Bitcoin Cash was born not out of greed, deceit, or opportunism, but rather from the passion of the community who wanted to see Bitcoin continue as peer-to-peer electronic cash.

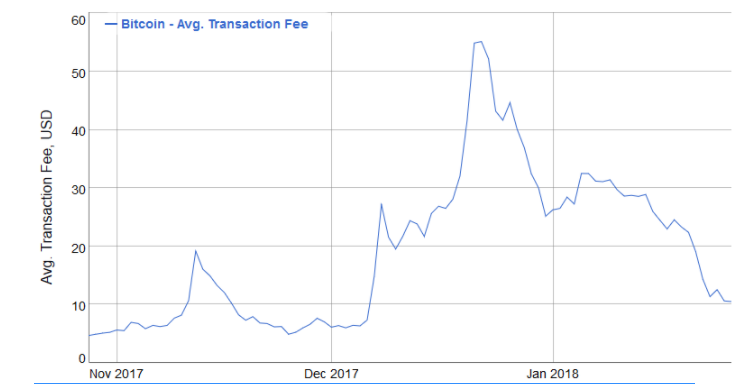

1.Bitcoin is Supposed to Have Low Fees

Bitcoin, from the early days, was touted as a low fee solution to global payments. It would have never gained any traction to begin with had it not been superior in this regard. Satoshi Nakamoto (Bitcoin’s creator) even said, “We should always allow at least some free transactions”.

Bitcoin Core current transaction fees are high by design, as the Core developers intentionally did not allow any meaningful capacity increase — which in turn created a highly competitive “fee market”.

Bitcoin Core current transaction fees are high by design, as the Core developers intentionally did not allow any meaningful capacity increase — which in turn created a highly competitive “fee market”.

2.Bitcoin Should be A Reliable Network

This is directly related to the high fee situation, which stems from the fatal decision to limit Bitcoin’s transaction capacity. Because transaction capacity is limited, you are unlikely to get your transaction included in the next Bitcoin block unless you pay a higher fee than everyone else who is waiting.

It used to be that if your transaction wasn’t included in a block in 72 hours, it would be dropped from the memory pool (“mempool”), and the funds would be sent back to your wallet. However, that waiting period was increased to 2 weeks. That’s right — your funds can be stuck in limbo for 2 weeks and you don’t even know if your transaction will go through.

3.Bitcoin is “A Peer to Peer Electronic Cash System”

When Bitcoin hit the scene, it was so exciting because any individual could send money to anyone on the planet…almost instantly, without high fees, and without permission from anyone.

It was all about Electronic Cash that was cheap, fast, and secure, and it was all about being able to make payments.

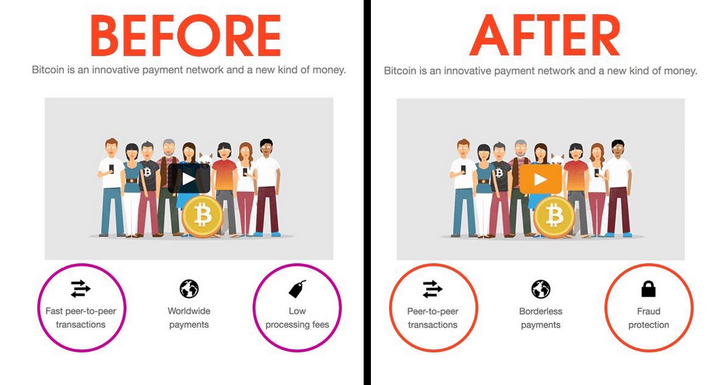

Since transaction fees on BTC have skyrocketed, its supporters have moved away from that narrative. They now say that Bitcoin is instead “digital gold”…and that its main use case is that of a “store of value”.

4.Bitcoin Was Intended to Scale “On-Chain”

Sadly, for BTC, the Core developers never gave on-chain scaling a chance, and took an extremist position against permitting this. Instead, they fear-mongered with the boogeyman of “centralization”.

Only mining nodes secure the Bitcoin network. Most users can run an SPV wallet like Electrum and they will be just fine.

So, instead of allowing scaling to happen on the blockchain itself, the Core team wants to add so-called “second layer solutions” like the Lightning Network.

However, this is an extreme change to Bitcoin’s design. These layers not only add orders of magnitude of complexity, but they also radically change Bitcoin’s security model and economics, which was always based on mining.

5.Bitcoin Should Allow Instant Transactions

A transaction is confirmed once a miner includes it in a block. Transactions not yet included in a block are unconfirmed but are expected to be included in a block soon. The practice of merchants accepting a transaction as valid, even before it is confirmed is known as “0-conf”.

Historically, this has been relatively safe for small to medium sized transactions. However, with a congested network and uncertainty over when (if ever) your transaction will be confirmed, the security and reliability of 0-conf is destroyed.

6.Bitcoin Cash is Gaining Merchants, Bitcoin Core is Losing Them

Bitcoin isn’t a get-rich-quick scheme. Although some people have done well investing in cryptocurrencies, the foundation is about creating a better form of money.

