We bet when people hear “Dubai” they do not imagine a desert with camels and oil derricks anymore. They do not imagine brilliants, gold, and luxury cars in most cases also. What comes to mind first when we hear “Dubai” is a number of the most challenging innovations such as flying taxis, artificial intelligence, pneumatic trains, 3D-printed buildings, cryptocurrencies, and robocops. Moreover, our imagination shows us all those sci-fi gizmos already existing, already available in the streets of the Arab megalopolises.

Why is it so? Why don’t we imagine the same when we hear “New York”, “London” or “Moscow”, for example?

It seems two basic ideas dominate in our mind when we clearly link the rich Arab States such as UAE or Saudi Arabia with the disruptive contemporary technologies such as robotics or artificial intelligence:

the abundant wealth and

very proactive visionary investors.

We do not say “money” because money makes money only in a virtual sector of financial speculations which is far from the topic of the present post.

Our common logic suggests that namely rich people whose wealth is based on oil and gas in passing days of the fossil-fuel-driven economy could have enough time and intuition to grasp the holistic picture of the future. Most probably, the rich elites from the Arab States could realize that sooner or later their oil-dependent economies start getting obsolete. The significant fluctuations of the oil market price over the past few years also added fuel to fire.

Besides, such seemingly “crazy” projects as Tesla, Hyperloop, and SpaceX prove that the technology keeps evaluating to disrupt many traditional sectors and markets.

However, the wealth alone does not imply any progressive vision of the future. Many other rich oil-driven economies such as Russia, for example, can hardly be associated with innovations. Perhaps the rich kleptocratic elites of the post-Soviet terrains are unable to see beyond their short-term self-interests.

There should be some specific capabilities pushing the Arab investors to fund innovations instead of spending their money on pleasure, luxuries, or just on the military build-up of their States.

East is a delicate matter, as people say. We are not going to dive deeply into the psycho-philosophical peculiarities of the Arab elites. Who knows, maybe the mental sobriety inherent in the true Islamic mindset, maybe the natural wisdom reinforced by the world-class education, but in any case, there should be a special driver making the far-sighted Arab investors what they are.

Anyway, the certain fact is that both private investors and State authorities from the Arab World are continuously looking for the new opportunities to be at the forefront of the global transition to the new more sustainable and healthier economy.

Sceptics may argue that nothing but the fear to end up with nothing when the oil deposits are exhausted to zero motivates the Arab investors to participate in the newest hi-tech projects, that just gullibility along with “easy money” backed by petrodollars make them fund various fancy technologies having nothing common with a “brutal reality”.

Even though a part of the truth can take place in such a vision, the actual situation looks utterly different.

When you have an abundant stable income allowing to think about neither competition nor further development of your business (well, stop throwing rotten tomatoes at me — I know that it sounds defiant, but the oil & gas rent is just the type of business which corresponds to a “lazy income” rather more than less!), your excessive wealth requires to be invested into some lucrative commodities. Of course, you can invest your “excessives” in gold, in stocks, in oil after all. But such an ordinary investment can hardly change the way you live as well as the current type of your state economy.

Now we are approaching the deep reasons that encourage the Arab investors to keep a close eye on the new disruptive technologies. Thanks to their wealth, they have some free intellectual capabilities and intuition to see beyond a day-to-day routine. They possess enough power of suggestion to realize that the New Brave World won’t come on its own. And by investing in what is looking like sci-fi today they acquire an ability to control the future! Namely, control is the key concept here. But we will come back to this issue later.

Rich people track innovations more attentively than the ordinary ones since abundant wealth represents both the time and inner peace to insight into the actual meaning and far-reaching outcomes of such phenomena as the transition to an electric-driven economy, for example. While common people just passively watch what’s going on in the reality, the rich investors actively participate in a reformation of the world outside.

And just the Arab investors happen so proactive in it because they understand better than anyone else that the present world order based on the oil-driven economy is rapidly coming to its end whatever price for oil & gas we pay today.

