There are basically four asset classes:

- Business (Big companies 500+ employees)

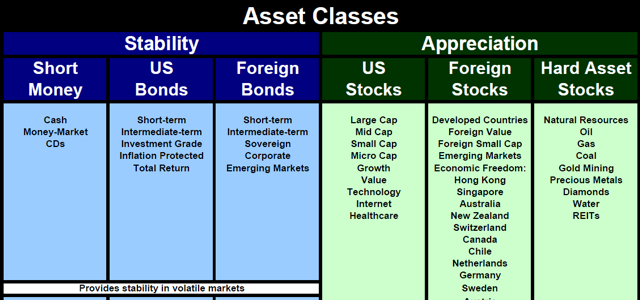

- Paper Assets (Stocks, Bonds, FX, Derivatives etc)

- Real Estate (Great for cashflow)

- Commodities (Gold, Silver, Oil etc)

To make money you must learn to focus on one asset class and master it.

Some say that cash (FX) is an asset class. And it is. Sort of. Cash is just a transitory item. A medium which you can use for changing one class to another. In the so called "cash-less society", physical cash (paper and coins) are replaced with cards and accounts loaded with digital currency. The advantage is that you can transfer large amounts in an instant. The disadvantage is that all transactions can be traced to your person. This means the governement can trace all your activities, as long as they have access to the systems handling your transactions.

Gold and silver (a commodity) is traded as a FX item against the other currencies. As we all know gold and silver are physical items. However, the big banks have been printing paper saying they redeem it for gold and silver (an old scam). This is of course not true, since they do not deliver on their promise. Instead you get cash if you win. It is thus pure speculation.

Can you protect your assets against speculation?

The answer is yes. But you have to own tangibles (physical) items. And be debt free. A seemingly impossible task these days, since all investing is based on debt (leverage).