Cont'd

Intro

In our view, there are fundamentally two different types of exchanges: the ones that

deal with fiat currency; and the ones that deal purely in crypto. It is the latter one that

we will focus on. Even though they are small now, we strongly believe that pure

crypto exchanges will be bigger, many times bigger, than fiat based exchanges in the

near future. They will play an ever more important role in world finance and we call

this new paradigm Binance; Binary Finance.

With your help, Binance will build a world-class crypto exchange, powering the future

of crypto finance.

Problems

Some of the current crypto exchanges suffer from a number of problems:

● Poor technical architecture

Many exchanges are “put together quickly”, by good tech people, but who

have little or no experience in finance or in operating an exchange. They often

choose the simplest approach to get the system up and running. While this

may work well in the beginning, as traffic grows, the system will not able to

handle the increased load. Exchange systems need to be engineered from

the ground up with security, efficiency, speed, and scalability in mind. This

often slows down the initial development, but is critical for long-term success.

Our team has decades of combined experience building and maintaining

world class financial systems that shape the economy. We understand how

these systems are built from the ground up.

● Insecure platform

There are hundreds of exchanges that went down due to being hacked .

1

Binance is built to high standards, audited, and penetration tested. We have

experience building financial systems to the highest security standards and

strive to ensure security first.

● Poor market liquidity

Professional traders and normal users are significantly affected by this.

Having a shallow orderbook means high slippage when trading, which is very

expensive for traders. Getting miners, institutional investors and large traders

into a new exchange is a chicken and egg problem, and requires a team with

deep industry resources.

Binance’s team have been in both the finance and crypto industry for many

years. The team has worked on and operated a number of exchanges, and

have accumulated a large network of partners in this space. These partners

will be key in bootstrapping the exchange.

● Poor customer service

Traders are a different breed when it comes to users. Understanding the

trader mentality is vital for running a successful exchange. Money is literally

on-the-line. Many exchanges service traders as if they were running a social

media site. A 3-second delay in seeing your friends’ status update would

hardly be noticed, but on an exchange, the same would be unacceptable,

resulting in a torrent of user complaints.

In additional to the technology stack, Binance is built with service in mind.

Binance shares support responsibilities across the entire staff and company.

When a trader has a problem, they get an answer directly from someone who

knows the system and not someone reading from a script.

● Poor internationalization and language support

Blockchains have no borders. Most exchanges focus only on one language

or one country.

Our international multi-lingual team has extensive working experience in

North America, Europe and Asia, and we are able to smoothly support the

global market.

1 https://bitcointalk.org/index.php?topic=576337

[Written about 6 months ago, we see they have definitely kept up with their word]

Binance Exchange

Matching Engine

Our matching engine is capable of sustaining 1,400,000 orders / second, making

Binance one of the fastest exchanges in the market today. You can be certain, on

our exchange, that your orders will never be stuck due to the matching engine being

overwhelmed.

Feature Rollout

We will roll out the platform in roughly the following order:

● Spot trading

● Margin trading

● Futures

● Anonymous instant exchange

● Decentralized (on-chain) exchange

● and more…

Coins

Binance will support trading pairs in the following coins:

● BTC

● ETH

● LTC

● NEO (ANS)

● BNB (Binance Coin)

More coins will be added over time. We generally will only add coins that have

strong credibility, user base, and liquidity. If you have a coin that you wish to be

listed on Binance later, participating in our ICO will help.

We have no plans to support any fiat currencies such as USD, RMB, JPY, or KRX.