It’s all about growing the Bitcoin economy and that means getting a growing number of merchants to adopt the new payment system.

Because of the high fees and poor user experience, Bitcoin legacy (BTC) has been going backwards and losing merchants. Dell, Microsoft, and Steam are just three examples of prominent merchants that once accepted Bitcoin but stopped because small retail payments simply don’t make economic sense.

7.Bitcoin Was Meant to Bank the Unbanked

Bitcoin is a humanitarian project. It has the possibility to help the billions of people who don’t have access to modern banking. This potential was passionately espoused by evangelists like Andreas Antonopoulos… until Bitcoin’s high fees made that impossible.

People living in third-world countries often live on only a few dollars a day, and certainly can’t afford to pay a $10 fee. However, Bitcoin Cash makes “banking the unbanked” possible once again.

8.Bitcoin Core Development is Centralized

Decentralization is one of the main tenets of Bitcoin. It’s not just decentralization of merchants, users, and miners that’s important… Development should also be decentralized — there shouldn’t be one small group of people dictating how the network should operate.

Yet, that is exactly what has been happening in Bitcoin. A small group, known as the “Core” developers has wielded enormous influence because of their control over the reference code repository.

Although hundreds of individuals have contributed to the project, there is only a tiny handful of people (about 5) that have permission to merge code changes.

The notion that “anyone can contribute” is only true if you accept the reality that all changes must be in line with the approved roadmap or they will not be adopted.

9.Bitcoin Cash Allows Combining and Splitting Value

Satoshi Nakamoto’s original whitepaper has stood the test of time and remains a brilliant encapsulation of the most important technical facets of Bitcoin.

An often overlooked part of the paper is section 9: Combining and Splitting Value. When you spend Bitcoin, you’re usually splitting off a part of an unspent output and sending change back to yourself. And when Bitcoin is received, it is combined if there was more than one output.

This is happening all the time, even though you might not give it much thought. Yet, high Bitcoin fees make combining unspent outputs very expensive. A $10 fee can turn into a $100 fee or worse.

So, the functionality is hampered. The privacy and fungibility of the coin is also compromised as users tiptoe around this problem by minimizing their transactions.

10.Bitcoin Cash is Censorship Resistant

One of the big talking points from Bitcoin Core supporters is that the high fees are worth it because of how “censorship resistant” the Bitcoin blockchain is.

It may be worth it if you are transferring large amounts of capital and can afford to pay the high fees. But for the rest of the world, being priced out of using the blockchain is the quintessence of economic censorship.

A second layer solution, namely the Lightning Network, does not help much. It is inherently susceptible to economic censorship because the network structure will coalesce around large, heavily connected hubs.

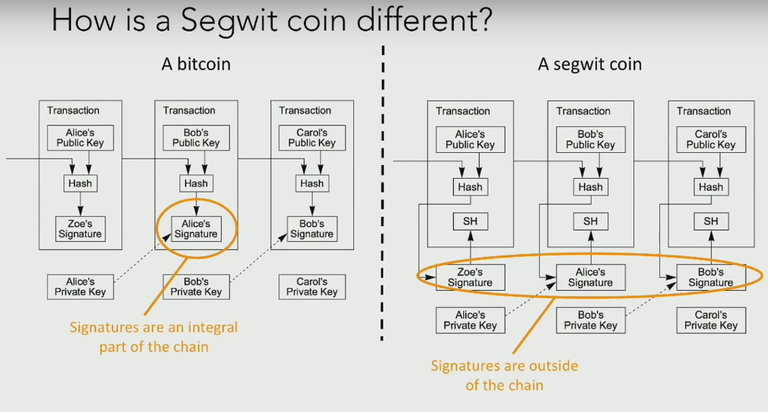

11.A Bitcoin is Defined as a Chain of Digital Signatures

This is the most “technical” reason in this article, so don’t worry if you don’t fully understand it.

You see, Bitcoin Core adopted a proposal known as Segregated Witness, or ‘SegWit’ for short. SegWit took the digital signatures that were part of every transaction, and moved them to a separate part of the blockchain.

In the Bitcoin whitepaper, Satoshi writes: “We define an electronic coin as a chain of digital signatures”. SegWit changes this.

The following diagram illustrates the difference. It comes from Dr. Peter Rizun’s 2017 speech entitled “A SegWit coin is not a Bitcoin”.

Bitcoin Core supporters will rebut this by claiming that the structure is irrelevant, since miners will not accept blocks without valid signatures.

12.Bitcoin Cash Will Allow Smart Contracts

“Money is only the first application of this new technology”, quipped many a Bitcoin pundit during the early years of Bitcoin. But many of the Bitcoin Script operation codes (opcodes) that would have allowed smart contract development have been disabled.

That is why Vitalik Buterin left Bitcoin to create Ethereum. He was essentially told by the Core developers that his ideas and plans were not welcome in Bitcoin. And today, Ethereum dominates as a smart contract platform.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://getbitcoinguide.com/12-reasons-bitcoin-cash-is-the-real-bitcoin/