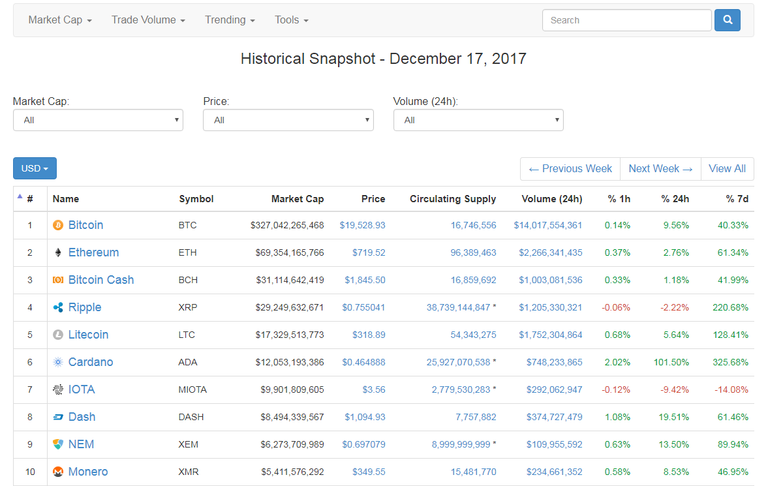

Did you know, if you invested $10,000 in December 2016, you already have $250,000 in your pockets when you sold all your Bitcoin in its highest price last December 2017? Why? Because Bitcoin experienced an unbelievable surge in price last December 2017 for reaching $20,089 per coin one time compared to just around $800 in December 2016. What more to the whales who can afford to splash hundreds of thousands to millions of dollars? Also, I wonder what are the earnings of the earliest adopters when Bitcoin was just around $1 - $10?

Alternative coins aka “altcoins” rode the trend last year. The two most famous altcoins are Ethereum and Litecoin. Just like Bitcoin, they also experienced sudden surge in price that’s why they also got attention.

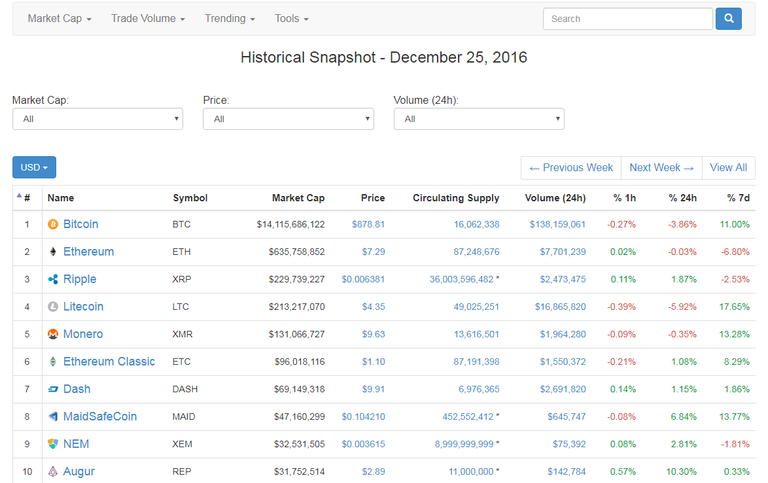

Below is the historical snapshot of the top coins based from the Coin Market Cap website, in December 2016 and December 2017. As you can see below after a year, all coins increased significantly their price especially the most famous cryptocurrencies mainly Bitcoin, Ethereum, and Litecoin.

The most famous cryptocurrency Bitcoin was launched in 2009 by Satoshi Nakamoto. No one knows who he is because many believe it’s just a pseudonym. It can pertain to a single person or a group of people who developed Bitcoin. This 2018, Bitcoin is on its 9th year in circulation and we managed to compile some memorable stories regarding Bitcoin, some successful ones and some that are cringe-worthy.

The first major purchase of Bitcoin was from Laszlo Hanyecz. On May 22, 2010, Hanyecz traded 10,000 Bitcoin worth $41 during that time for two boxes of Papa John’s Pizza. It’s considered as one of the most viral and legendary in the world of crypto because if he had just held his Bitcoin, it’s now worth $88 million at current $8,763.85 price. We can consider that his lunch was the most expensive lunch ever recorded.

You may have a chance to see this screenshot of a tweet from Greg Schoen in May 2011 when you’re active in Facebook groups and other forums. He said that he sold his 1,700 Bitcoin for $0.30 each. Although he already gained profit from selling his Bitcoin after purchasing it for just $0.06, he then regretted his action because Bitcoin went to $8.00 during his post. He bought all his 1,700 Bitcoin for just $102 before. He then sold all his Bitcoin for $510. He regretted not selling his Bitcoin for $13,600. If he only held his Bitcoin until now, he already have $15 million at current prices.

