There's been a lot of talk about a possible "Fake Squeeze" recently. So the question is, will the hedgies attempt to convince us that a piffling rise is the squeeze being squoze, or is there more to it? This DD was posted by Ape Anna, a good friend to us here at Apes Army, on December 19, 2021, and it provides the thesis and anti-thesis for a Fake Squeeze.

Apes Army takes no credit whatsoever for this information and it is presented without editing here. This is not Financial Advice. Do Your Own Research, as always.

Can Hedgies "Fake" a Squeeze? Let's talk about that...

Hello Ape Family, Ape Anna here again! Did you miss me? I missed you!

It feels sad that I even have to note this... but: of COURSE I'm still HODLing! Ape Anna has just been busy with real-life monkey business, but I was always here, checking up on my Ape family.

Now that we got that out of the way, I wanted to pop in and give my thoughts on a point of discussion I have a few things to say on, and that is this idea of a "fake-out squeeze" -- or, a high-volatility, ATH-reaching upwards momentum that is followed by a large-scale drop in price, making it look as though the "squeeze" has squeezeded even if it hadn't!

How nefarious! We know hedgies are desperate and would do anything, right? So it is only natural that I see some of you Apes considering this, especially with the recent JP Morgan announcement that seemed... SUSPISHUS (and I will discuss that later on in this post).

Well, I wanted to outline all of the factors on both sides of this argument, and leave it up to you to determine whether or not a "fake squeeze" could truly occur.

As always, this is just for fun, informational purposes. It's not financial advice, nor am I telling you to think any certain way in particular. I am spitballing with my Ape Family, and working through my own thoughts on this subject!

And, as always, Hedgies R Fuk.

Theory: Why a "Fake Squeeze" COULD NOT Happen...

- A "fake squeeze" would first necessitate a strong, violent movement upwards, and for the stonks to reach an ATH at minimum.

- The stonks blasting upwards would very likely lead to a failed margin call on the "lower rungs" of the shorting hierarchy.

- You must remember that AMC, GME, and other stonks are not being short by ONE or TWO entities, even though we usually only give attention to just one or two (normally Shitadel and Point72). There are dozens of short entities, funds, institutions, even individual shorts!

- It stands to reason that if a "fake squeeze" was organised (likely by the largest shorts at the top of the shorting hierarchy), the smaller shorts would get their asses handed to them. And if that happened, they would contribute to upwards pressure by being forced to buy back shares and close their positions.

- Further, there is the issue of OPTIONS! People who hold high-ticket call options would very likely exercise those options if the price was skyrocketing, as at some point it would become insane not to. That would also contribute to upwards pressure.

- Another issue: FOMO! Tremendous upwards movement always brings FOMO. There is plenty of evidence of that, both from January 2021 with both AMC and GME, as well as the major runs AMC had to the $70s. Word gets out, retail traders get interested, and start throwing money at the green candles because that's what retail traders like to do. This FOMO would also contribute to upwards pressure.

- So the "fake squeeze not possible" narrative boils down to CONTROL.

- Could the hedgies at the top, those who would be orchestrating this fake-out for the purposes of snuffing the apes out of existence, reasonably control the upwards momentum enough not to completely screw themselves in the process?

Now I want to look at the other side of this!

Theory: Why a "Fake Squeeze" COULD Happen...

- A "fake squeeze", if orchestrated properly, could be one of the biggest weapons in the hedgie arsenal by way of trying to put AMC and GME off the map for good, and make the apes a footnote in history.

- "You see? It happened! You were right! Now go away." -- While that might not do anything for us hardcore apes, it might be enough to fully disinterest the public, get rid of those paper hands who never would have made it to the top anyway, and relegate Apedom to a small, weird schizo movement of people who can't give it up.

- With respect to CONTROL (as outlined above), a "fake squeeze" would require hedgies, in their calculations prior to setting this off, to reasonably account for:

- Smaller shorts getting blown out: One could argue they have all of that data in their possession, and would easily be able to calculate for those shorts getting margin called and what they would contribute to upwards price movement.

