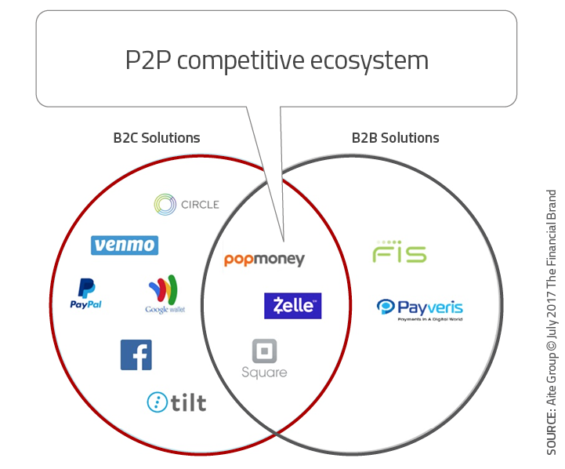

Building a digital payment solution using a bank membership model, Zelle is the latest in a series of simple, free and ubiquitous digital payment options that use a mobile application, replacing Cash, checks or cards, within a network of friends and acquaintances. By adhering to more established person-to-person (P2P) payment options such as Venmo, PayPal, Square and PopMoney, Zelle is built at the top of the clearXchange infrastructure, with the goal of becoming the first P2P brand consumed by 'industry.

Officially presented in June, Zelle will provide more than 86 million US mobile banking customers with the ability to send and receive money through their mobile banking application (no additional applications will be required). As with other competitors, Zelle allows you to send funds from one bank account to another within minutes, using only the e-mail address or mobile phone number of a recipient.

"Send money with Zelle" is ideally available in mobile banking applications of Zelle Network participants, Without additional application to download, Zelle is intended to make digital payments a quick, safe and easy alternative to checks and cash.

At the introduction, more than 30 financial institutions were announced as partners, including Bank of America, Citibank, JPMorgan Chase and Wells Fargo. In addition to working directly with financial institutions, Early Warning has established strategic partnerships with some of the leading payment processors including CO-OP Financial Services, FIS, Fiserv and Jack Henry and Associates. These relationships will expand the network and marketing power through community banks and credit unions, with the goal of having a single P2P platform for all traditional financial institutions.

A standalone Zelle application will be released this year for consumers of banks and non-Zelle Network credit unions. Until then, those who are outside the network can collect payments via Zelle by filling their bank information and linking their accounts.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://thefinancialbrand.com/66475/banking-p2p-zelle-digital-payments/