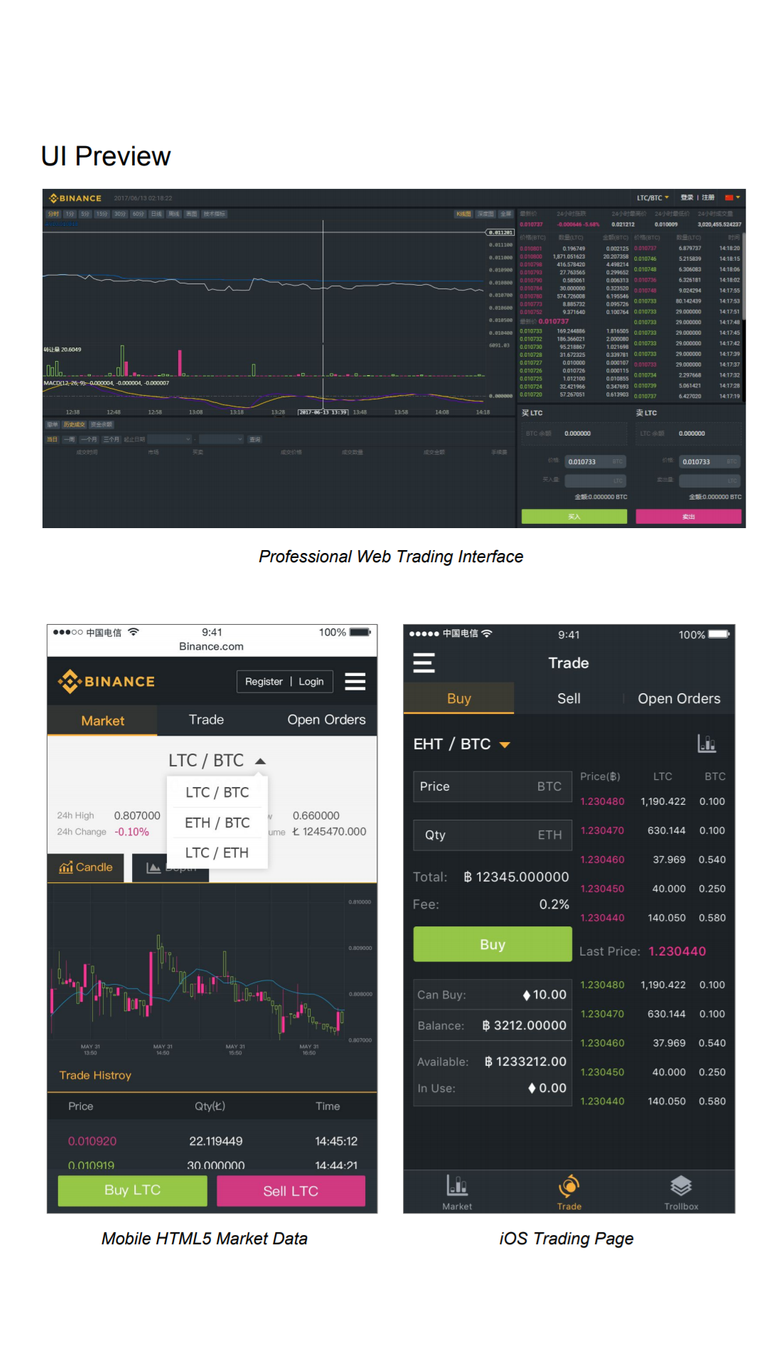

Device Coverage

We will provide cross-platform trading clients for:

● Web-based trading client

● Android native client

● iOS native client (pending App Store review)

● Mobile HTML5 client (including WeChat H5 client)

● PC (Windows) native client

● REST API

Multilingual Support

We will support English, Chinese,Japanese and Korean on all of our user

interfaces. (The very initial release will be in English and Chinese only.) More

languages will be added over time.

[My PERSONAL experience with the exchange has been exceptional, no complaints, they are frequently issuing updates but they are honestly seamless in the experience. Trades are super quick and the mobile app works just as good if not better than the website]

Revenue Model

Binance’s revenue will come from the following sources:

Source Description

Exchange Fee Binance initially will charge a 0.2% fixed fee per trade. Other

variations will be subsequently introduced, including

maker-taker, volumed based tiering and 0 fee promotions.

We have no plan to charge above 0.2%.

Withdrawal Fee Binance may charge a small fee for withdrawals.

Listing Fee Binance will select innovative coins and other assets to be

listed on the exchange, there may be a fee associated with

those listings.

Margin Fee If you trade on margin, there may be a fee or interest on the

borrowed amount.

Other Fees There may be other fees the platform may collect for various

services such as automated algorithmic order etc.

