sure.

I think you might not be correct though that SP can be considered under income tax. For example, I can't actually pay you in bananas in the US or UK, I must pay you in currency. You must only pay income tax on pay as income, so there is no income tax on non-currency payments. I think this is to protect people from unfair pay and to be able to account for it easily, and thus facilitate tax.

There is such a thing as "benefit in kind", which is probably what the bananas would count as if the relationship was employer / employee. I'm not to sure what a trade counts as, which in the case of witnessing would probably be running a service for an asset.

I'd also be interested to know whether SP qualifies as a currency even in the UK, since it is non-transferrable for example. You can only divest it into Steem at a fixed rate, suggesting that it's more like game or store points. Have you considered this?

Thx for information sir

@someguy123 after looking through your guide, I have felt so much encouraged by the fact that you can just work with the block chain remotely without actually downloading it. But i wonder how much one can be able to achieve with this approach, because i'm currently working on a project in Africa where i want people to able to purchase STEEM using the local fiat currency. In other words i'm creating a local exchange to try and promote steemit to our community. You can guide me on how to go about this. Cheers

You cannot be taxed for collecting coupons. A coupon is something that can only be spent in one place, just like your SBD. Steem however can be spent in a number of places and can be traded for USD. From my understanding, however, your income isn't taxable until you create a "taxable event". This essentially means converting your crypto to fiat. If it stays as crypto it's untaxable. If you make a purchase or trade, it's the trade that is taxable.

Besides, you are absolutely anonymous when you receive crypto unless it's to a phone owned by a big telecom company, and even then it would be difficult. so the IRS does not know how much you have until you put it on an exchange you signed up to with your ID, you try to convert it to USD fiat which requires an ID, or you try to make a purchase which requires your shipping address.

This article explains it very well.

It is difficult to leave the area of confor in many opportunities but always all doing so to be able to have the success that one looks for

Nice poet. very helpful

Wow so much information. Thanks for the update.

click here.Congratulations @someguy123, this post is the eighth most rewarded post (based on pending payouts) in the last 12 hours written by a Superhero or Legend account holder (accounts hold greater than 100 Mega Vests). The total number of posts by Superhero and Legend account holders during this period was 42 and the total pending payments to posts in these categories was $8774.10. To see the full list of highest paid posts across all accounts categories,

If you do not wish to receive these messages in future, please reply stop to this comment.

Excellent very interested I do not speak English but I translated and I liked it a lot. I follow you

Hello someguy123,

@SteemEngineTeam would like to take the time to thank you for signing up and participating in our community. Your contributions and support are important to us and we hope you will continue to use our platform.

We plan to give back to our community members, so have an upvote on us

Thank you.

Wow this is really helpful, thank you for all your thoroughness and hard work.

Great work keep it up bro

Hello @someguy123, I wrote a tutorial on how to use anonsteem. Can you resteem it so that It can get more visibility. You can find it in my blog.

Resteemed

Posted using Partiko Android