The “go-to” answer for nearly everything at IRS is “file your 1040.” So much so that almost everyone believes they are required to do so. Form 1040 is government’s evidence that it provides Due Process. Weak evidence, unless you know with confidence the ‘inside baseball’ reasons why they can get away with saying that. The form is, to IRS, a procedural nuisance the agency is required to meet, even though this “due process” accrues in government’s favor 100% of the time.

Anyone unfortunate enough to deal with IRS administrative “due process” knows it is a Byzantine mess. The total fear of the charade is why most people simply capitulate and fork over huge ransom every year.

Anyone unfortunate enough to deal with IRS administrative “due process” knows it is a Byzantine mess. The total fear of the charade is why most people simply capitulate and fork over huge ransom every year.

American foundations of the 1040

Actually, Form 1040 is not as much Byzantine as it is medieval. Foundations date to Justinian in the 5th century, upon which revenue processes were codified into English law the 12th and 13th century. Legal principles that are alive and well today. Their modern enactment is the Form 1040.

Standard IRS procedures follow rules set forth in Murray’s Lessee v Hoboken Land and Improvement Co. 59 U.S. 272 at 277; 18 How. 272 (1856). There, the Supreme Court said that if the constitution did not say for how Fifth Amendment due process applied to Government’s summary, non-judicial revenue collection, the next best source for guidance was English law when the Fifth Amendment was ratified.1 The Court ruled that the Government must use processes and procedures no different in principle than that used by the King of England to collect debt in 1791. Those procedures were already settled usage in some of the States.

More recently Government argued, and the Court agreed, that Murray’s Lessee governs today’s standard IRS procedures.2 This is why the knowledge of ancient English rules and medieval cornerstones upon which Murray’s Lessee depends are required to understand the Form 1040.

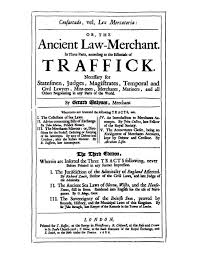

English precursor of the 1040

English commerce suffered in the thirteenth century. Common law had permitted a the debtor’s friends to testify that no debt existed, effectively extinguishing any merchant’s claim that money was owed. Common law also provided for “no process whereby a man could pledge his body or liberty for payment of a debt.” Without effective court procedure, and with personal freedom protections against inferior claims, a creditor’s only recourse was to attach the debtor’s property.

Problem was, before King Edward I, the feudal lord owned the debtor’s land. So a creditor could not go after land property, either. The only remedy left to satisfy the debt was against personal goods or chattels, which generally meant crops. In practice, local sheriffs were slow to seize the tools of a neighbor’s livelihood and the local economy just to satisfy a foreign merchant. In this time of expanding mercantile trade in Europe, England’s common law process hampered foreign commercial interactions.

Problem was, before King Edward I, the feudal lord owned the debtor’s land. So a creditor could not go after land property, either. The only remedy left to satisfy the debt was against personal goods or chattels, which generally meant crops. In practice, local sheriffs were slow to seize the tools of a neighbor’s livelihood and the local economy just to satisfy a foreign merchant. In this time of expanding mercantile trade in Europe, England’s common law process hampered foreign commercial interactions.

Statutory relief

The Statute of Acton-Burnel (1283) and the Statute of Merchants, (1285)3 gave creditors new protections. Mayors were empowered to enroll recognizances4 - contracts - under the King’s royal seal. No longer was tedious and costly common law court action required to collect delinquent debts. Delinquent debtors could be imprisoned, and creditors could seize a debtor’s land on default. Exhs (3, 4, 5)

The Statute of the Staple (1353)5 modified these prior statutes. The Statute of the Staple was governed by the Law Merchant.6 Contracts taken under seal by the mayor became known as the ‘statute staple’, displacing tedious common law in merchant transactions. The new ‘statute staple’ essentially formed two contracts: first, for the mercantile transaction itself, and, second, for an open-ended security pledge in case of default on that transaction.

Agreement to be bound by the terms of these agreements, and thereby gain the benefits of the monopoly, required the one-party statute staple bond that ensured payment for the commercial transaction be voluntary. Moreover, the statute forbade such recognizance until the “pain of the statute” had been read aloud to the debtor, making him aware it was a deliberate, binding contract.7 Finally, a staple contract to the ruler became a specialty contract8 enrolled as a debt of record. Exhs (6, 7)

The ancient ‘statutes merchant’, ‘statutes staple’, and ‘recognizances in the nature of statute staple’ (‘staples’) faded from commercial market use by the nineteenth century. American colonials and others had rebelled against English mercantilism. Grants of trade monopolies, especially for woolens, became dated as mercantile policy for monopoly trading communities were replaced by newer commerce, and ‘staples’ lost their usefulness. However, the power and energy of statutes staple continued in use by the King and his Exchequer for routine collection of debts. This is what the Murray Court recognized. As a result, no collection on an English tax debt could proceed before it became a matter of record in the Exchequer, and collection on an American tax debt could proceed before it became a matter of record in the Department of the Treasury. IRS procedures are built on this principle to this day.