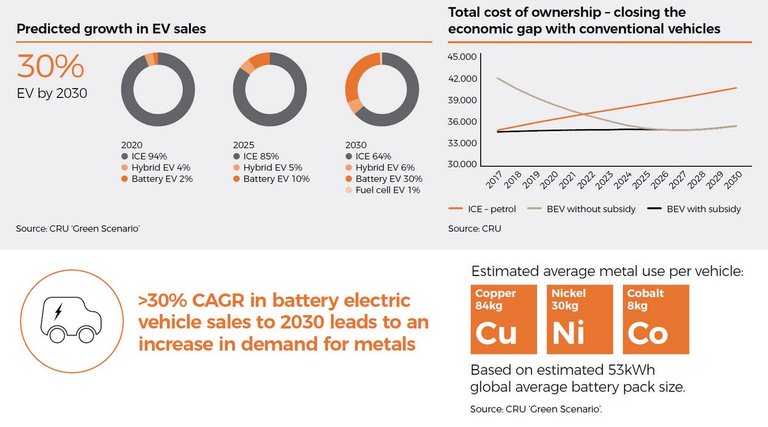

They consider new ideas and technologies in order to evaluate what investment opportunities each of them offers. And there should be two basic things in each new idea — a message and a promise. The message implies an appeal to what should be changed today. The promise implies the advantages one or another technology can bring after all. The present ICE (inner-combustion-engine) cars should be replaced by another type of vehicles due to environmental concerns — this is a message. The electric vehicles seem the most well-developed and feasible substitute for ICE cars — this is a promise. Hence, the EV sector is worth investing. This is how the investment decisions are made. And it works!

Does all the above mean that the Arab World is guaranteed to get to the future earlier than the rest of the world? Are there no clouds on the horizon of the hi-tech investment?

To say the truth, there is one terrible discrepancy there that puzzles badly. When we try to encompass a common feature of the progressive technologies driving us to the bright oil-free future, we find out that all those solar & wind power plants, electric vehicles, flying taxis, as well as numerous gadgets and computers are battery-dependent. Thus, the future oil-free economy will be electric-addicted. Moreover, the prime cost of the green energy keeps rapidly going down while the number of electric-driven commodities grows faster than anyone could predict.

So what, some may ask, nothing contradicts the trend. And what should investors in general and the Arab investors, in particular, worry about with regard to this trend?

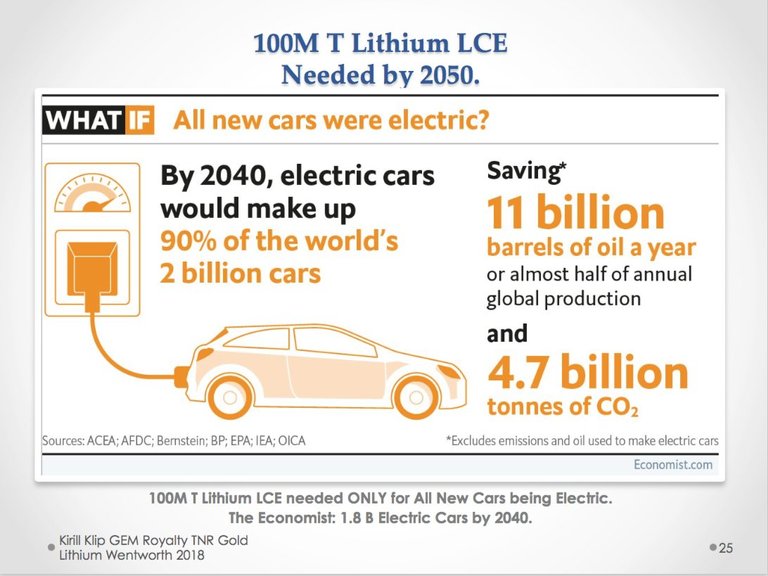

The thing is that even today’s electric vehicle sector, for instance, starts suffering from the battery shortage. And the battery shortage, in its turn, appeared due to the quite limited world deposits of the battery-related metals such as cobalt, nickel, lithium, and copper. Even the specific terms “Cobalt Crunch” started bouncing around the Internet. It means that in the nearest future when the number of electric vehicles grows up by an order of magnitude, the global battery sector will face a much severer rare-metal shortage than we have now.

