Yesterday, 11th of November 2017, we have seen Bitcoin Cash shooting up in market cap as if it was one of Elon Musk's new rockets. That sent everybody wondering what the heck is going on??

I don’t believe what we’re seeing right now is an ‘organic’ movement to Bitcoin Cash. It looks more like a well organized manipulation, or I would go as far as calling it a ‘terrorist attack’ on Bitcoin, as clearly, it took a lot of planning, organization and resource to:

1/ Pump enough money into Bitcoin Cash to surpass the market cap of Etherum in just 24 hrs

2/ Switch enough mining power resource over to Bitcoin Cash, giving it greater hashing power than Bitcoin itself

3/ Come out with a messages across social media and news platforms stating that this is the ‘end of Bitcoin’ (https://www.coindesk.com/confusion-euphoria-bitcoin-cash-30-billion-2000/)

...all this in a mere few hours...a coincidence??

Let's have a look at the hashrate chart for Bitcoin.

Can you see that dip in Bitcoin hashrate starting November 9? Yes, that the opportunistic miners for whom it pays better to mine Bitcoin Cash right now. Ironically, by moving 'traffic' across to Bitcoin Cash, this will make the difficulty on the Bitcoin network adjust and become easier, whereas it will increase for Bitcoin Cash.

I think that’s a very dirty move by a group of miners, such as Roger Ver, aka. ‘Bitcoin Jesus’ (who may have just earned himself a new nickname: ‘Bitcoin Terrorist’) as well as big Chinese miners, who were very quick to declare the ‘death’ of Bitcoin, just as we saw this phenomena occurring live in front of our eyes.

Don’t get me wrong, after researching Bitcoin Cash I do believe it offers some major benefits right now, however this ‘move’ to force Bitcoin out of existence, sending people into panic and manipulating the market is wrong and clearly no matter how good Bitcoin Cash is, I don’t want to be associated with a community that is managing themselves by these types of events... Bitcoin Cash might have just shot itself in the foot with this move.

I hope that the crypto community will stay strong, resist the FOMO and stay the hell away from Bitcoin Cash (at least until this whole manipulation is over and we can see the clear state of the market). If indeed Bitcoin Cash is a better alternative, everyone should have the opportunity to decide for themselves and make an informed decision…and not be made to try and jump ship, when it's difficult to say whether it's really sinking at all..

Oh, I’m really pissed off at you Bitcoin Cash!

I don’t think we’re seeing the end of Bitcoin. Yes, it does have challenges it needs to sort out but man, I’d rather wait and give it time to sort it out than join the Bitcoin Cash terrorists! ***

Without further ado, ladies and gents, let me present you: Bitcoin Cash.

What is Bitcoin Cash?

Bitcoin Cash (BCC) is a cryptocurrency created via a fork of the Bitcoin network. This means that any user who held Bitcoin at the time of the fork (August 1st, 2017), had received an equivalent amount of Bitcoin Cash on the forked Bitcoin Cash blockchain.

Why was Bitcoin Cash created?

Bitcoin Cash was created as an answer to a year’s long debate in the Bitcoin community regarding the best way to scale Bitcoin to increase the number of transactions per second.

Bitcoin blocks of 1MB are found to have the capacity of around three transactions per second (even though theoretically it can be up to 7). Compare this with the capacity of Visa that handles comfortably 1700 transactions per second. It can be easily seen that in order to increase the mainstream adoption of Bitcoin it will need to be able to upscale its throughput.

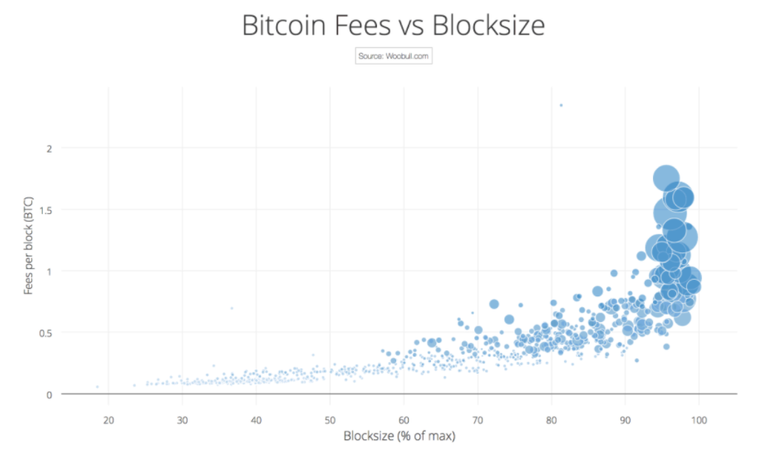

With the fast adoption of Bitcoin and growing number of transactions, the blocks grow to 95% of their size, and the new transactions are queued up in ‘mempools’ awaiting processing. At that point fees start to exponentially increase in competition to move ahead in the queue and get into the next block without delay. This shows the limitation of the current network and is certainly not the best experience for the young community.

There are two main ways in which to address this problem. One is to increase the block size. The other is to reduce the amount of data that needs to be verified in each block. Signature data has been estimated too account for up to 65% of data processed in each block

SegWit2x was an approach that was going to implement both removal of signatures and increasing block size to 2MB. This was seen as a short term solution and also a move away from the original vision by Satoshi Nakamoto by part of the community who decided to fork Bitcoin and create Bitcoin Cash.

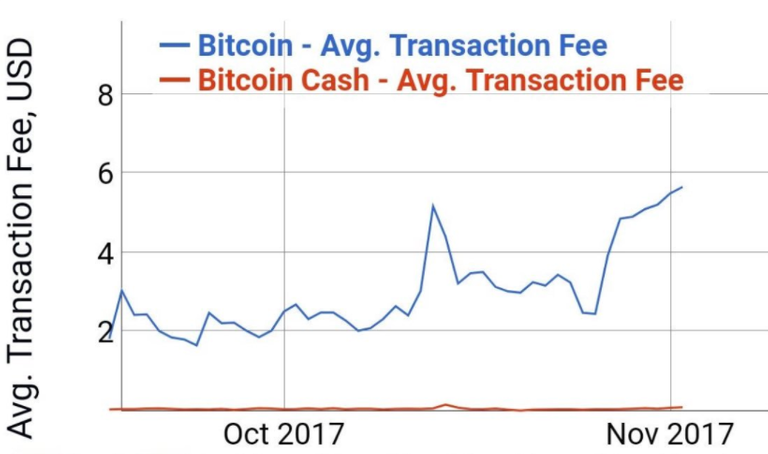

Bitcoin Cash is indeed a more pristine implementation of Bitcoin blockchain, comparing to the blockchain altered by SegWit2x (mind you, SegWit2x was cancelled!). Bitcoin Cash has successfully address the block capacity problem by increasing own block size to 8MB and as result the transaction fees are staying very low comparing to the original Bitcoin.

Bitcoin Cash is also running research project that is aiming to increase the block size to a point where Bitcoin Cash will be able to serve 3000 transactions per second, a volume that would make a mainstream adoption a much more realistic concept. This would mean a block size of 1GB. This seems crazy comparing to today’s block size of 8MB, however, chief scientist of Bitcoin Unlimited announced on Oct 16th that a first 1GB block has been successfully mined on a testnet.

Disclaimer: Please note that opinions expressed in this blog should not be treated as investment advice.

Congratulations @digitalisbetter! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP