All the current markets trend indicates that a bull run is around the corner. While writing this article, Bitcoin is holding it’s fort in 6600–6900 zones and volume is growing as well. This is very positive news for the investors and they can start looking into investing in projects which have strong fundamentals, a great team and have real-world application.To make things just a little easier,

I tried to compare 3 projects which I feel you should have a look at. It’s just my perspective and before investing DYOR.

Aelf.(The “Linux” of Blockchains)

One of the most interesting projects I am tracking is Aelf. (ELF). Based out of Singapore, Aelf is a decentralized platform for cloud computing blockchain network, that is trying to develop be the operating system exclusively for blockchains. As per the team “aelf is planning to be the “Linux system” of the Blockchain.If you are a follower of the blockchain space, you will be aware of three core issues current blockchain are facing.

- Scalability(Majority of existing blockchain performance depends upon a single node)

- Resource segregation( The entire system gets clogged if any contract takes too many resources in the main chain)

- Adaptable governance model( Remember the clash of BTC and BCH fanboys)

Aelf Solution

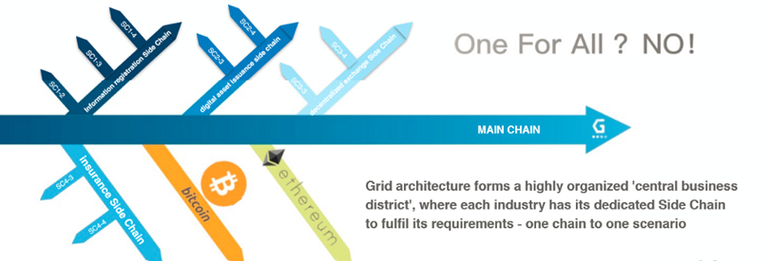

To tackle the above-said issues with current blockchain, Aelf introduced side chains to improve scalability and a unique governance system called DPOS which helped to resolve the problem.

Unlike traditional blockchain which depends upon the main chain for all the processing, Aelf consists of a main chain and will have many side chains, which will be used to run smart contracts. The job of the main chain is to oversee the side chains, whereas the job of the side chain which is connected to the main chain is to execute transactions. With the introduction of side chains, the network doesn’t get congested which will help the network to efficiently scale.

One more advantage of side chains is the Cross chain Interaction. That means Aelf blockchain will be able to interact with external blockchain networks like Ethereum, Bitcoin, etc which helps the sharing of information.

To tackle the governance issues, Aelf has opted for Delegated Proof-of-Stake process. DPoS is in a way similar to PoS, but has different and more “democratic” features that Aelf feels it makes more efficient and fair. In DPoS, token holders are able to cast votes to elect block or we can say the miners. Votes are weighted by the voter’s stake, and the Block that receives the most votes are those who produce/mine blocks. This process is more democratic and makes all the token holders the part of the ecosystem and governance more smooth. DPoS also is environmentally friendly because electricity isn’t wasted like in Proof of Work which means Aelf cares for the environment as well.

Why You Should Invest in Aelf.

The main factor that makes a project successful is how well it can be adapted to the real world. Since most of the large organizations have complex business needs, it’s not easy for the current existing rigid structured blockchains to fulfil the needs, which is where Aelf comes into play. Aelf has the capability to tailor the blockchain as per the demand of the industry. It can create a mix of public and private chains on the aelf network as per the business demands. That’s the reason you can see a lot of organizations are so keen on this project.

The second factor you should look into is the team. Aelf is Co-founded by Ma Haobo & Zhuling Chen. Mr.Haobo was previously the founder/CEO of Hoopox as well as the CTO of GemPay and AllCoin. Ma Haobo also has an advisory position to the Chinese Government in relation to blockchain technology. Zhuling has secured many investor relationships including J. Michael Arrington, founder and CEO of TechCrunch, and Zhou Shouji, founding partner of FGB Capital, who support the team as members of their advisory board. With this solid team comes solid performance.

Another factor I look for is the liquidity part. Aelf is currently listed in all major exchanges, that means no issues with liquidity as wellOne more concern I had in the initial days was “Can Aelf Handle so many transactions as they are promising to be capable of enterprise-scale solutions”.But with the recent test net performance of 15,000 tps, I don’t think anything more is needed to cement the fact that Aelf is the one exciting project for the year 2018–2019.