[I completely hear them out on their protocols, a little upset about the minimums throughout the site but it shouldn't matter if your investing right (:....they are definitely making some conscience decisions when listing coin so I like that )

+Binance Coin (BNB)

We will issue our token coin, called the Binance Coin. A strict limit of 200MM BNB

will be created, never to be increased. BNB will run natively on the Ethereum

blockchain with ERC 20.

Allocation

% Amount (BNB) Participant

50% 100,000,000 ICO

40% 80,000,000 Founding Team

10% 20,000,000 Angel investors

ICO

The ICO will be done in BTC and ETH, on multiple platforms around the world.

ICO Schedule

All times below are China Standard Time (CST), UTC+8 hours.

Date Task

2017/06/14 Confirmed start of the Binance project

2017/06/16 Initial draft white paper completed, circulated to potential angel

investors

2017/06/22 Announce Binance ICO plan, and release whitepaper to general

public

2017/07/01 ICO starts (platforms will be announced soon)

2017/07/15 Binance.com release v0.1 go live, active trading begins

2017/07/21 ICO finishes, or whenever the coins are sold out

ICO will start from 3PM July 1st, investors can purchase BNB tokens in 3

phases on a first-come, first-served basis until 100,000,000 tokens are sold.

As each new phase starts, the price will increase.

Investors will receive BNB tokens within 5 working days after the ICO finishes.

[Did not get a chance to participate but hey it's never too late]

+BNB Value & Repurchasing Plan

You can use BNB to pay for any fees on our platform, including but not limited to:

● Exchange fees

● Withdraw fees

● Listing fees

● Any other fee

When you use BNB to pay for fees, you will receive a significant discount:

1st year 2nd year 3rd year 4th year 5th year

Discount Rate 50% 25% 12.5% 6.75% no discount

Repurchasing plan

Every quarter, we will use 20% of our profits to buy back BNB and destroy them, until

we buy 50% of all the BNB (100MM) back. All buy-back transactions will be

announced on the blockchain. We eventually will destroy 100MM BNB, leaving

100MM BNB remaining.

Decentralized Exchange

In the future, Binance will build a decentralized exchange, where BNB will be used as

one of the key base assets as well as gas to be spent.

BNB Vesting Plan for the Team

Initial release: 20% (16MM)

After 1 year: 20% (16MM)

After 2 year: 20% (16MM)

After 3 year: 20% (16MM)

After 4 year: 20% (16MM)

Funds Usage

● 35% of the funds will be used to build the Binance platform and perform

upgrades to the system, which includes team recruiting, training, and the

development budget.

● 50% will be used for Binance branding and marketing, including continuous

promotion and education of Binance and blockchain innovations in industry

mediums. A sufficient budget for various advertisement activities, to help

Binance become popular among investors, and to attract active users to the

platform.

● 15% will be kept in reserve to cope with any emergency or unexpected

situation that might come up.

[I have made some good returns from many different coins from Binance but I cashed out on most and am just holding as many BNB coins as I can get my hands on. Once they move to decentralized the coin is going to moon 🌒 so hard]

Team

We have a solid team led by Changpeng Zhao, with both traditional wall street

finance and cryptocurrency experience. We have a track record of successful

startups under our belt.

+Changpeng Zhao - CEO

(aka CZ in the crypto community) LinkedIn Profile

CZ is the founder and CEO of BijieTech, a company that

provides cloud-based exchange systems to exchange

operators. Since founding in Sept 2015, BijieTech now powers

30+ exchanges in Asia. In the first 12 months since founding,

BijieTech closed 36.1 million RMB ($5.3MM USD) in revenue,

and will double that in its second year. BijieTech has never

accepted any outside investments, being cash flow positive

from day one.

As soon as the Binance ICO finishes, CZ will remain a shareholder of BijieTech, but

will relinquish all of his management duties to a new CEO. CZ will focus exclusively

on Binance. This applies to all BijieTech members listed in this whitepaper.

Prior to BijieTech, CZ was the co-founder and CTO of OKCoin. During his stay

there, OKCoin launched their international site, and their futures trading platform.

Co-ordinating with Stefan Thomas, CZ also lead the first proof-of-reserves in any

China crypto exchange. Most other major exchanges in China followed soon after.