The Winklevoss twin brothers were schoolmates of Mark Zuckerberg during his days in Harvard. In 2004, they sued the founder of Facebook, claiming he stole their ConnectU idea to create the popular social networking site and received $65 million after the verdict of the court. In April 2013, the Winklevoss twins bought $11 million worth of Bitcoin priced at $120 a coin. Their Bitcoin grew to be worth more than $1 billion in December 2017 as the price of one coin surpassed $11,000. Talking about perseverance, winning a case, having lots of money invested to Bitcoin, and mix it with a huge amount of luck, they were instant billionaires because of what transpired.

Last for the Bitcoin stories, we shouldn’t forget the best success story, Satoshi Nakamoto himself. Many believe that Satoshi Nakamoto owns around 1 million Bitcoin. Since he is the one who developed and launched Bitcoin, it’s just normal for him to own that amount as a pre-mined coin before launching the blockchain to the public. Again, Satoshi Nakamoto is just a pseudonym so nobody knows if he’s just a single entity or a group of developers hiding their true identity so no one can treat them as Santa Claus during Christmas. As of this writing, 1 million Bitcoin is worth $8.8 billion. That’s a lot of money for an individual or a group while still being unknown to the world.

Since we’re talking about success stories of Bitcoin from its low prices up to now, Acorn Collective is giving us a very good opportunity with their Initial Coin Offering (ICO) scheduled to start on the 28th of April. Acorn plans to be the first online crowdfunding platform where there will be no fees for the crowdfunding, all legal and non-harmful projects will be allowed, projects from any country can be funded, and the early adopters will be rewareded. They want to build a crowdfunding platform built on top of blockchain and they now have many projects from prospective clients waiting to be listed.

Bitcoin started only around $0.10 per coin in 2009 so in the world of cryptocurrencies, your best bet is to join early especially during ICOs because after the ICO and the crypto launches to the exchange, their price can multiply twice or even up to ten times in months or just even weeks.

The following is the summary of the ICO of Acorn:

Name: Acorn Collective

Category: Crowdfunding

Token name: OAK

Price: $1.40 per token during the ICO

Maximum Supply: 90,000,000

As you can see, Acorn only has 90 million of maximum token supply. The main reason Bitcoin’s price surged last year because the circulating supply is nearing its maximum supply. The maximum supply of Bitcoin is only 21,000,000 and they are now nearing the 17 million mark. With the finite supply of Acorn, I’m sure the price of OAK will surely increase in the future.

Let’s compare it to other currently trading cryptocurrencies around the same supply of 90 million.

Name: Binance Coin

Category: Exchange

Token name: BNB

Price: $13.27

Circulating Supply: 114,041,290

Total Supply: 194,972,068

Name: Neo

Category: Platform

Token name: Neo

Price: $73.93

Circulating Supply: 65,000,000

Total Supply: 100,000,000

Name: Salt

Category: Lending

Token name: Salt

Price: $ 3.34

Circulating Supply: 57,902,340

Total Supply: 120,000,000

We listed three different trading cryptocurrencies in different categories. Binance Coin is the cryptocurrency of the Binance exchange. Its circulating supply is above the 90 million mark, the maximum supply of Acorn. Its total supply surpassed the double of the maximum supply of Acorn. Neo is a platform like Ethereum where developers can create tokens and applications under its smart contract. As you can see, both Binance Coin and Neo already have high prices.

The closest example to compare to Acorn is Salt. Salt is a lending platform which had their ICO last August 2017. In their ICO, the price of Salt is $0.89 per token. As of this writing, Salt’s price is $3.34 per token. Since Salt is within the same range of supply of Acorn, I’m pretty confident to say that Acorn will also reach or even exceed the price of Salt in months’ time.

For more info about Acorn and its underlying technology, just visit their website at https://aco.ai/ and start by reading their white paper.

Disclaimer: This is not an investment advice. Invest at your own risk. Invest only the amount you can afford to lose.

Website: https://aco.ai/

Whitepaper: https://drive.google.com/open?id=0B1PbmmXatTeAODdsWUl4bmRJOW8

Facebook: https://www.facebook.com/TheAcornCollectiveICO

Twitter: https://twitter.com/AcoCollective

Telegram: https://t.me/joinchat/HI_eCBG0fCRCl1ja-d5JDg

Medium: https://medium.com/@Acorn.Collective

Author: https://bitcointalk.org/index.php?action=profile;u=1767289