But the most discouraging fact is that the whole global continental deposits of rare metals won’t be sufficient to satisfy the growing battery market. For example, 60% of the world cobalt reserves are located in the Democratic Republic of Congo (DRC) where the biggest transnational mining corporations are fighting each other for the cobalt mine concessions from the Congolese Government who is torn between the profits from cobalt and the permanent civil war in which Congo is immersed for decades. Besides, those 80–90 thousand tons of cobalt per a year that DRC can potentially supply would barely change the situation in the world mineral market significantly in the light of the growing cobalt demand.

One way or another but the visionary Arab investors should come to quite obvious conclusions regarding the promising but battery-dependent hi-tech technologies of our oil-free future:

no minerals — no sustainable development of the new electric-driven economy;

the available continental deposits won’t be sufficient to feed the whole humanity with minerals.

Hence, the dream-like fossil-fuel-free civilization is jeopardized by a trivial mineral shortage. And the electric-driven economy seems too risky without being backed by the reliable material basis.

In such a case, what is the investment in all those innovations worth?

Here we came back to the issue of control. And we dare to determine a golden formula for everyone who is going to succeed in the new green world:

Since the majority of the battery-dependent innovations rely on rare metals, the one who controls mineral mining will control the whole electric-driven economy of the future.

To simplify the understanding of this formula we can declare that namely rare metals such as cobalt, lithium, and nickel are becoming the “new oil” in the coming oil-free era! And just the Arab World knows best how to deal with oil — no matter by which physical substance “the new oil” will be actually represented.

To complete the topic with positive connotations we can only reveal where the huge deposits of minerals can be explored. No, not Mars, asteroids, and the other extraterrestrial objects are referred to — space explorations are still too unfeasible with regard to commercial mining despite the buzz built by media around the issue.

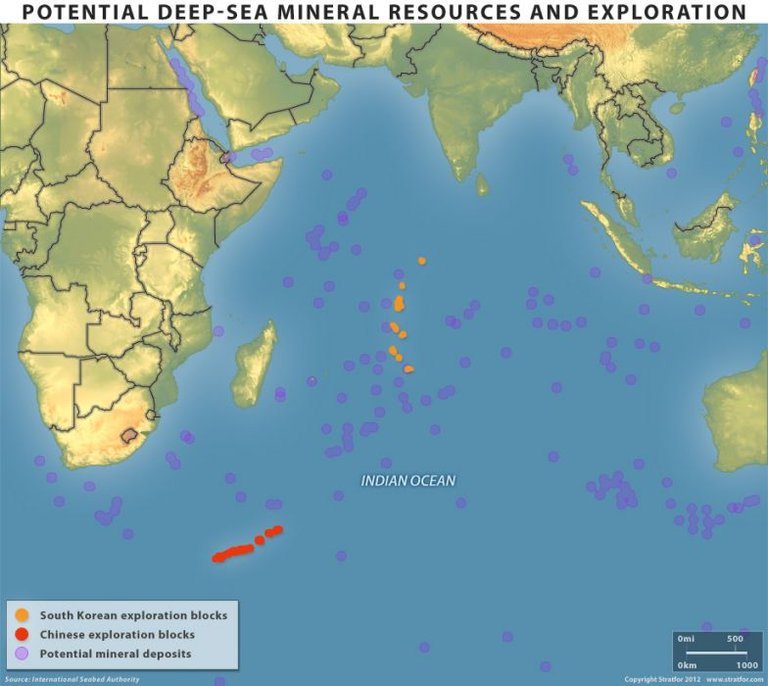

We mean our Earth’s oceans where about 10 billion tons of polymetallic sediments are generated every year. The ocean bottom, therefore, is the huge field where people can collect minerals for hundreds and hundreds of years without fear to exhaust the ocean resources once the oceans reproduce minerals all the time. It means that seaborn minerals are renewable. Just consider how organic and reasonable the following statement sounds: renewable minerals for renewable energy!

