AEPS stands for the Aadhaar enabled payment system. This is the new age of payment in which a bank customer whose bank account is linked with Aadhaar card can use basic banking activities like cash deposit, cash withdrawal, fund transfer and most importantly cash withdrawal. AEPS service leads and supports cashless society in all over India. This service is started in January 2016, and supported by NPCI (National Payment Corporation of India). There are many places where banks are unable to reach. The main aim behind the AEPS service is to reach banking service to those people so that they can use banking service and can get the advantage of It. You can start your own AEPS (mini banking) business using the AEPS portal.

What is AEPS Portal?

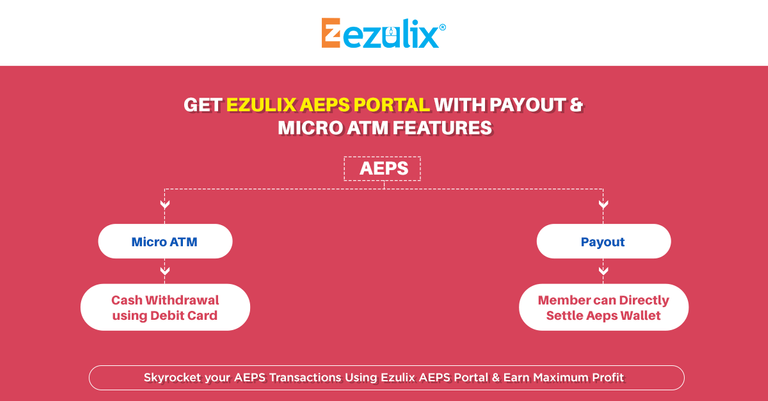

AEPS portal is a software solution integrated with AEPS API. AEPS portal provides you the facility to offer AEPS service to your customers. This is a customized software solution, which facilitates all AEPS services like fund transfer, cash withdrawal, balance inquiry, and cash deposit.

By using AEPS portal, you can start your own AEPS business. As I told you this is a web & mobile software solution integrated with AEPS API of any bank. You can offer AEPS service by using It. To offer AEPS service, you have to use Aadhaar card number and biometric machine for fingerprint authentication. This biometric machine linked with the AEPS portal through your system or mobile.

What are the Features of AEPS Portal?

Here we will discuss the features of AEPS Portal. You must consider that your AEPS portal consists of all the features.

- Bank customers can use basic banking service using Aadhaar card

- Safe & secure transaction under NPCI

- No need to visit the bank or ATM for banking services

- People from rural areas connecting with banks

- You can use banking service anytime (not depend on bank hours)

- To use AEPS, the only information required is Aadhaar card number, bank name & fingerprint authentication

- Fastest cashless transaction service

- Interoperable across all the banks

- No need to stand in bank queues

- It also helps in government schemes

- Easy to use

- No need of remembering PIN or OTP

- Shopkeepers can also use it to accept payments

- AEPS helping banks to Increase users

- Helping to create a cashless society all over India

What is AEPS Payout System?

To understand the logic of payout, first, we have to discuss the process of AEPS.

So without wasting time, I come to the point.

Keep Reading: Advanced AEPS Portal