Approximate spot prices

Gold: $1,255 per paper ounce

Silver: $16.70 per paper ounce

Bitcoin: $2,500 per coin

The rumor mills are flying in every direction right now as a counterpunch against the deep state appears to be lining up while war tensions rise in Syria. We have whispers that Justice Kennedy will retire from the Supreme Court, a profound development considering the age of the remaining leftist black robes and the potential for the Trump administration to redefine the shape of the Supreme Court for several decades.

Meanwhile, Bernie Sanders appears to be under more FBI investigations than President Trump, Loretta Lynch and Jon Podesta are under scrutiny again, and the light is being shone on various records making their way under executive privilege to the as of yet unbuilt Presidential Library of our former fearless leader from Chicago. Trump supporters don’t yet seem to be tired of winning as more inflammatory rhetoric from mindless elites in Hollywood, establishment politics, and the media lead to further cancellations and dismissals of the psychotic fringe leftists who have taken over the mainline progressive and Democrat platforms.

The murky spot is still the Middle East, and the dynamic there is rendered more challenging by the situation in Europe. I’d encourage everyone to watch the Oliver Stone interviews with Putin if only for the primer on the past few decades of Russian history. This is certainly provocative material, but now is the time to remain vigilant as rhetoric continues to escalate.

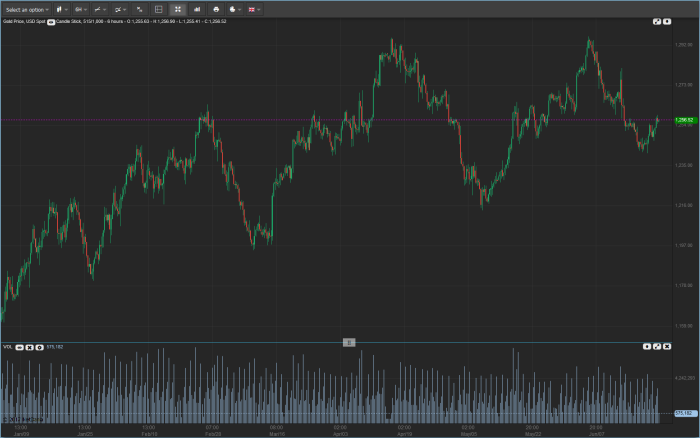

Gold

Casual action in gold over the week as nothing really seemed to move the price. If we do proceed upwards from here then another higher low will be in. The key test will be a break above the $1,300 level. I took a small portion of my gold holdings that I grabbed closer to $1,100 from the post election meltdown off the table in order to establish a position in litecoin and bolster my stack on ethereum. Again, please let me know if you’d like me to add ethereum to my coverage. I’m getting my fancier charts from Bitfinex for the cryptos, so I can be sure to make everything look nice and tidy.

Silver

Keep accumulating silver. If they run it back down below $16.00 I likely won’t be able to resist buying some more. I’m beginning to think that the industrial value of silver is potentially even more important than its monetary functions, but in either case it will be a monster when it gets let out of the manipulation cage. After being bullied for so long, one can only imagine how it will react to the destruction of its shackles.

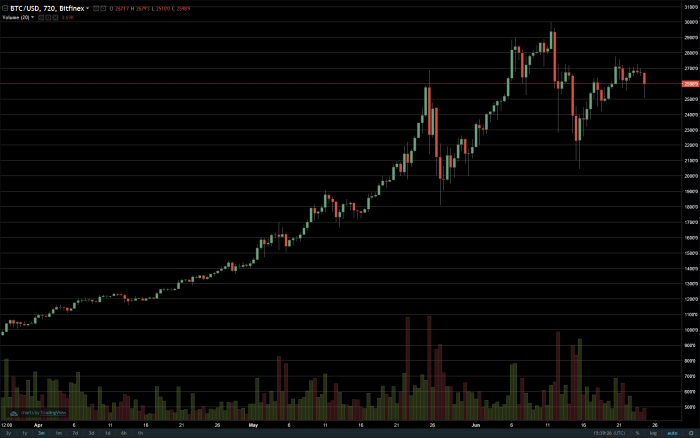

Bitcoin

This screenshot is a bit old as bitcoin is now trading back towards $2,500 as I type. There appear to be some additional jitters about the upcoming user activated soft fork (that’s what UASF means in case you see that somewhere). At least that’s the story that’s being floated. Perhaps the ethereum flash crash also spooked some people. Be careful with your stop orders folks. There’s a lot of slippage, volatility, and clunkiness from the exchanges at the moment. If you’d like more information about the upcoming fork and a secure way to set up cold (offline) storage check out the following websites:

https://www.weusecoins.com/uasf-guide/ (Warning: Technical)

https://glacierprotocol.org/ (Warning: Long)

Full disclosure: I use paper wallets distributed in many secure locations rather than the full Glacier Protocol because I’m not housing crazy amounts of cryptocurrencies. If you have more questions about this area please send me an email at [email protected].

The bitcoin band looks like $2,000 to $3,000, but in general any major dips should and will be bought. If you’re just getting into any of these spaces the advice is simple. Don’t worry about the price: simply dollar cost average by putting a predetermined fraction of what you would save every month into the precious metals and cryptocurrencies. Instead of saving in a dying asset (fiat dollar), you can, should, and must save in instruments that will actually preserve purchasing power through the transition into a new paradigm.

The crack up boom / hyperinflation scenarios now look more likely than they once were, but keep in mind that the Dow to go either to 0 or to 100,000. We are in bizarre times, and your best bet is to gradually move into the real money lifeboats. The rest is a consideration of timing and magnitude. I don’t play in those cesspools anymore except for some additional mining stocks held passively.

Now is the time to learn and position appropriately!

Read a good book on the blockchain: https://www.amazon.com/Blockchain-Revolution-Technology-Changing-Business/dp/1101980133

Conclusion

There is no excuse for being lazy.

Disclaimer: These are one amateur’s fallible opinions. Holding any asset is risky, so do your own research and make your own investment decisions.

thanks for sharing fam , im new to crypto , soaking up as many info i can get my hands on :)

New but not too late! Definitely look into paper wallets, dollar cost averaging, and the Blockchain Revolution book.

thanks will do my friend

Upvoted!

Thanks for the support!