After a deep correction of a few weeks bitcoin (Bitcoin), ether (ETH/USD), Ripple (XRP/USD) and litecoin (LTC/USD) rose markedly over the past week, gaining 19.87%, 10.48%, 30.57% and 53.90% respectively.

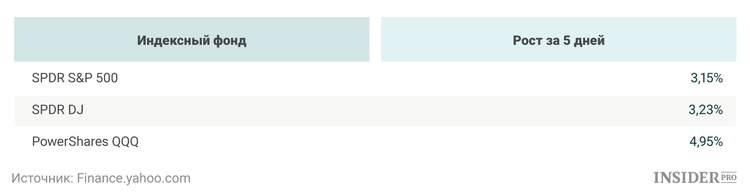

At the same time, the stock markets recovered from the sale of the beginning of the month — over the past 5 days, NASDAQ index gained about 5%.

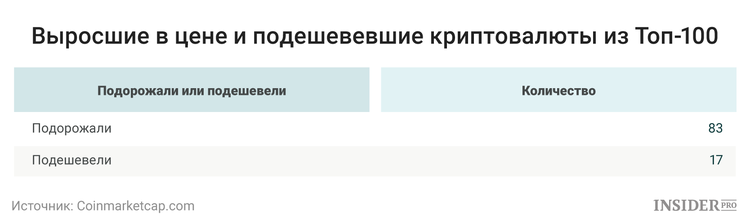

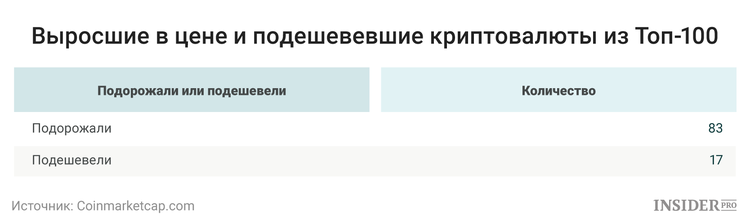

We see that most cryptocurrencies go up — 83 of the first hundred have risen in price, and only 17 have fallen in price

For investors who bought the "bottom", the rebound, of course, was a holiday.

How long will this holiday last? Will the prices of the largest cryptocurrencies return to their previous highs? It is difficult to guarantee this, but there are several factors that could help in this.

First, it is the spread of index funds and futures contracts, expanding the range of investors in cryptocurrencies. We can recall that the beginning of futures trading in December on CBOE, and then on CME Group led to a jump in prices for cryptocurrencies.

Another factor is the simplification of cryptocurrency exchange, which facilitates the purchase for the average investor. Jesse Cohen, senior analyst Investing.com, says:

"The most important prerequisites for growth that I see is the growing popularity of cryptocurrencies among traditional investors and the simplification of access to crypto-exchange systems. For example, the RobinHood trading application has already signed 1.2 million users to its not yet launched cryptocurrency service, designed to help you easily, quickly and, most importantly, safely invest in all major coins."

The third factor is the acceptance of cryptocurrencies as a means of payment by large retail chains. There are rumors that Starbucks and Dunkin Donuts are considering accepting bitcoin, and while all this is talking, if any large company starts accepting payment in cryptocurrency, it will attract the attention of young people to the problem.

These factors, together or separately, there may be a driver of new growth in the prices of cryptocurrencies — if governments, big banks or hackers again don't screw it up.

This post has received a 2.85 % upvote from @drotto thanks to: @kirillone.