EOS( ETH Killer)

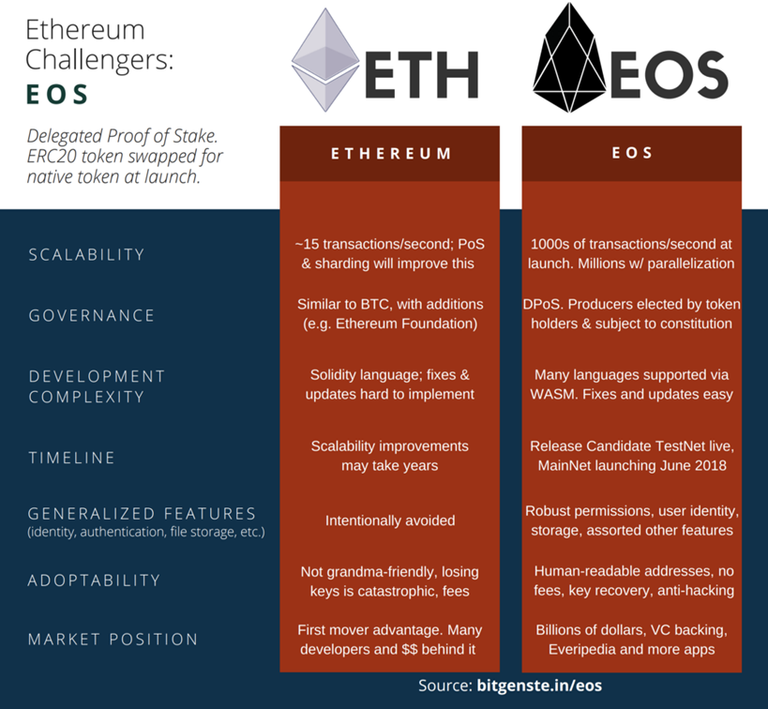

EOS project is we can say fairly young in the blockchain space that aims to radically improve on what is on the market today by bringing together positive elements of both the Bitcoin and Ethereum platforms. The decentralized operating system will, much like Ethereum, allow developers to build decentralized applications through smart contracts.

The major focus EOS platform is to eventually allow for industrial-scale applications, through the elimination of transaction fees and an ability to process tens of thousands of transactions per second in contrast, Ethereum that can currently handle around 15 transactions per second and Bitcoin with 7 transactions a second, only. This differentiation is critical in terms of wider general adoption in industrial terms, as corporate will prefer a coin that could be transferred instantly without any holdup or delay in the network.

Why You Should Invest in EOS.

As Aelf, EOS is also targeting industrial wide usage. It is also targeting the same area of resolving the scalability issue. So far it has achieved 600 TPS with 2 second block times on the testnet. (Still less than 15,000 TPS achieved by Aelf)One more reason is the leadership of Dan Larimer who introduced and developed projects like Steem and Bitshares. Its true he left both the projects and I hope he stays with the EOS Project for a long term.

But one thing that concerns me is that even after the mainnet is launched, EOS is still plagued with bugs. With a whopping $4 Billion raised via ICO, this is not expected from such a large project.One more factor is the presence of 21 block producers. This makes the system too much centralized. Since the block producers are financially incentivized, It has high chances to cheat the system.

Zilliqa ( The Shradder )

Zilliqa is one of my favourite project for the year 2018. This was the project that caught the eye of blockchain world by successfully implementing the groundbreaking concept of sharding (the concept of dividing the network into several smaller network which process transaction in parallel). In simple terms, Zilliqa platform will split the transactions into groups of 600 mining nodes and get the work done to process and validate. Each group of 600 will be a shard.

Unlike Aelf and EOS which uses DPoS mechanism to achieve consensus, Zilliqa will utilize a hybrid of POW and Byzantine Fault Tolerance in order to validate transactions and add blocks to the blockchain. Zilliqa expects PoW to add a high level of decentralization and Byzantine Fault Tolerance will make the network faster and more scalable.

Why You Should Invest in Zilliqa.

All three projects are targeting the same issue of Blockchain “Scalability”. Recently Zilliqa recorded 2,400+ TPS on their test net with 3,600 nodes. Again Still short of 15,000 TPS recorded by Aelf.One more thing attractive about the project is its leadership. The founder Mr.Xinshu Dong has done his PhD from the Top-rated National University of Singapore. Prior to joining Zilliqa he was a researcher in Advanced Digital Sciences Center as well as a senior research fellow with NUS.

Conclusion

All the three projects hold great promises. If you ask me to select one, I will go with Aelf. Mainly because of its adaptability to real-world use and well as proven TPS results. The next one will be Zilliqa due to the implementing the groundbreaking concept of sharding which holds a great future.

Thank you for taking the time to read this article.

As always this isn’t financial advice, please DYOR.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/swlh/three-promising-blockchain-projects-to-invest-for-2019-2ead8e617f