Only one example: the Clarion-Clipperton Zone — the ocean bottom area located in the Pacific ocean between Hawaii and Mexico contains 134 million tons of cobalt in the form of polymetallic nodules. Such a deposit is enough to feed the global battery industry for hundreds of years.

And just with regard to the ocean minerals, the above-mentioned discrepancy arises: why does the Arab World have no any involvement in what we can call the future of the extractive industry — seabed mining?

Any Arab State isn’t available among the official contractors of the International Seabed Authority (ISBA) — the official UN entity responsible for licensing the States interested in both exploration and exploitation of seabed mineral resources. Even Russia is an old member of ISBA (to say the truth, it was the Soviet times when Russia entered ISBA — there was another vision of statesmanship among Russian leaders actually). The oldest member of ISBA is India conducting explorations of the mineral-rich Indian ocean since 1981. And the most active participant of seabed mining today is China having the largest reserved ocean bottom area of 86,000 square kilometers for exploitation.

By the way, when we say “Indian ocean” it doesn’t mean that only India has rights to exploit the seabed mineral resources there. In fact, the deposits we are talking about are located beyond the exclusive economic zone of either India or any other State. That’s why such an authority as ISBA appeared — just to provide any interested State with a piece of the ocean bottom for exploitation.

When it comes to the mineral resources of the already explored area in the Indian ocean, the Indian National Institute of Ocean technology (NIOT) says that about 380 million tons of polymetallic nodules are available there. This amount includes 92.6 million tons of manganese, 560 thousand tons of cobalt, 4.7 million tons of nickel, and 4.3 million tons of copper. Isn’t it impressive?

The Arab States have an outlet to the ports of the Indian ocean. It means that from an infrastructural perspective the rare-metal processing capacities created in the Arab World would have a direct access to the ocean deposits.

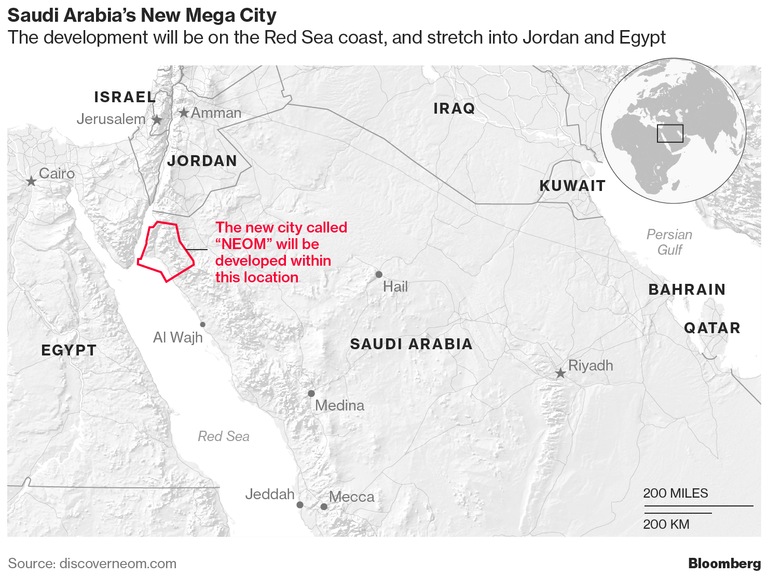

Saudi Arabia, by the way, announced a plan to build a new hi-tech city on the Red Sea coast for about USD 500 billion. The project could potentially include facilities for processing the so-called REY-rich mud abundantly available in the Red Sea. One doesn’t exclude the other, right?