- Just as well, I want to remind you that in January/February, Point72 and Citadel BAILED OUT Melvin. Had Melvin fallen in January, the squeeze actually would have happened. It would have been over. Citadel and Point72 gave Gabe Plotkin $2.75 BILLION just to survive. Not because they were friends, not because they liked each other, but because Melvin going down would have brought everyone else down with them. That $2.75 billion was a margin pad to keep Melvin from getting wrecked and having to close the positions on their end.

- Could the big hedgies organise with the smaller shorts to keep them afloat during a fake-out, just like Citadel and Point72 did with Melvin?

- FOMO: One could argue that they would look at January and July for examples of widespread retail, non-ape FOMO, and roughly come to an estimated % of how many retail traders are going to FOMO in, as well as how much money, on average, they will spend, as well as the contribution that would have to upwards price movement.

- Options: One could argue they have all of that data in their possession, and would be all to calculate for how many options would get exercised, and what contribution that would have to upwards price movement.

- Smaller shorts getting blown out: One could argue they have all of that data in their possession, and would easily be able to calculate for those shorts getting margin called and what they would contribute to upwards price movement.

- So the "fake squeeze is possible" narrative boils down to the big hedgies HAVING ENOUGH DATA.

- Do the hedgies have enough data in their possession to roughly calculate the factors they need to account for to ensure they do not get caught up in the upwards momentum and screw themselves?

IN MY HUMBLE OPINION, while I think it is unlikely, I do not wholesale disregard the "fake squeeze" thesis simply because I do not believe in underestimating my opponent.

Are hedgies dumb? Yes! But they aren't stupid.

They are trying to survive, and I do not put anything past them at this point. Neither should you.

Remember that the purpose of a potential "fake squeeze", like with ALL of their tactics. is to make you demoralised. And so long as you are not demoralised, trust your DD, trust the process, and go with the flow -- it doesn't fucking matter what they do.Now, some thoughts on JP Morgan's announcement...

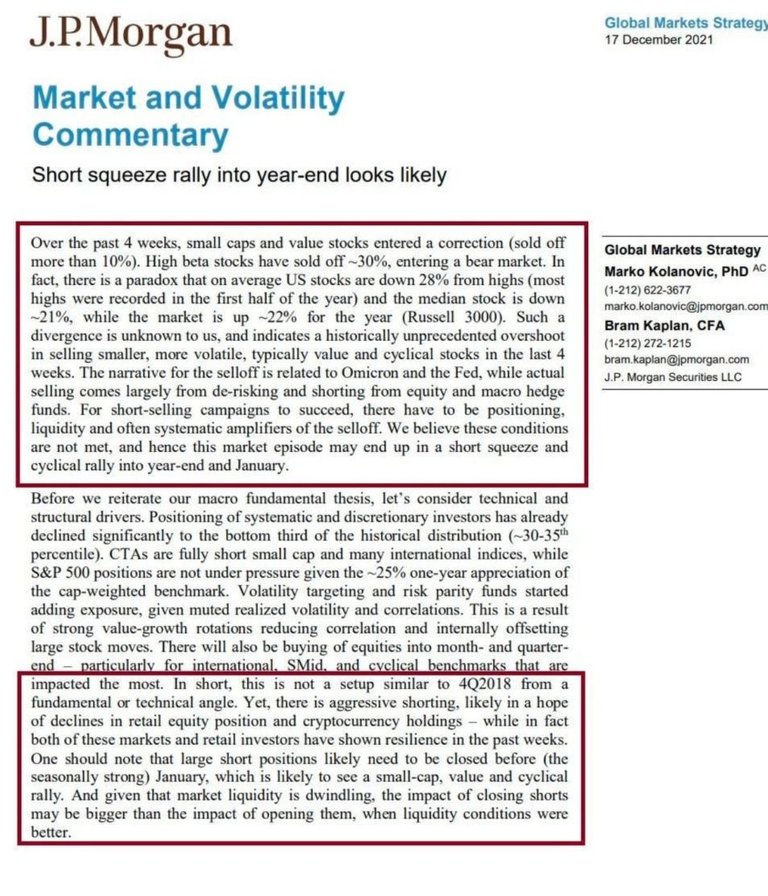

Here's the full thingie:

