In the ecosystem of cryptocurrency exchange today, there exist two kinds of exchanges – centralized and decentralized exchanges (CEX and DEX). Centralized exchanges require a third-party or a middleman to keep it operational while the decentralized is a peer-to-peer system of operation void of a third-party. DEX is seen to be more secure, transparent and fast compared to CEX which can be manipulated by an external force or authority.

Centralized exchanges mostly necessitate users to place their private keys on the platform, trades (buy and sell orders) are directed to a third-party, thereby placing the user assets at risk – middlemen are defenseless to government influence and hacking attacks. Centralized exchanges have been in existence and are seen to be the standard in the actual world, away from coins, tokens and distributed ledgers. Some of these exchanges like NASDAQ, NYSE allows the trading of stocks and similar digital asset, liquidity, and have provided low latency (quick processing of orders), and tools like marginal, and high-frequency, trading which has attracted participation from individual and institutional investors, the latter contributing to even more liquidity. CEX lacks transparency, data, accountability, trust, security, it is susceptible to hacks, it is at risk of downtime, putting investors and traders in high risks – investors losing hundreds of thousands of dollars because they lost the private keys to their hardware wallet, vulnerable to hackers, frequent DDoS-attacks, unable to instantly get access to funds because of the technical activities performed within an exchange platform and countless challenge that give rise to insecurity, inconveniences and endangering users assets.

Decentralized Exchanges, permit users to retain much of their confidentiality by retaining complete control of their private keys. DEX operates on a blockchain technology and a smart contract that makes it extremely difficult to subject them to any form of government regulation that necessitates CEX to amass information on their users. Decentralized exchanges do not hold buyers, sellers or investors assets, which implies that they are not as defenseless to hacking, providing more security incomparable to CEX coequals. Owing to rate-restricted trading APIs, non-real-time transaction authorization, and deferred order book updates, traders are unable to trade in real-time. Blockchain technology has changed the ecosphere of investment endlessly which has led to ICOs proven to be secure and successful resources of financing companies and projects.

Even the present-day blockchain platforms are slow as a result of speed, scalability and not capable of handling high-transactions. They are also expensive such that the high transaction charges weigh down the economics of implementation. More so, there are restrictions, making it not to concurrently support private and public blockchain. This limits their capabilities and business solutions.

Source: https://www.linkedin.com/pulse/xcrypt-tivere-akporode

The hybrid blockchain exchange provides a trustless, real-time, and high-throughput trading experience in combination with a blockchain based settlement. As a result of centrally managing trade matching and Ethereum transaction dispatch, the hybrid exchange empowers users to trade constantly without waiting for transactions to mine, fill various orders at once, and revoke orders immediately without gas charges.

BEXAM PLATFORM

The Bexam platform is a hybrid blockchain-based exchange that has put in position via security measures combining blockchain and Directed Acyclic Graph DAG that will prevent tampering and unauthorized access platforms thereby providing a stress-free user experience with high-speeds and scalability, immutable network that is cryptographically secured, cross-platform operations to enhance broad business uses cases, fraud security with multiple layered protections of wallet nodes, multiple layer protections for inner and external distributed protocol, excellent and effective performance void of downtime and interruptions, customers reliability of high-level data security, and operational cost-effective in terms of server maintenance and security.

