(Yeah, you’re right. It’s me, Aidan. LoL!)

Hello. This is Aidan.

Some of you might think, "What? Let's find this easy coin more easily?" I am writing this article to make it easier for the general investors who lack of IT knowledge. I'll try to make it as clear as possible. I will replace footnote with parentheses.

- MasterNodes

The APIS coin is a masternode mediation platform.

I'm sure you've heard of MasterNodes while investing in blockchain. But only few people know exactly. A masternode is a way of locking a certain number of coins and receiving a certain percentage of reward.

The benefit of Masternodes is that they are more stable and higher than mining, such as Pow and Pos. Instead, they need more upfront capital than Pow or Pos, and they also need separate computing knowledge.

This huge entry barrier has caused the investment in the masternode to be hesitant.

- Entry barrier of Masternode.

To break down this high entry barrier to the master node, investors often take the ‘Shared method’ of sharing the masternode with a little capital together. However, this has its disadvantages: low reliability, removal and deployment are not free. (Because other people's money is with them) And because I had to buy coins from the market, it took too long.

The capital barrier has been dismantled, but it's technically too complex, and it's limited by the loose contractual problem of building on mutual trust.

- Then what about APIS?

The APIS is breaking down these masternode entry barriers. Even if you're not familiar with Masternodes, Apis Coin allows you to participate in Major Masternodes with just a few clicks. What if it's a major masternode here? I mean such as DASH, PIVX, and SYS.(If ETH is converted to Pos, APIS will also mediate the ETH Pos.)

The team first owns and operates the major masternode. then participants just need to prove their interests on the blockchain.(Using only Apis Coin)

In addition, Apis' C level staff are those who used to work in the financial sector. So, various solutions for inflation, deflation and liquidity problems were also prepared in consideration of financial engineering design.

- What's the difference between APIS' equity participation and General masternode Shared?

The basic concept maybe similar, but the APIS platform is fundamentally different from ‘General Shared’

The APIS platform is a system that works transparently within a blockchain.

But ‘General Shared’ is shown by analog methods. It can look complicated and uncomfortable. And I'm a little bit suspicious of their transparency.

Compared to them, the APIS are a system that runs inside blockchain. If you use the APIS to participate in the Dash Masternodes, you'll see a lot of information at a glance about where my coin was moved and how much my share rate is.

- If ‘Shared’ raise money first and then built Masternode. The APIS set up Masternode first, distribute the rewards according to their respective stake.

- If ‘Shared’ works on analog contracts and mutual trust, The Apis works in a blockchian system that is mathematically irreversible. It's a big difference. (Of course there are terms and conditions!)

- In conclusion.

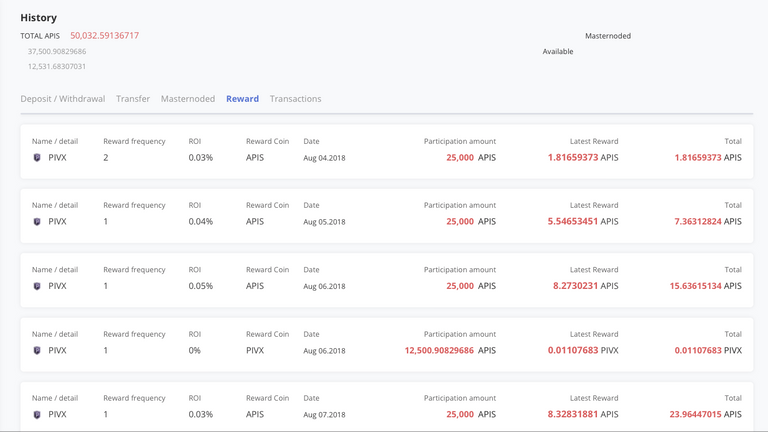

To be honest, it's so good that you might think it's fraudulent and crazy. But a few days ago, a ‘beta platform’ that actually works was launched and is being tested by many ordinary investors. And the results keep coming.

(You can see that reward is actually paid.)

So to sum up, Masternode a big advantage to be able to reliably increase the number of coins, but it's been too difficult to access. APIS solves it by using an irreversible blockchain system and an efficient ecosystem designed by financial workers.

“With only 8 clicks.”