Hello everyone... Today I want to write about BANKERA - Bank For The Digital Era

The birth of Blockhain has enabled us to digitalize money via cryptocurrencies, there have been many attempts to apply Blockchain technology to revolutionize other financial sectors. However, so far most FinTech companies have been focusing only on a certain niche (e.g. remittances or lending) and cannot take advantage of economies of scale. Which is one of the main advantages enjoyed by traditional banks that may not be as technologically advanced.

BANKERA plans to achieve the scale to offer traditional and emerging banking products in a technology driven Blockchain era environment, eventually becoming the one-stop shop for all banking requirements. Bankera has the necessary regulatory and IT arrangements to offer individual international bank account numbers (IBAN) which can accept and make payments in the Single Euro Payments Area (SEPA).

BANKERA is building a digital bank to last, the focus will be on the scale, elimination of counterparties and offering core banking services such as savings and loans accounts and Bankera also plans to be a member of key financial networks, such as achieving issuer and acquirer status with major payment card schemes as well as becoming a participant in payment networks such as SEPA in EU, Faster Payments in the United Kingdom and EFT in Canada.

In addition to traditional banking products, Bankera will be providing innovative solutions for both individual customers and businesses alike, in a low-cost banking environment, for example:

- For businesses, Bankera will improve cash flow by extending finance for payment processing against future expected payments, based on historical cash flows and expected payments.

- For individuals, Bankera will address the age-old problem of client’s savings not keeping up with inflation by creating an investment product linked to a basket of goods that automatically adjusts with inflation.

To achieve these objectives, Bankera as a company is to be set up and an initial coin offering (ICO) will be conducted. The offering will be a virtual currency tokens known as a“Bankers” (BNK). Now, Bankera is launching an initial coin offering, which starts on November 27th on the SpectroCoin platform. The offering will be virtual currency-tokens known as Bankers (BNK). Bankera already have a minimum viable product (MVP) via SpectroCoin, so you can already try out the services and products.!

Bankers (BNK) TOKENS

Bankers (BNK) will be issued in exchange for a number of cryptocurrencies based on the smart contract. Token holders will be able to use Bankers (BNK) to pay for services and products of Bankera at a discounted rate. Also they will be allocated a commission of 20% of net transaction fees paid by Bankera and SpectroCoin customers on a weekly basis.

Net transaction revenue represents the difference between transaction fees paid by customers less direct costs associated with the transaction. For example, if Bankera’s client’s exchange 100M EUR to foreign currencies in a week with an average fee of 0.25% and Bankera faces an average fee of 0.1% the average net transaction revenue will be 0.15%, hence token holders will be allocated 30,000 EUR as a commission from foreign currency exchange net fees during that week. Allocated commissions will be distributed via smart contract to holders of Banker (BNK) tokens.

- What is the minimum BNK purchase during the ICO?

There’s no minimum amount, everyone is welcome! - What is the SOFTCAP and HARDCAP for the ICO?

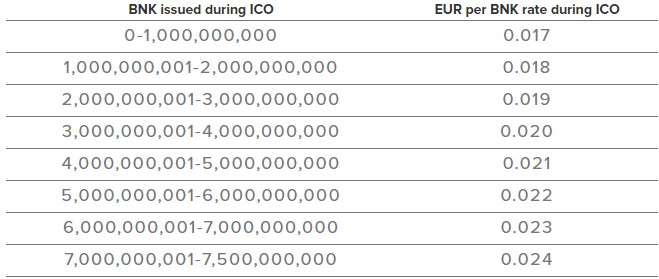

The HARDCAP for Bankera's ICO is 7,500,000,000 BNK worth 152M EUR. Bankera will also have SOFTCAPS during the ICO – after each 1,000,000,000 BNK sold, the price will increase by 0,001 EUR. - What is the Bankera token price during the ICO?

The starting price of 0,017 EUR per BNK token was set during the pre-ICO. The Bankera token price during the ICO will depend on the number of tokens issued, according to the table bellow:

- What will happen with BNK tokens if they are not sold?

If Bankera do not sell all 7,500,000,000 BNK tokens during the ICO, the remainder will be distributed pro-rata to pre-ICO and ICO token holders. For example, if 90% of the BNK tokens are sold by the ICO end date, the remaining 10% will be proportionally allocated to contributors of the pre-ICO and ICO. - Will BNK tokens be placed on any big exchange platforms?

Yes, BNK tokens will be listed on SpectroCoin from day one, and it will be listed on other exchanges later on. - What do contributors of Bankera's ICO get?

20% of the net transactional revenue share is paid weekly to BNK token holders. You can find detailed summaries of each weekly commission on Bankera blog! Also, BNK tokens will be accepted as payment for Bankera services at a discounted rate. For example, you will be able to cover your monthly card fees with your BNKs.

The Team and Advisors

For more details and to read the white paper, visit the Bankera’s official website.