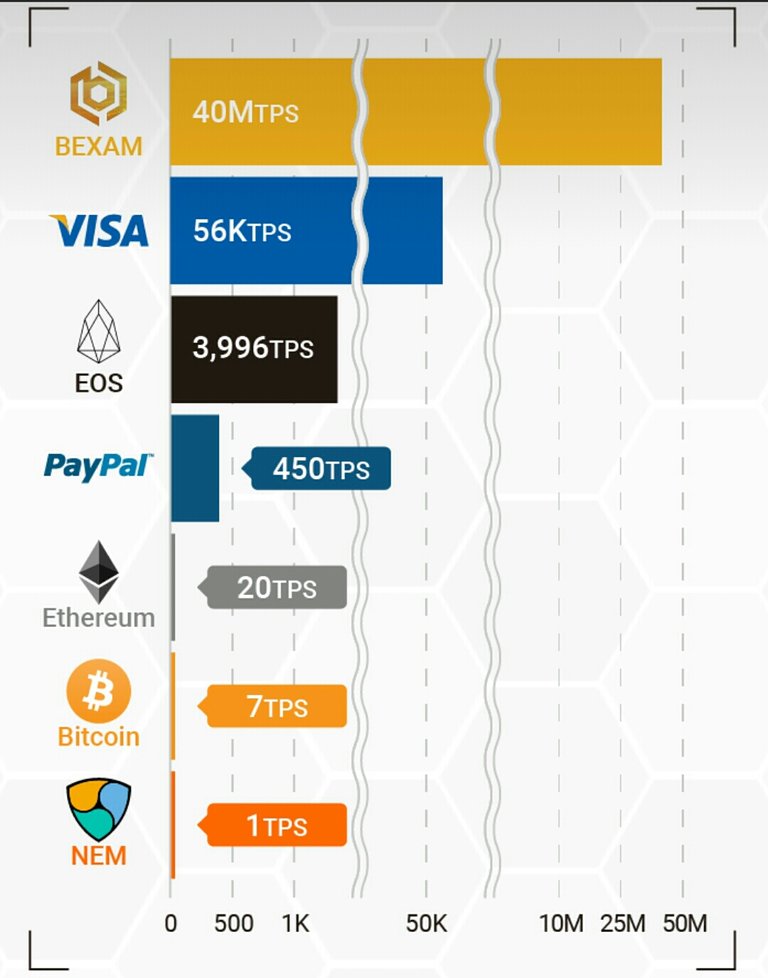

The Bexam hybrid blockchain-based exchange is capable of transacting at block time of 0.2 seconds and forty (40) million transactions per second (TPS) which makes a platform with extreme speed, scalability and security. See image below for transactions comparisons

This is why Bexam has revolutionized to practically solve the underlying issues faced by the present blockchain platforms. The Bexam's platform is a hybrid exchange peer-to-peer system that uses the Proof of Rounds (PoR) consensus mechanism which is a new consensus-building algorithm that resolves high speed in combination with high security. PoR unravels the existing challenges of existing protocols like the low transaction speed and abridged scalability, slow block times, thereby maintaining data distribution impartiality, zero downtime, and anti-counterfeit measures. PoR has noteworthy benefits over existing blockchain platforms because of its 0.2 second block time, scalability and unvarying data volume distribution.

The PoR has three inimitable physiognomies such as the Authorization of transactions by variations, Enhancement of processes by passing on roles by means of a node hierarchy, the building of a unique network that allocates data proficiently.

BEXAM TOKEN INFORMATION

The Bexam has its own native token called BXA token that serves as the fuel of the platform which will be used for all transactions across the platform globally. BXA is a multi-utility token that will be used for voting rights for new coin listing, creating enterprise POR networks, discount on fees made using BXA, referral program, staking and rewards for master node and supernode. Transactions made with BXA token attracts a 10% discount.

TOKEN NAME: BEXAM

SYMBOL: BXA

PROTOCOL: ETHEREUM

PRICE PER BXA: $0.12c

SOFT CAP: $2,500,000 (2.5 MILLION USD)

HARD CAP: $16,000,000 (16 MILLION USD)

