Since this month more and more institutional investors announced that they will start trading Bitcoin or share their bullish perspective with the rest of the world. More big names seem to understand the huge potential of Bitcoin and bankers are making a turnaround from Bitcoin is a bubble to being investor. Since there will never be more than 21 million Bitcoins, investors will have to raise their bids to be able to buy and this will push the price.

the tsunami of institutional money will create an imbalance in supply and demand that we have never seen before.

Bitcoin is unique in it’s limited supply.

For every single asset on earth the supply will be increased when the price goes up. More oil will be drilled when the oil price goes up, more gold will be minted when the gold price goes up and we all know the story of fiat money and paper assets……

Bitcoin follows a very strict supply schedule that is predictable and decreasing over time. When the Bitcoin price goes up there will not be more Bitcoins created, but the security level will increase because of the extra hashing power to be added to the network. This doesn't decrease the value but increase it instead.

I think this is the reason why investors are positively surprised by the gains of Bitcoin in the past and will be in the future too. Investors calculate with measures we know from other assets, but the way Bitcoin works is new and still unknown by many.

There are many signs the institutional money wants to enter NOW

There are many signs that investors with serious money want to come in now, and I don’t blame them, it could be the best time ever. Of course a few years earlier would be better, but my point is that the relative price is extremely low now, we haven’t seen a bigger undervaluation often. Here some obvious signs:

Multi-billionaires show interest

Extremely rich people like Soros and the Rockefellers have announced to start trading cryptocurrencies. I don’t like them at all, I would rather see ‘normal’ people come in before them, but it is a fact that they could literary blow up the Bitcoin price.

Institutional investors are extremely bullish

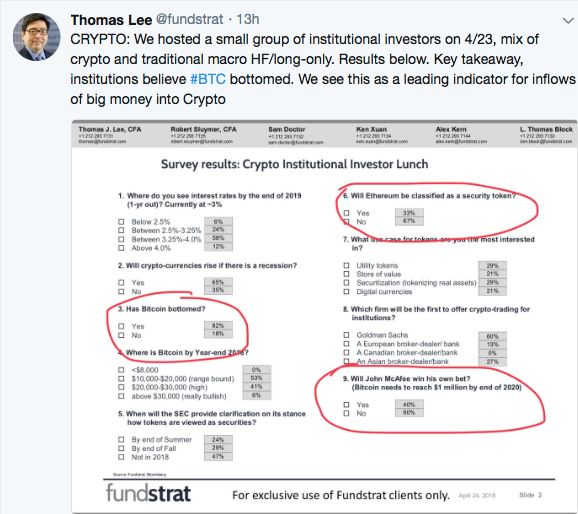

This one is big: Fundstrat CEO Tommy Lee did a survey among institutional investors and the outcome was that 82% expected that the bottom was in and 40% expected the Bitcoin price to hit a million dollars at the end of 2020 as predicted by John McAfee. This means that the people who manage huge amounts of money are extremely bullish and will probably be buyers at this moment!

Big names make huge predictions

Also more big names are coming out with extremely bullish predictions:

Tim Draper

Tim Draper said recently that he expect Bitcoin to be bigger than the internet and in a few years people will laugh at you when you use fiat. Furthermore, his Bitcoin investment will be the best one among all his investments he said. Tim Draper was very close when he predicted a bitcoin price of 10k for 2017 in 2014. Today he is predicting 250k for 2022.

https://crypto.samnews.net/bitcoin-bigger-internet-billionaire-investor-tim-draper/

John Pfeffer thinks Bitcoin will replace gold

John Pfeffer said in a speech that Bitcoin is better than gold on every front and even could replace it. He said that when Bitcoin takes 25% of the foreign reserves the market cap of Bitcoin would be 6.4 trillion. This equals a price of around 350k.

http://www.globalcryptopress.com/2018/04/john-pfeffer-speech-at-investment.html

Many financial firms want to enter

http://bitcoinist.com/hell-will-break-loose-1-5-financial-firms-ready-enter-crypto-market/

Conclusion

The currently low valuation in combination with the limited supply and a lot of money ready to flow in simply have to cause the Bitcoin price to take off. Of course this can be delayed when a successful attack takes place or the sentiment changes suddenly, but long term it will be likely the best investment ever and the short term looks now bullish too!

Disclaimer

This is no financial advice, just my view on the market.