There are some great trade opportunities in front of us. A little pullback in the majors (Bitcoin, Litecoin, Ethereum, Bitcoin Cash) is expected and brings with it profitable entries.

IOTA/BTC

IOTA is trading within its arc and looks to be held inside of it, this is a very bullish condition which signals that another impulse wave is in order. Not only that, but there is significant space above IOTA with very little resistance stopping it from gaining >25%.

Entry: 0.00023899

Stop: 0.000215

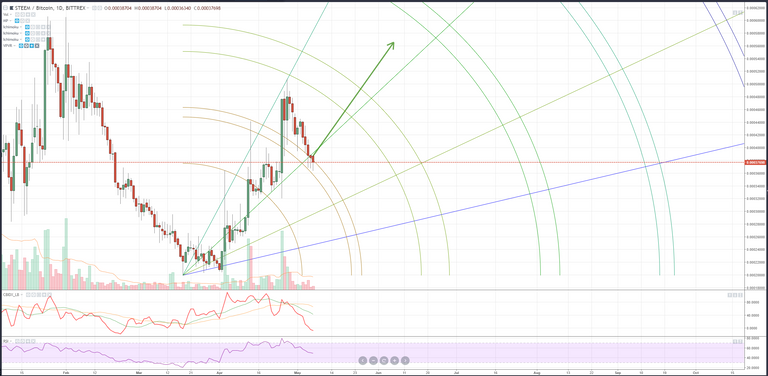

STEEM/BTC

Very much in an oversold condition. This instrument is a different kind of asset class within this asset class. For me, I hold a good amount of STEEM for my own investing, but for trading, STEEM provides a lot of fun opportunities as well. It has found support on the arc it’s trading inside for the past three trading days, so we should expect a nice bounce out of the arc and back above the 45-degree line. Risk is very limited.

Entry: 0.00037698

Stop: 0.0003495

ADA/BTC

Very oversold on the Composite Index and flashing a BUY ME NOW signal. RSI is in a supportive bullish support level. Very nice hammer on the daily right below the 45-degree angle. All of these signals point to a probable and massive drive higher. We look to be heading towards the next impulse wave which should bring us well above the .000043 value area. Additionally, the fact that Cardano is trading below the 45 is a great buy signal. Perfect conditions to catch a great run.

Entry: 0.0000358

Exit 0.00003

ADX/BTC

You’re probably wondering what the heck is ADX (AdEx)? I have no idea. I don’t need to. And neither do you. The joys of trading solely based on technical analysis mean the instrument doesn’t matter: the chart does. I am using this coin as an example that it doesn’t matter if you know it or not. You just need to know how to trade and apply your analysis. Based on this chart, I know two things:

It’s a slave to the aggregate market and moves swiftly during a bear move.

It’s slow to recover during a bull run.

#2 is the kind of conditions I love, I love finding laggards in the market. ADX is one of them. Not only is it one of them but it’s a stupidly oversold and structurally supportive buy zone. This has all the signs of a big return over a short time. This is especially true because of the relationship of where price is compared to the 45-degree line. The drive back up to the 45 will either be swift and violent or it will be a very deliberate and strong drive higher over a period of 3-5 trading days. Either way, it’s nice to get these trades early.

Entry: 0.0000103

Exit: 0.00009

Check out ICX / WAN

Congratulations @captainquenta! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPhttps://discord.gg/Upr39TF

https://discord.gg/Upr39TF

https://t.me/sgnlkings

Thanks for the tips. Often they don't go as planned, but hoping for the best.

Great analysis. I will have to keep checking up on what you are analyzing next and how those predictions turn out. Appreciate your time and effort!