Bearish Pennants

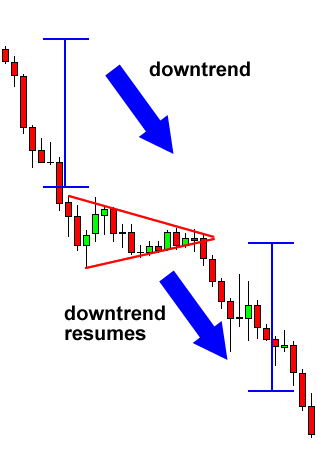

A bearish pennant is formed during a steep, almost vertical, downtrend.

After that sharp drop in price, some sellers close their positions while other sellers decide to join the trend, making the price consolidate for a bit.

.png)

As soon as enough sellers jump in, the price breaks below the bottom of the pennant and continues to move down.

As you can see, the drop resumed after the price made a breakout to the bottom.

To trade this chart pattern, we’d put a short order at the bottom of the pennant with a stop loss above the pennant.

School of Pipsology

Middle School

Important Chart Patterns

Show all lessons

How to Trade Bearish and Bullish Pennants

Partner Center

Find a Broker

Similar to rectangles, pennants are continuation chart patterns formed after strong moves.

After a big upward or downward move, buyers or sellers usually pause to catch their breath before taking the pair further in the same direction.

Because of this, the price usually consolidates and forms a tiny symmetrical triangle, which is called a pennant.

Pennant

While the price is still consolidating, more buyers or sellers usually decide to jump in on the strong move, forcing the price to bust out of the pennant formation.

Bearish Pennants

A bearish pennant is formed during a steep, almost vertical, downtrend.

After that sharp drop in price, some sellers close their positions while other sellers decide to join the trend, making the price consolidate for a bit.

Bearish Pennant

As soon as enough sellers jump in, the price breaks below the bottom of the pennant and continues to move down.

Forex Bearish Pennant Breakdown

As you can see, the drop resumed after the price made a breakout to the bottom.

To trade this chart pattern, we’d put a short order at the bottom of the pennant with a stop loss above the pennant.

That way, we’d be out of the trade right away in case the breakdown was a fake out.

Unlike the other chart patterns wherein the size of the next move is approximately the height of the formation, pennants signal much stronger moves.

Usually, the height of the earlier move (also known as the mast) is used to estimate the size of the breakout move.

Source creadit: https://www.babypips.com/learn/forex/pennants

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.babypips.com/learn/forex/pennants