It's anything but difficult to envision a world in which "Alexa" is synonymous with talking PCs, or Echo with brilliant speakers—similarly as Kleenex is synonymous with facial tissue, Xerox with duplicate machines, or Google with online pursuit. (These are called genericized trademarks, or exclusive eponyms, coincidentally. They require a superior name.)

That is nearly the world we live in today, on account of the emotional early accomplishment of Amazon's spearheading savvy speaker and the shockingly skilled computerized aide that quickens it. Nearly, yet not exactly.

It's valid that voice-controlled savvy speakers are on the way to universality: Analysts foresee that generally U.S. families will in the long run have one. However, when deals are blasting the world over, it's ending up obvious that Amazon's first-mover advantage wasn't worked to last.

While there are no official deals figures, mounting proof proposes that Echo gadgets have been losing ground in the previous year to contenders on numerous fronts. Collect the pieces from a variety of statistical surveying reports with various techniques, and the photo is that of a quickly moving scene in which no single organization is probably going to overwhelm long haul—yet in the event that anybody does, it may be Google. That issues to industry watchers and financial specialists as well as to any individual who thinks about the plans of action and protection practices of the tech goliaths that intercede what we say, realize, purchase, and do.

Amazon, Google, and Apple don't report offers of the Echo, Home, or HomePod, separately, liking to shield them from financial specialist examination by lumping them into classifications, for example, "Different Products" when they report profit. What we are aware of their business, at that point, comes to a great extent from outsider statistical surveying firms, in addition to goodies and clues that the organizations at times drop. The statistical surveying firms' assessments can fluctuate, some of the time broadly, in light of their technique.

As of late as a year back, Amazon without any help controlled the worldwide savvy speaker industry, with a piece of the pie upward of 75 percent, as per gauges from two of the main market watchers, Strategy Analytics and Canalys, situated in Singapore. Amazon itself bragged in a February income report that it had sold "many millions" of Echo gadgets in 2017. That figure included its lead Echo brilliant speaker as well as the Echo Dot, Echo Show, and different Echos, the organization elucidated to me (however not other Alexa-fueled thingamajigs, for example, the Tap or Fire TV). It bodes well that Amazon was smashing the opposition, in light of the fact that there wasn't much rivalry yet: Google had quite recently propelled the Home in late 2016, and Apple's HomePod was not yet available. The Echo has been accessible since 2014.

Would-be rivals confronted a difficult task. Amazon's head begin in keen speakers took after the overwhelming leads that Apple broadly inherent compact MP3 players, cell phones, and tablets. In any case, Apple's high costs at any rate gave contenders an opening to construct less expensive choices for the mass market. Not so with Amazon. Since it saw Echo mostly as a way to Amazon buys, the organization sold its savvy speakers at reasonable costs, picking to augment deals as opposed to overall revenues. How could latecomers contend?

However dreams of an Amazon keen speaker imposing business model blurred speedier than nearly anybody anticipated. Google specifically has been making up for lost time in a rush. That could be incompletely in light of the fact that its Assistant is "more brilliant" than Alexa, by a few measurements. Be that as it may, the Echo is more fit in different regards, and it keeps on being a top of the line gadget in the classification.

Examiners say the key to Google's prosperity lie somewhere else. A major spending promoting rush, a forceful push to join forces with retailers and creators of keen home devices, and the organization's notoriety for noting seek questions got it off to a decent begin. It didn't hurt that the organization was additionally pushing the Google Assistant—its likeness Alexa—onto a huge number of Android gadgets. Maybe above all, Google has involvement, accomplices, and dialect capacities in abroad markets where Amazon is less settled.

Goodness, and maybe you've heard that physical retailers aren't huge Amazon fans. "Retailers are more open to masterminding Google's shrewd speakers, since Google isn't viewed in that capacity an immediate contender," said Vincent Thielke, explore expert for Canalys.

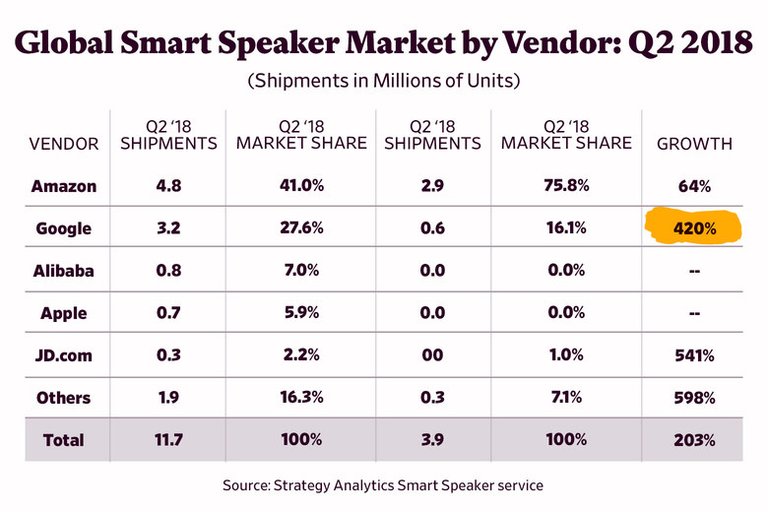

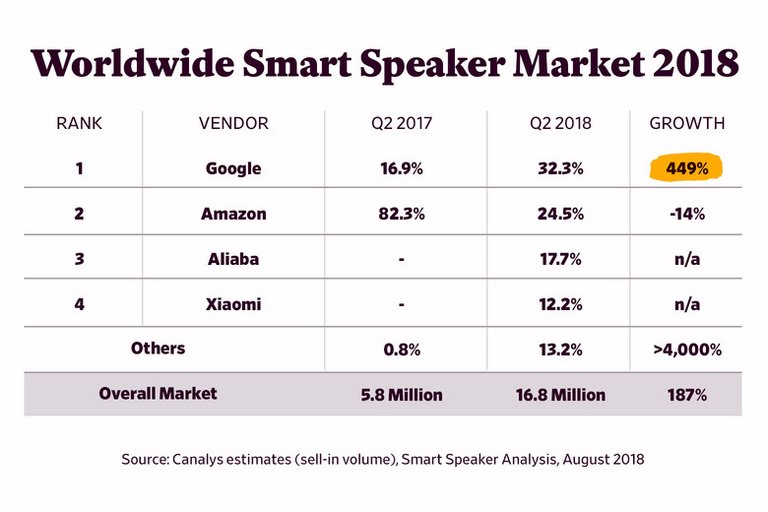

By early this year, as per different industry reports, the tide was turning to support Google. One firm, Strategy Analytics, assessed for the current month that Amazon's worldwide piece of the pie plunged from 76 percent to 41 percent over the previous year, with Google's ascending to 28 percent. The firm undertakings Google's keen speaker deals to outperform Amazon's by 2020, said Bill Ablondi, executive of shrewd home methodologies.

For Amazon, those numbers would be ominous enough. But Canalys reckoned in an Aug. 16 report that Google has already eclipsed Amazon in quarterly sales.

It's important that Canalys tallies gadgets dispatched to retailers, regardless of whether they haven't yet been bought by customers. Canalys gets its assessments mostly from providers, merchants, and other outsiders, while Strategy Analytics depends on sources inside the organizations that make them. A third report, from the news and research site Voicebot, utilized customer overviews to appraise what number of clients each association's shrewd speakers have. It found that 62 percent of U.S. shrewd speaker proprietors had an Amazon Echo, while 27 percent had a Google Home, as of May. That system favors Amazon by including gadgets obtained the past. However, even there, Google was quickly making progress, tripling its piece of the pie in the main portion of 2018.

While Google seems, by all accounts, to be beating Amazon unexpectedly, Apple is playing an alternate one. Its HomePod begins at a cool $350, contrasted with $100 for a Home and $85 for an Echo, and goes for audiophiles with the guarantee of howdy fi sound quality. Early reports of dull HomePod deals have hosed excitement, however both Voicebot and Strategy Analytics said it's too early to discount Apple as a genuine contender. The previous put Apple's second-quarter piece of the overall industry at 6 percent, enough to gouge both Amazon and Google's development.

More contenders are approaching: Electronics monster Samsung has quite recently propelled its Galaxy Home savvy speaker, and a flock of sound organizations are step by step getting in on the amusement. In the mean time, savvy shows are developing as a contrasting option to sound just speakers, and Facebook is taking a shot at a gadget considered Portal that could center around video calling.

Over the long haul, however, it isn't simply Silicon Valley that undermines Amazon's brilliant speaker lead. It's China.

A year back, intellectuals were asking why shrewd speakers weren't getting on in China. Nobody's pondering that any longer: It is apparently the quickest developing business sector for keen speakers. Furthermore, essentially none of that development is going to Amazon or its U.S. rivals, which don't offer Chinese-dialect forms. It's going rather to Chinese goliaths, for example, Alibaba, Xiaomi, and Baidu, which are directing out brilliant speakers that go at a small amount of the cost of the Echo or Home. These aren't simply modest knockoffs, either. At CES this year, Baidu flaunted high-idea brilliant speakers that resemble lights, roof lights, or even a bright pile of squares. Amazon and Google's gadgets look obsolete by examination.

The shrewd speaker wars aren't only an industry story. Truly, these organizations are competing for cuts of a business pie that could top $23 billion by 2023, as per Strategy Analytics (or $30 billion by 2024, as indicated by Global Market Insights). In any case, savvy speakers, as cell phones, aren't just about the equipment. They're about the stage that forces them—for this situation, the voice A.I.— and how it shapes clients' conduct.

When you purchase an Echo, you're paying Amazon $85 today. Be that as it may, it additionally gives you a solid impetus to pay it $120 a year for Amazon Prime, and maybe another $80 every year for Amazon Music Unlimited. Over that, it makes it simple to purchase things on Amazon, and plays pleasantly with other Alexa gadgets like the Fire TV.

Buy a Google Home, then again, and it will fit right in with Chromecast, YouTube, your Gmail and Google Calendar, and the Google Assistant on your Android gadget. A HomePod will extend your association with Siri and iTunes, et cetera.

And constantly, whichever A.I. associate you pick will get know you personally—not simply your voice and your method for talking, yet your propensities and inclinations. In a blog entry this week, Google VP of designing, Scott Huffman, revealed that questions of Google Assistant have a tendency to be activity situated, similar to "Turn on the lights and play some music" or "Make an arrangement for twelve on Saturday." Google, whose business spins around focused promoting, definitely recognizes what we're scanning for on the web and what we're doing on our Android telephones. It would love to realize what we're up to in our kitchens and family rooms as well.

So an Echo-filled world would extend Amazon's retail domain; a Home-filled world would expand Google's observation system and feed its A.I.; a universe of HomePods would keep individuals tucked away in Apple's biological community (particularly on the off chance that they're fortunate). What's more, one shivers to think what a universe of Facebook Portals may do. (Gossip has it the organization deferred the gadget's dispatch because of the Cambridge Analytica embarrassment.) The main darker situation may be one in which the oversight well disposed Chinese tech organizations eventually win.

That Amazon never again looks ready to hoard savvy speakers may console faultfinders careful about its online retail strength. Yet, the possibility of Google's strength should give security advocates delay. What we have for the present, gratefully, is a fervently industry—the kind that is probably not going to offer ascent to any exclusive eponyms whatsoever.