Have you ever had an issue with your bank? Your account was blocked, your bank rejected a payment or told you, that your daily withdrawal limit has been reached? Imagine a bank, where these and many more issues are stories of the past. Where customers are free of choice, independent and of full control over their funds.

Banking situation

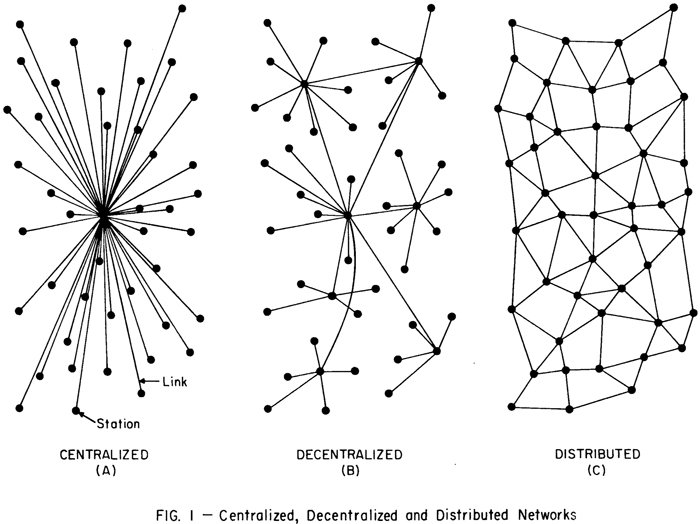

If we take a look on the traditional banking market and in particular focusing on advantages as well as disadvantages, we see, that today's financial services are mainly slow, limited and, well, centralized. Especially the last point is an essential cause of mixed feelings on the customer side, since a main issue in banking is trust. They have to trust the certain institution, that it is handling their money safe and sustainable, since after all, customers are legally just creditors.

As we know from the past, this is actually not always the case. Banks are involved in many risky, sometimes even barely legal practices or embezzlement, which can cause serious aftermaths or even lead to their bankruptcy. In that case, there is only limited hope for clients to get credited money recovered. After all, relying on a single entity means putting all your eggs into one basket. A basket, which is relentlessly exposed to human arbitrariness.

In addition, political issues are more and more threatening the customer's privacy, since banking secret and account protection has been abolished in most countries over the past years. If governments insist, banks are giving out account information, freezing them, or even enforcing deductions.

Not to forget, banking, especially for businesses, is very expensive. International transfers cost 50€ and more, which is added up to currency exchange fees. Receiving payments as a merchant from customers always results in high fees and banking accounts itself are having fixed monthly prices. When it comes to investment products, let’s assume the rare case that the bank is even giving easy access to their customer, the accessing and management fees are often eating up the investment’s performance or interests.

Last but not least, limitations of services are an ongoing pain in the industry. Banks are still working in the 90s, when it comes to easy wealth- and asset management, digitalization, automation or speed. Still, a transaction often needs a few days and is limited to a specific amount. Internal account functions mostly only focussing on transacting money or receive. Additional features, such as short-term investments, Peer-to-peer instant transactions, access to different asset classes or simple digital notifications, alerts, transaction confirmations you will hardly find in a classic bank account of your next house bank.

Banking - Decentralized

Instead of relying on a central third party, which is keeping full control over your assets, the development of blockchain technology is opening a totally new approach to asset management. It is now possible to give back control and access to the owner while storing his wealth in a decentralized network, or better, community.

Via blockchain, people who take part in the network, could build the institution, the pool, where money and wealth is being held, by themselves. Interactions with each other, especially transactions, do not need to be verified by an external participant, but can be regulated and determined by automated algorithms, so-called smart contracts. Blockchain technology is not only providing the opportunity to drastically reduce risk factors and dependency on others mood but will also have a huge impact on pricing and speed.

Within crypto communities, this knowledge is already widespread. The main challenge now is to connect these opportunities to the real world and, especially, to existing Fiat (Dollar, Euro) money systems. In addition, when it comes to cryptocurrency „banking“, solutions are still quite rudimentary, not able to fulfill daily or business needs. Most of them are restricted to a wallet and the ability to make transactions to another wallet which is capable to hold the same currency.

Besides, the handling of those wallets is often difficult and sometimes even dangerous. What is truly needed, is an easy-to-use universal interface, adaptable to external services, giving free choice of currency usage. Now, a network, built on a blockchain, forms the underlying backbone of an ecosystem, connecting all participants with each other. Within this network, transactions are being made, either automatically transformed to a universal base currency, or using new rising technologies, such as atomic swaps (https://www.cryptocompare.com/coins/guides/what-are-atomic-swaps/) or COMIT (http://www.comit.network/), to realize transaction cross-chain and currency-independent.

Within such a system, the actual bank is now only a service provider, putting necessary algorithms and technology in place for usage and a working infrastructure. As already mentioned, the key question is: How to realize such a system for Fiat currencies without keeping control over users bank account?