Of course, this announcement was what renewed discussions in the Ape community about the "fake squeeze" thesis. And I wanted to, again, present some informal thoughts on this document from JPM:

- JP Morgan is long AMC to the tune of just over 1 million shares, as of the November 13Fs.

- JP Morgan is also long GME to the tune of just over 110,000 shares.

- An institution being long one of our stonks DOES NOT mean I trust them. In fact, I distrust them even more. Why? Because you must understand that they do not benefit from the squeeze REGARDLESS of their positions. Let me explain:

- Recall that the DTCC "insurance" many like to claim will "cover" the squeeze cost is not really insurance at all! It's actually a procedural obligation on the side of non-defaulting members of the DTCC to clean up and pitch in to help cover the excess expenses of the defaulting members.

- So once the squeeze happens, Citadel and co. getting BTFO will only mean that those other members who may not have been short at all have to clean up Citadel's mess financially.

- Thus... what does it matter if they are long AMC/GME/etc if they are basically responsible for paying themselves (it's like taking money out of your left pocket and putting it into your right, it doesn't make a difference!)

- An institutional mega long is far more likely to be a case of that institution wanting to either a) temporarily milk shorts for lending fees by borrowing out their shares, or b) having a pool of shares that can then be infinitely rehypothecated. I am fairly confident institutional collusion has been the reason why things have dragged out as long as they have.

- I highly doubt the vast majority of institutional longs, especially where they are hedgies themselves, are in it because they see the same thing we see. If anything, they are trying to keep things from falling apart in their side of the world. Remember: THEY ARE ALL IN THE SAME SINKING SHIP, regardless of if they actually caused the leak or not.

- I think the only exception to that is Blackrock, which is a giant, parasitic vulture that genuinely would actually benefit from a systemic collapse -- in fact, they would THRIVE in a systemic collapse. They LOVE slurping up cheap real estate, cheap stocks, seizing as much property as they can, and generally weaselling their way into a greater expression of power. Their AUM is an incredible 10 TRILLION, and they invest and manage it very strategically to ensure they have greater control over everything happening in the world.

- I cannot feign to know what JP Morgan is up to with their statement, other than generally causing chaos amongst short-squeeze-sighted retail investors like us.

- The only reasonable explanation for this announcement besides for the malicious sort is that JPM was speaking generally on visible market conditions which may cause some of their clients to experience a drop in the value of their investments (where they are short), and they are trying to front-run that concern by acting like they know what's going to happen and that they aren't scared (Morgan Freeman Narrator Voice: they do not really know what's going to happen and they are scared).

- The best strategy with it, as far as I am concerned, is to be neither bearish nor bullish on it because it does not matter. Their opinion is meaningless to us either way, and they are not our friends. They do not determine the course -- we have been on this path for a year now, and we know what the destination is.

- The entire point of this post can be summed up as: Hyper-vigilance is the key. Keep your eyes and ears open. These are uncharted waters we are wading through, and the thing you see in the distance could just be a log -- or it could be an alligator ready to snap you in half.

MOASS is inevitable. I know it may not feel that way sometimes, but it's true.

Do not doubt yourself for a moment, Apes.

Love you all,

Ape Anna

PS: What's going to be the first thing you do once MOASS begins? I mean even before the money even hits your bank account? Are you going to treat yourself to a fancy dinner? Call your mom? Dance? Tell me!

I think I will order sushi :D

Posted from Apes.Army : https://www.apes.army/will-there-be-a-fake-squeeze-amc-gme/