Administrative enforcement

The writ of extendi facias, or, writ of extent, authorized sheriffs to take person, goods, lands and debts in a single administrative action. The writ issued out of the Court of Exchequer and, as discussed above, enforced the King’s revenue process long after the process fell out of use in commercial merchant transactions. No writ could issue until a debt of record was recorded in the Exchequer.

“It would be contrary to the first principles of law and justice, to issue process of execution before it is ascertained what debt is due to the Crown, and such debt become a debt on record. It may, therefore, be laid down, as a general rule, that till the debt, not being per se of record, be ascertained, and become a record by a commission and proceeding thereon, the Crown is not entitled to process of execution, unless in cases of danger, or insolvency, when an immediate extent may be issued, subject to the rules Which will be mentioned. The Crown has no election on this subject. It is bound strictly by this principle.”9

The Crown could reduce the debtor’s voluntary commitment to a compelling debt of record by one of two administrative processes. The first was by ‘commission’. There, a hearing convened before two Barons of the Exchequer. The judges took testimony under oath in an open proceeding, tested their findings against Exchequer procedures, and sent those findings to its Office of the Pipe for recording on the judgment rolls. The debtor’s signature, or seal, never appeared. The commission’s own proceeding became the debt of record. This process worked for everything except debts of record under the Statute of the Staple.10

The second process was by that Statute of the Staple. It required all specialty debts due the king to be “of the same nature, kind, quality, force and effect, to all intents and purposes, as the writings obligatory taken and acknowledged according to the statute of the staple at Westminster…”11 Specialty debts included not only Statute Staple, but also, “recognizances in the nature of a statute staple.” It excluded ancient recognizances and statute merchant contracts handled by commission.

The Murray Court also recognized that these ancient statutes were clear: “To authorize a writ of extent, however, the debt must be matter record in the King’s Exchequer.”12 Today, an IRS levy is no different in principle than a writ of extent. It is taken and acknowledged according to the statute of the staple at Westminster, and reflected in the Internal Revenue Code, the Internal Revenue Manual, and the procedures at U.S. Tax Court.

Modern revenue process and the Form 1040

Today, IRS revenue procedures follow the Murray’s Lessee standard upheld in G.M. Leasing. They mirror the ancient process, with one exception - the jurisdictional prerequisite for the modern commission, the Tax Court, is voluntary 1040 in a person’s tax file. The record there a 1040 signed under the person’s seal (penalty of perjury; a requirement without which IRS does not proceed to act on the document.) and Tax Court findings under its seal. Since Murray held that due process for non-judicial, administrative revenue procedures must mirror principles of 1791 English process, the Form 1040 must reflect either an Exchequer commission finding or a statute staple bond contract.

Form 1040 has nothing to do with the first method of reducing a debt to record, the commission finding. But the form does have all the elements for the second process, a “recognizance in the nature of a statute staple”: 1) it is a one-party document; 2) it is required to be filed under penalty of perjury, the modern form of a ‘seal’; 3) it is treated as a debt of record; 4) it is commercial in nature,13 and, 5) Form 1040 is voluntary. Therefore, in accord with the ruling of the Murray Court, the 1040 is no different in principle from the statute staple that the King used as a debt of record in 1791. Just as the King had no seizure authority without the statute staple contract, the United States government has no seizure authority without a Form 1040 appearing in the record.

So what happens if you do not volunteer a Form 1040? Since IRS cannot proceed without one, they make one for you. This is one of the weakest parts of IRS process, upheld by judicial fiat. “They” is backdoor process built into IRS computers to do automatically through a protal called the Non-Master File for which no accountable (indictable) human being is identified and no record of its production exists. A dummy 1040 shell magically just shows up. You will never find a sentient human being, of marals, conscience and fibre, to place on a witness stand.

The dummy form becomes the basis to make an assessment. ‘Assessment’ requires human accountability say the courts who recognized the nightmare science fiction scenario of machines run amok. IRS “meets” this human requirement by having an employee sign off on a master role of each day’s assessments. This totals several hundred to several thousand, daily. The signing person verifies that each of the assessments is correct! Which, of course, means that this highly productive and industrious employee examined the facts, viability and amounts for every one of those case files. This process continues unless you take the smart steps that challenge the fraud.

Sign a 1040 voluntarily and bind yourself and your property to service Washington, DC appetites before your own. No less so than if you had appeared before the mayor of an English staple town, taken and enrolled a statute staple, and pledged all of your property to the service of the Crown. Once upon a time, Englishmen living in America fought a war against monopoly privilege and profit. Today, not so much.

Congratulations @jeffgardner! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @jeffgardner! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!