TOTAL BXA SUPPLY: 1 BILLION

ACCEPTED CRYPTOCURRENCY FOR PURCHASE: BITCOIN

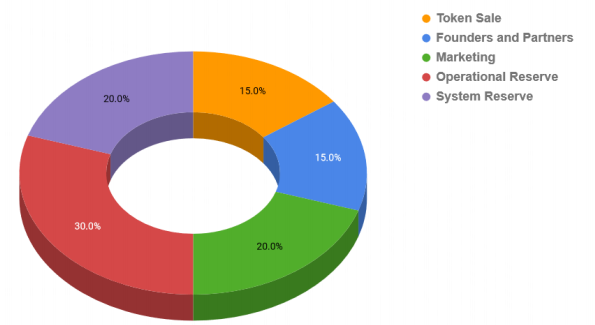

TOKEN DISTRIBUTION

TOKEN SALE: 15%

FOUNDERS AND PARTNERS: 15%

MARKETING: 20%

OPERATIONAL RESERVE: 30%

SYSTEM RESERVE: 20%

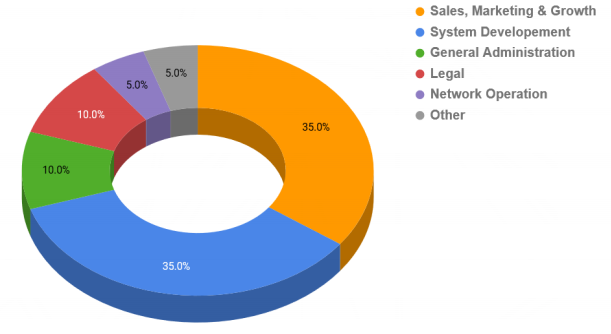

FUNDS DISTRIBUTION

SALES, MARKETING, AND GROWTH: 35%

SYSTEM DEVELOPMENT: 35%

GENERAL ADMINISTRATION: 10%

LEGAL: 10%

NETWORK OPERATION: 5%

OTHERS: 5%

PARTNERS

EARLY WORKS BASE I.M WORKS HACKEN

STARTUP TOKEN AIDCOIN CHARITY STARS

FEATURED ON

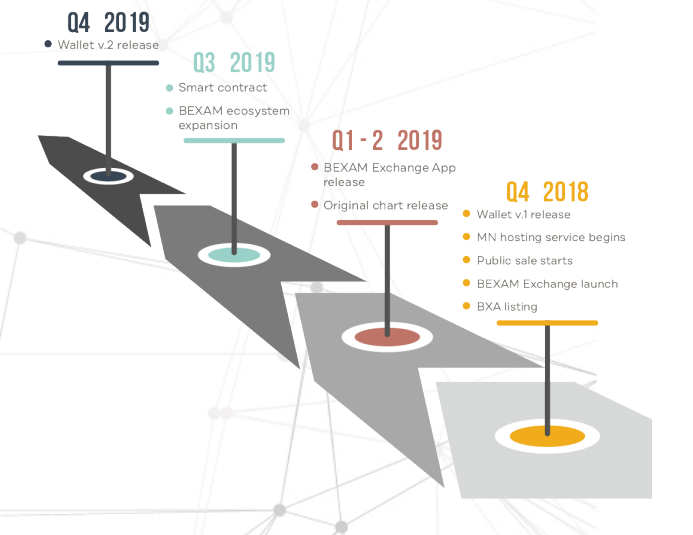

ROADMAP

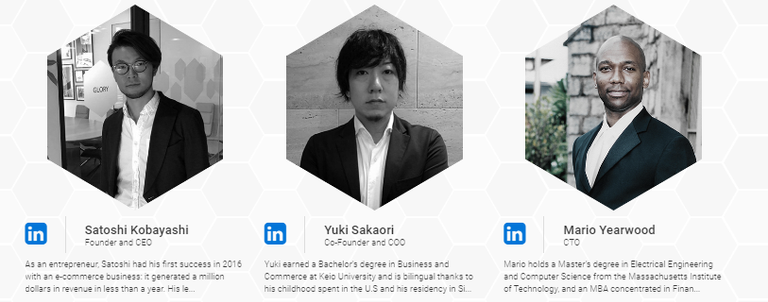

TEAM

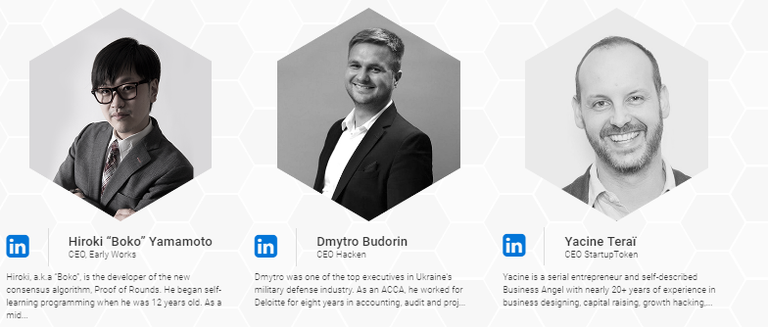

ADVISORY BOARD

MARKETING & DEVELOPMENT

CONTACT INFORMATON ABOUT BEXAM

ARTICLE WRITTEN BY MICKEY OBERABOR

BOUNTY0X USERNAME: MICKEYBERRY1

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord