Some of the wealthiest families in Latin America now have access to a new way to invest, thanks in part to a former senior manager at consulting firm Bain & Company.

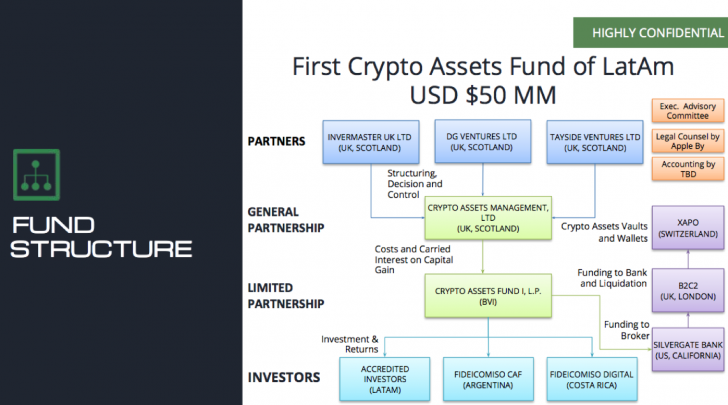

Announced today, the newly formed Crypto Assets Fund, co-founded by former senior manager at Bain, Roberto Ponce Romay, is helping to raise $50m with the purpose of buying cryptocurrencies for family offices. Revealed exclusively to CoinDesk, Crypto Assets Fund (CAF) will invest directly in bitcoin, ether, zcash, ripple, litecoin and dash.

The first tranche of the fund, estimated to be valued about $10m, is in the final stages of closing, and is expected to be announced by the end of this month.

In interview, Romay explained that the purpose of the fund was two-fold. First, it was designed to give investors in some of Latin America’s more unstable economies a new way to hedge their investments, and second, it was meant to provide the opportunity to safely learn about these new stores of value for possible future investments.

According to Romay, as the fund's investors are becoming increasingly familiar with the crypto-asset class, the CAF could eventually raise new funds that also include tokens sold as part of initial coin offerings, or ICOs.

"This fund is investor driven," said Romay, who is now the director of investment banking boutique, Invermaster. "It is a simple strategy to give access."

source: http://www.coindesk.com/former-bain-manager-launches-50-million-bitcoin-ethereum-fund/

nice to see private investors entering the market

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.coindesk.com/former-bain-manager-launches-50-million-bitcoin-ethereum-fund/