Regarding the Indian ocean mineral resources we can notice that if any Arab State doesn’t participate in their exploitation, Chinese mining companies will appear to occupy those free seabed areas rather sooner than later. And please note that any national legislation won’t be violated — just “the throne is never vacant”, as people say.

Now the visionary Arab investors should ask themselves: how are they going to control the future electric-driven economy if the material basis of it belongs to someone other than the Arab World?

Perhaps, the following chain of reasoning might appear:

investment in the electric-driven innovations is a short-term play having unpredictable results in the light of the growing cobalt shortage;

investment in the existing onshore deposits of rare minerals is a fancy practice promising high profits before the moment when someone floods the mineral market with abundant seaborn minerals;

investment in the leading mining corporations fighting each other for quite limited continental deposits of rare metals is unreliable since the continental deposits won’t be enough to satisfy the global demand for rare minerals;

investment in seabed mining can promise huge profit opportunities since just the renewable seaborn minerals can be the actual material basis for the whole electric-driven economy.

in the light of the growing mineral shortage, the one who controls the supply of seabed minerals will control the global oil-free economy.

If the seabed mining is so important and promising, some may ask, why almost nothing about the progressive seabed mining technologies is available in a broad public discourse? Why don’t the world-famous mining corporations practice the extraction of seaborn cobalt, for example?

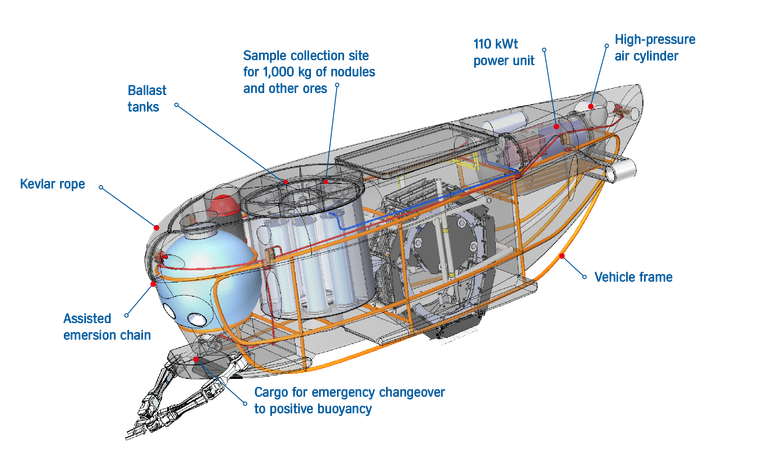

To find an unequivocal response to those questions is not so easy. On the one hand, there are some certain technological challenges in seabed mining since the rich ocean deposits reside at the depth of 4–6 km. It means the huge pressure of 40–60 MPa that the submersible mining equipment should be able to withstand. This is not an unsolvable technical task in fact, but the problem is that only a handful of organizations in the world are engaged in the development of the deepwater vehicles today.

On the other hand, the current rapid transition to the electric-driven economy does not represent enough time for consideration to the huge transnational corporations whose business is tightly linked to the available onshore minerals. Hence, the fundamental reformation of the technological and working cycles in favor of seabed mining is hardly possible for the present-day mining behemoths.

If we combine all above-mentioned considerations into a holistic concept of the most attractive investment opportunity, we can find out two entities to be involved in it:

the visionary rich Arab investors as a subject of the issue since just their experience, wealth, and business intuition are the most appropriate features for the guidance of the future oil-free economy;

the seabed mineral mining as a subject of the issue since just this industry offers both a message of emergency and a promise of long-term reliable incomes.

In summary, we can safely assume that the day will soon come when some Arab State appears number one in the seaborn cobalt supply which will change the rules of the entire world mineral market. The very common sense suggests so. And this is how the Arab World could control the future oil-free economy.