In addition to managing the tech team there, he also lead the international marketing

team. He is still mentor to and good friends with Zane Tackett.

Before OKCoin, CZ was the Head of Technology and the 3rd person to join the

Blockchain.info team. He worked closely with Ben Reeves, Roger Ver, Anthony

Antonopoulos and Nicolas Cary to grow the Blockchain.info service.

Before Blockchain.info, CZ co-founded Fusion Systems Ltd in 2005, a company that

specializes in ultra-low-latency trading systems for brokers. Fusion Systems was

started in Shanghai, and currently has offices in Tokyo, Hong Kong, and Los

Angeles. Among other tasks, CZ was responsible closing and deploying trading

systems at Credit Suisse, Goldman Sachs, Deutsche Bank, and more. CZ left

Fusion System to work full time in the blockchain industry in 2013.

Before Fusion Systems, CZ was the Head of Development at Bloomberg Tradebook

Futures for 4 years, in New York. There CZ managed a team that was responsible

for the entire futures trading platform in Bloomberg, with annual revenues exceeding

$300 million USD.

Prior to Bloomberg, CZ’s college internship and first job out of college was in Tokyo,

working for a tech outsource company that was involved in developing trading

systems for the Tokyo Stock Exchange. This is where his exchange experience

began.

CZ was born in China and went to high school and college in Canada. CZ is fully

bilingual in English and Chinese, and can speak basic Japanese.

+Roger Wang - CTO

LinkedIn Profile

Roger is a co-founder and the CTO. He has been working in

the financial industry for 10+ years, responsible for building up

technical teams, designing the high level architecture of the

exchange and clearing systems, and running ops teams to

ensure the security and stability of exchange systems.

Prior to BijieTech, Roger worked at Nomura Securities, the

largest investment bank in Japan. He was responsible for a

global credit booking, analytics, and marking system, which supported thousands of

global traders and analysts. He has also successfully implemented a smart bond

matching engine, which consumes firm wide trading/order/position data, client

enquiry info, 3rd party data as well as public bond data, to discover business

opportunities for the firm using sophisticated custom built algorithms. It now

generates over 100MM USD revenue annually for Nomura.

Before Nomura, he was a tech leader in Morgan Stanley, where he designed and

built a financial TB level data warehouse, which supported a large number of users to

do real time data analysis and financial modeling. He was also a core developer for

low latency algorithmic trading systems, which served the firm’s largest clients like

Blackstone and Wellington Fund, that delivered significant commission income for

Morgan Stanley.

Roger is fully trilingual in English, Chinese and Japanese.

+James Hofbauer - Chief Architect

LinkedIn Profile

James is a co-founder and the Chief Architect of BijieTech.

He architects and implements the core matching engine and

its middleware. He also oversees client exchanges' public

endpoints to ensure security and high performance.

Before BijieTech, James worked at Palantir, a Silicon Valley

company that focuses on big data analysis. Palantir's

large-scale high-performance systems are used for

cyber-security, anti-money laundering, fraud detection, counter-terrorism, and many

other data relationship analysis purposes by both private and government entities.

Before Palantir, James worked at Fusion Systems. A notable project James worked

on was a global investment bank's systems architecture redesign, focusing on

reducing the number of systems, encrypting and securely handling sensitive data,

and introduced a new user security system which provides authentication,

authorization, and action audit logging.

James was raised and educated in America, earning a Bachelor’s of Science, Cum

Laude, in Computer Science. He is bilingual, native in English and fluent in Japanese

(JLPT N2 certified), and has lived in Japan for over 10 years.

James has known CZ for 7 years and they have worked in two startups together.

+Paul Jankunas - VP of Engineering

LinkedIn Profile

Paul is the VP of Engineering at BijieTech, responsible for the

C++ implementation of the core machine engine. He has over

15 years of experience in developing exchange systems and

financial trading applications. He is constantly looking for new

ways to improve the performance and scalability of the system.

Prior to BijieTech, Paul worked at SBI BITS, part of SBI Group, in Tokyo. SBI Group

is a listed financial services company with interests in a wide assortment of

businesses. Paul was responsible for both client and server side development for

trading applications.

