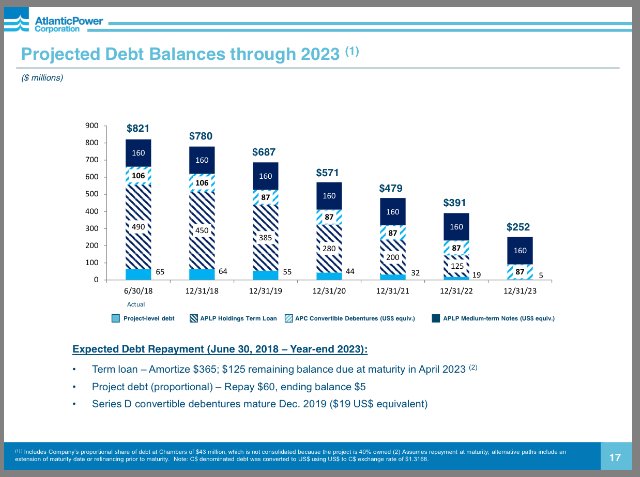

Atlantic Power Corporation is starting to look undervalued and in the next five years will get even more attractive. Since 2013 the new management has paid down over a billion dollars worth of debt. And they are projected to pay off another $500M in the next five years.

That means they will be saving at least another $30M per year in interest expenses. And by 2023 will free up another $100M per year that they are currently allocating towards debt buy backs.

The company’s assets are strong enough to maintain this free cash flow and in 2023 when the debt level decreases to the management's goal of 2x EBITA ($250M total debt) the company should have $100M per year to give back to investors in dividends, stock buybacks or allocate towards growth opportunities with attractive returns. That is very substantial considering the company is only selling for $250M on the stock market.

A fairly valued EBITA multiple for this company would be 10x. Even if you cut the above predictions in half to $50M this still represent a doubling of the market cap to $500M (10x$50M).

This is a very conservative estimate of free cash flow and still represents a doubling of the stock price over the next five years. Furthmore, the current management team has capital allocation talent and will only chase attractive rates of return. This investment looks to have great downside protection with the potential for an above average rate of return and should be bought at current levels.

Congratulations @owinvestments! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemFest³ - SteemitBoard support the Travel Reimbursement Fund.