Sources close to the American multinational finance company, Goldman Sachs, has revealed the firm is looking into creating a new trading operation that deals with bitcoin.

Goldman Sachs May Enter the Cryptocurrency Trading Arena

Image source

The Manhattan-based financial management service, Goldman Sachs Group, says that it’s looking into entering the world of bitcoin trading markets according to a report from the Wall Street Journal. The publication’s columnist, Paul Vigna, explains that people familiar with the matter say Goldman Sachs is interested in dealing with bitcoin trading markets. The source explained Goldman’s plan is in its “early stages,” but is the first Wall Street firm to show this much interest in the bitcoin trading arena.

“In response to client interest in digital currencies we are exploring how best to serve them in this space,” a Goldman spokeswoman told both the Wall Street Journal and CNBC news outlets.

If You Can’t Beat Them — Join Them

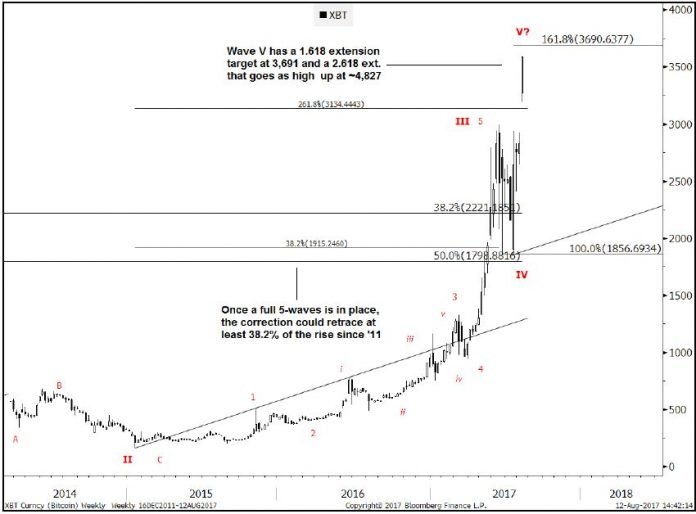

Goldman Sachs interest in bitcoin started off with the firm discounting nearly every benefit the technology had to offer a few years ago. A couple of years down the line the financial management company suddenly couldn’t stop talking about bitcoin and this time highlighting its positive attributes. Goldman Sachs also has technical stock and forex analysts watching the market closely and has given investors trading advice in a few market reports. Just recently a lead technical strategist at Goldman, Sheba Jafari, has been plotting charts and predicting price waves for clients. Reports reveal that the company started covering bitcoin markets due to “numerous client requests.”

Image source

Lead technical strategist at Goldman Sachs, Sheba Jafari’s recent bitcoin price predictions.

Returns on Cryptocurrency Have Been Nothing Short of Spectacular

According to Vigna’s report, Goldman’s earnings lately have been waning due to poor trading performance in forex markets. Other news outlets this year have stated; that this past summer Goldman has “lost it’s golden trading touch” as the firm lost 40 percent in revenue compared to the year prior. Many cryptocurrency advocates believe Goldman cannot ignore the money being made within cryptocurrency trading markets.

“The returns on cryptocurrency have been nothing short of spectacular, and we are excited to see mainstream institutions entering this space,” explains Bharath Rao, CEO of Leverj, the decentralized exchange startup for cryptocurrency derivatives. “Among Wall Street firms, Goldman was one of the first to recognize the potential of bitcoin and the blockchain. Realizing crypto would be a significant part of the financial future is one thing; acting on it is another.”

A large financial institution will not jump straight into a market until it has checked the boxes for the necessary operational readiness, regulatory certainty, and technical depth.

Some Bitcoiners Delighted to See Goldman Joining the Bitcoin Environment, While Others Believe the Firm Will Try to Rig the Market

Some people from the bitcoin ‘community’ expressed delight towards Goldman possibly creating a trading operation over social media and forums, while others disliked the news. One individual sarcastically writes, “fantastic, the vampire squid is gonna get its tentacles into this market and rig it to hell, as they have done with most other markets — Watch as I do cartwheels.”

Other speculators believe Goldman is already investing in bitcoin similarly to JP Morgan Securities Ltd., executing buying of bitcoin-based exchange-traded notes for its clients.

What do you think about Goldman Sachs joining the bitcoin trading ecosystem? Let us know in the comments below.

Images via Shutterstock Goldman’s Tower, the Goldman Sachs logo and Bloomberg.

If we open a quarrel between past and present, we shall find that we have lost the future.

- Winston Churchill

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/goldman-sachs-creating-a-new-bitcoin-trading-operation/

For bitcoin to go mainstream we need institutional investors such as Goldman Sachs. Just as we have credits, futures, options, derivatives etc. based on other stores of value, we must have these for bitcoin too.

An entire ecosystem of financial products must be developed around cryptocurrencies. And this can be much faster with powerful institutions like Goldman Sachs.