Before that, Paul worked at Fusions Systems in Tokyo as the Head of Development

on Raptor, a market gateway with latencies under 2 microseconds, and before that

for Bloomberg in New York.

Paul has known CZ for 9 years and they have worked together in 3 companies.

Allan Yan - Product Director

LinkedIn Profile

Allan is a co-founder and the Product Director of BijieTech.

Allan has over 10 years of experience in product design, user

experience and trading. He drives the innovations in the

exchange systems built by BijieTech, and pushes the product

far ahead of the the competition in this ultra competitive

space.

Before BijieTech, Allan worked in Orient International Holding,

which is one of the biggest import & export firms in Shanghai. He was responsible for

the implementation of several informationization products, including ERP and e-Fax.

Meanwhile, he led a variety of game and VOD content platforms.

+Sunny Li - Operations Director

LinkedIn Profile

Sunny is a co-founder and the Operations Director of

BijieTech. He has many years of management and technology

consulting experience, has led 20+ exchange systems

projects, and provided comprehensive consulting for strategy,

operations, risk control and system development.

Prior to BijieTech, Sunny worked at Accenture as the senior

consultant. He provided many Top 500 companies for

strategic and IT consulting, and led a number of IOT, big data,

ERP information integration systems projects

+Investors & Advisors

In no particular order.

Matthew Roszak

Bloq co-founder.

Tally Capital Founding

Partner.

Roger Ver

Angel investors in many

blockchain businesses.

CEO of Bitcoin.com.

Ron Cao

MD of Sky9 Capital

Institutional investor in

BTCChina.

Chandler Guo

Angel Investor in

blockchain businesses in

China.

He Yi

CMO of Yixia

Technology.

Previously Co-founder at

OKCoin.

Yang Linke

Co-founder of BTCChina.

ICOCoin Founder.

Zhao Dong

One of the largest crypto

OTC brokers in China.

Da Hongfei

AntShares Founder.

Onchain CEO.

Jun Du

Co-founder of Huobi.

Angel investor.

Vincent Zhou

Founder of FinTech

Blockchain Group. Active

angel blockchain investor.

Lu Bin

CEO of Andui.com, a

blockchain financial

service company in China

Liu Sutong

Finance Channel TV

Anchor.

CEO of Heng Pool.

Eric Zhang

AntShares Core Member.

Lead match- engine

developer at Huobi.com

Leah Zhang

CMO of F2Pool.

Previously Investment

Manager of AngelCrunch.

Wang Qijun

Co-founder of Andui.

Formerly Marketing at

Blockchain.info

Roy Zou

CEO of Bitkio, Secretarl

at Ethereum Classic

Consortium (ECC)

Jackie Wang

Founding team member

of Bitbank.com and

BW.com and CHBTC.

Li Da

Co-founder of

JiulianTech.

Xiaoning Nan

Founder of BitOcean.

Jeff Cui

Founder and CEO of

TKing.cn. Tech lead at

Morgan Stanley.

Guicheng Xiong

Co-founder of 91

Wireless, acquired by

Baidu at $1.9 billion USD.

Xin Chen

Previous Product Director

of OKCoin. Analyst at

Guotai Junan Securities.

William Liu

Senior Partner at AllBright

Law Offices, the biggest

Law Firm in Shanghai.

+Risks

There are many risks involved in running an exchange. We understand this and have

the skills, experience, and leadership to overcome them.

Security is Paramount

Many crypto exchanges have failed due to poor security procedures. Most security

breaches could have been prevented by taking simple precautions to protect critical

resources. Our team has developed Binance with security as the foremost concern

in their minds. We strive to ensure that we have followed all the industry best

practices when it comes to securing infrastructure and data including ISO/IEC

27001:2013 and the CryptoCurrency Security Standard (CCSS) .

2 3

Market Competition

We know this will be an ultra competitive space. There are probably hundreds, if not

thousands of teams wanting, planning or doing exchanges. Competition will be fierce.

But in this age, this is a common risk in any decent concept/startup or mature

company. The question is: given our team, track record, experience, industry

resources, and product, do you believe we stand a better chance than the rest of the

pack? If yes, then please join our ICO.