First, some startling facts about Amazon:

Jeff Bezos, CEO of Amazon, is the world's richest man, with $100 Bn net worth.

Amazon had $43,700,000,000 in revenue in 3 months. That is almost twice the GDP of Estonia.

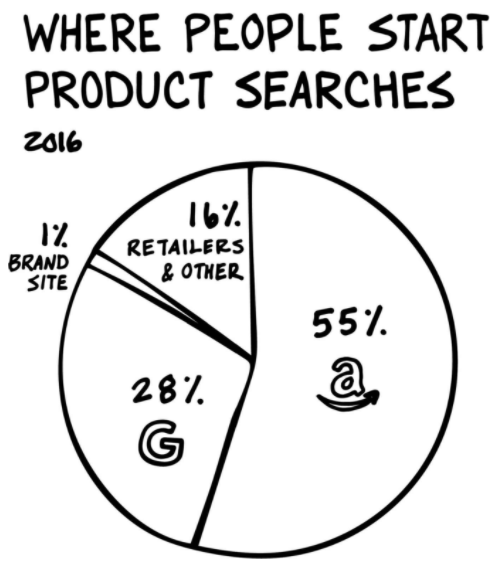

55% people prefer searching for products on Amazon first, 28% on Google, 16% on other retailers, and 1% on brand site.

Amazon's Market Cap:

Black Friday 1997: $1 billion

Black Friday 2007: $16 billion

Black Friday 2017: $572 billion

Now, what makes Amazon click:

Amazon has had more access to cheaper capital for a longer period than any firm in modern times.

Most successful VC-backed tech companies in the nineties raised less than $50 million before showing a return to investors. By comparison, Amazon raised $2.1 billion in investors’ money before the company broke even. As the company has shown, Amazon can launch a phone, invest tens, maybe hundreds, of millions of dollars on development and marketing, have it fail within the first thirty days, and then treat the whole disaster as a speed bump.

Now that is patient capital. If any other Fortune 500 company—be it HP, Unilever, or Microsoft—launched a phone that proved DOA, their stock would be off 20 percent plus, as Amazon’s stock was in 2014. But as shareholders screamed, the CEOs of those other companies would blink and order a company-wide retreat and pull in its horns. Not Amazon. Why? Because if you have enough chips and can play until sunrise, you’ll eventually get blackjack.

This cuts to Amazon’s core competence: storytelling.

The Story: Earth’s Biggest Store.

The Strategy: Huge investments in consumer benefits that stand the test of time—lower cost, greater selection, and faster delivery. Replacing profits with Vision and Growth.

Most retailers trade at a multiple of profits times eight. By comparison, Amazon trades at a multiple of forty.

Normal business thinking: If we can borrow money at historically low rates, buy back stock, and see the value of management’s options increase, why invest in growth and the jobs that come with it? That’s risky.

Amazon business thinking: If we can borrow money at historically low rates, why don’t we invest that money in extraordinarily expensive control delivery systems? That way we secure an impregnable position in retail and asphyxiate our competitors. Then we can get really big, fast.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.marketingjournal.org/the-four-horsemen-an-interview-with-scott-galloway/

so hes now the richest man

Well he actually gets company shares.......... as shares are fluctuating it can go up and down anytime

ok ok so its like the weather-it changes from time to time