For the last two decades, with the emergence of the internet and smartphones, business models and entire industries have been reshaped on a global scale. No other industry has been more impacted by this transformation than the media industry.

On the bright side, this digital transformation led to platforms like Facebook, with a reach that was unthinkable a few years ago. According to its latest quarter results, Facebook is now used by 1.94 billion people (over 25% of the world population), of which 66% on a daily basis. Financial results follow audiences, with companies like Facebook (+49% Y/Y in Q1’17 to US$ 8.0 billion) or Google (+22% Y/Y in Q1’17 to US$ 24.5 billion) posting double-digit growth rates on already sizeable revenues.

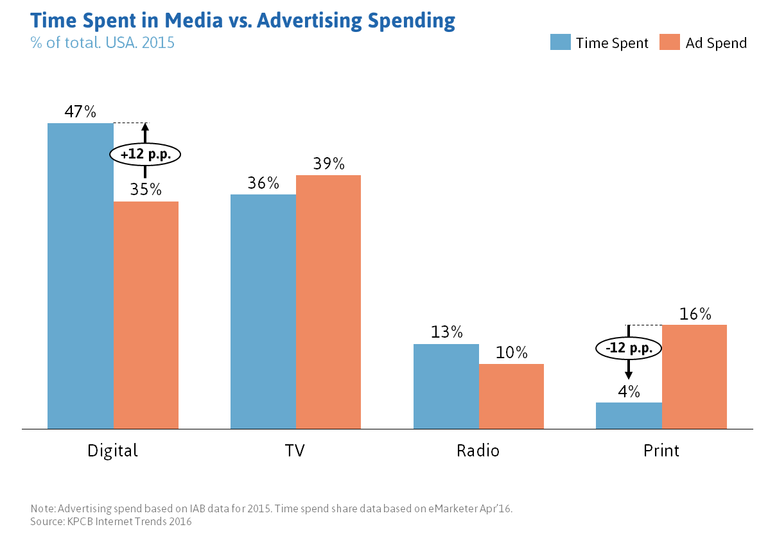

On the less positive side (depending from where you come from), there has been a significant rebalance of advertising revenues from traditional media to digital media. This rebalancing is inevitable and shall continue in the future — it’s a direct outcome of advertisers putting their money on the media where their target audiences spend their time.

As the chart shows, this shift is not without consequences for some players — print media has been significantly impacted. There is a clear decline of newspapers in US, which generate less than one third of the print revenue peak reached in 2000, and with the industry overwhelmed with layoffs and closures.

Similar trends are seen everywhere and print media will inevitably be a much smaller industry in the future. So the big question for any player on print media is: how can we successfully transition our business model to the digital space?

The answer to this question is far from obvious, and there is no single solution that can be applied to any given player. Of course, there are some guiding principles worth to explore as presented by consultants and industry experts in the past. But, as in most things in life, the "devil is in the detail" of the specific strategy and its execution.

There are some interesting case studies, like Newsweek which in 2012, after 79 years in print, decided to go digital only and to quickly revert back on this decision in 2014. But more interesting is the case of the New York Times, which seems to have found a successful digital strategy.

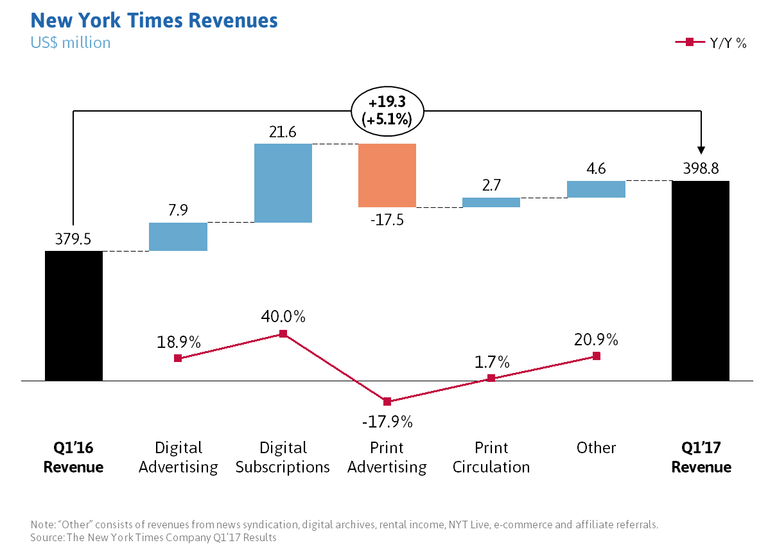

In Q1’17, the company registered a +5.1% Y/Y increase of revenues (from US$ 379.5 million in Q1’16 to US$ 398.8 million in Q1’17). Interestingly enough, this growth was fuelled by a strong uplift of digital subscriptions (+40.0% Y/Y) and digital advertising revenues (+18.9% Y/Y), which more than offset the inescapable -17.9% Y/Y decline in print advertising revenues.

This digital revenue performance was driven by a strong subscriber growth, with digital only subscriptions reaching 2.2 million, a +62% Y/Y increase. While the New York Times’ digital subscription efforts were at first controversial, this is now its largest source of revenue growth.

While the New York Times hasn’t recovered its pre-recession revenue peak, its digital strategy shows it can become a digital-only publisher, and serves as an example that there’s a digital life for print media.

Congratulations @lmmo! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @lukestokes

Congratulations @lmmo! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!