During the Crypto boom of 2019/2020 I like many who were partaking in the rise in prices likely got hooked to Defi liquidity pools. In short these liquidity pools were investors who wanted to hold crypto while earning interest. That way we would be yielding value by providing crypto to trade rather than facing the risk of losing my crypto through trading.

The boom meant there were a lot of new protocols that offered all kinds of earning yields. The biggest risk that comes from partaking in these protocols was the earned yield is some worthless token.

Apparently Yearn is maybe one of those worthless tokens.

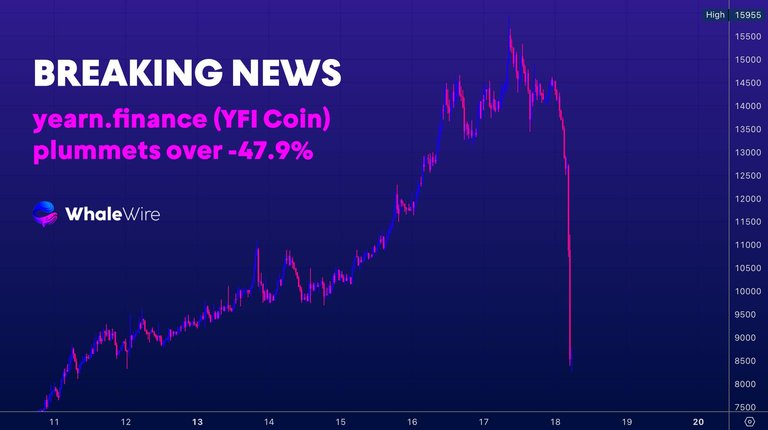

In the past 24 hours yearn token has drop close to half its value which is very abnormal. The likelihood that this is an exit scam is high and unfortunately for the retail investors who got in it’s likely difficult to get out without sustaining significant losses.

Over on Twitter Whalewire posted evidence that currently almost half of all Yearn tokens are held by only a few wallets and the tokens have been swapped to altcoins. While it may not be the full story it certainly fits the example of a rug pull on a project.

Over on coinmarketcap.Com price chart of Yearn.

In the past couple weeks Yearn had a significant rise in price in the tune of over 150% rise. This has now lead to some believing that the pull back is where whale holders of the token is cashing out of their yearns for more viable tokens like btc, usdt and eth.

This is another cautionary tale that not all defi are great investments. The reality is earning daily yield for just putting away crypto assets in a protocol be 100% safe bet. There can be instances were the crypto lose so much value that it can no longer be withdrawn to have any value.

Take best example in Luna and UST were defi protocols got wiped out when UST broke down of the $1 peg. The holders basically were wiped out even if they could make any withdrawals the crypto was worthless.

Sad day today to see it happen again even under slight positive gains in btc price and altcoin prices in recent months. Hopefully this doesn’t start some kind of domino effecting overall crypto market but remains to be seen what will happen. Be careful out there in the crypto investing world. When Something appears to be too good to be true it probably is something to avoid.

Until next time thanks for reading!!!

It definitely looks like a whale pulled out. I wouldn't say it's an exit scam unless they also pulled out their liquidity as well. It is however a rugpull.

I myself had seen this project in 2019 20 and had read some things about it and we also saw that its price increase was only seen by us because of its supply. It was very low and had a strong industry behind it due to which the price kept going up and down.