I agree Roy Sebag has some myopia, but he is correct that gold does not abuse the world’s energy opportunity cost. He is also correct that Bitcoin is heavy, and that is why most of us will be kicked off. But also as mining devices become more efficient (due to Moore’s law), then crypto mining becomes exponentially lighter. His choice of Bitcoin units for doing his calculations is arbitrary. Why not use Satoshis? Also he neglects that the mass of Bitcoin is not physically attached to the tokens. Obviously he is only focused on the store-of-value form of money, which is typically distinct from the medium-of-exchange and unit-of-account, so he is not incorrect to focus there since Bitcoin is also only a store-of-value.

I think BTC will go much, much higher in price before it will become extremely problematic to exchange in the real economy. But eventually Bitcoin will be a trap. It will either become nearly impossible to exchange it for anything other than maybe illicit gold. And btw, gold that does not have a traceable serial number (i.e. you must have kept it stored in compliant vault during your ownership of it) and for which you thus can not prove “proof of source of funds” will also likely become impossible to exchange for anything because it can’t be provably not hiding Bitcoin proceeds. This is how clever the bankster’s Bitcoin plan is. Bitcoin taints decentralized physical gold as well.

Circa 2010 I wrote in a blog End Game, Gold Investors Will be Destroyed:

Gold investors (myself included) are trapped at the end game, and they do not even realize it yet. No physical confiscation is needed to wipeout the gold hoarders. It is much simpler than that. At the end game, the gold investors will throw their gold into the streets willingly (or bury in ground forever). The physical gold will be useless. You don't think so? I will prove it.

The blackmarket (barter) market will die in the end game. I will prove it.

The current and future timeline:

1) Sovereign nations are socializing the debt defaults, which is parabolically accelerating the negative direction of already negative real interest rates. Politically and mathematically this can not stop until the fiat system has died (irregardless of any media circus about austerity).

3) […] As we push to hyper-inflation, defacto interest rates will go skyhigh (if not to infinity, meaning credit not offered) for the private sector, because no one wants to loan money during hyper-inflation (not even offer net 30 terms for wholesale), while the public sector can continue to print fiat to buy its own debt at low interest rates, causing fiat to lose more value relative gold+silver (gold+silver price to go up and up). The stampede away from this fiat deathstar […] is hyper-inflation. Analysts are fooled by the low sovereign bonds rates, and they need to be focusing on the reality that private sector interest rates are skyrocketing.

4) #3 is armageddon, because the modern economy can not function without debt. The hyper-inflation is a market driven mark-to-market gauntlet, that will reveal that most of the private sector has a negative networth. Since the hyper-inflation will inflate away the value of the debts, the networth of the private sector will not be negative, but rather near 0. However, money is not capital, and so much human potential, aka capital, will have been destroyed (bad investments, wasted time, old age, misdirected education, etc), that there will be negative capital balance for the private sector. Hyper-inflation is a reset of the economy in favor of the banksters

5) However, there is a group of elite […]Their plan is obvious, because you can safely assume they were not allowing us to buy

gold+silver[Bitcoin] without a plan to prevent us from competing with them at the end game. When the world is wallowing in shortages and starvation due to #4, the elite will bring out a newgold-backed[Bitcoin-backed] currency […] This new currency will be a great relief to the armageddon, because it will enable the private sector to make loans again

This will start to bring the interest rates down from their very high (nearly infinity) levels […] Those of us holding

gold+silver[Bitcoin], will have huge capital gains from the former hyper-inflation, and we will have no way to avoid paying those taxes in order to get some of this new currency, because the new currency will require proof of the price paid […] This new currency will effortlessly destroy the black (barter) market. Let me explain why. The new currency bonds will be offering very high real, after tax interest rates, and these gains (say 20+% per year, if not much much higher) will be accrued in redeemableto gold[in this Bitcoin-backed currency]! So it will be preferable [and only legally allowed for most of us] to hold the currency bonds, than to hold physicalgold[Bitcoin]. So who would have an incentive to use the blackmarket in physical~~ gold~~[Bitcoin]? The buyers (private sector-at-large) will have 0 networth, so they can only pay in the new currency which they have borrowed, so they can not participate in the black market. Wegold+silver[Bitcoin] investors will want to trade for something we need, and that will be difficult because the sellers of products will want the new currency, because everyone will want to buy the very high yielding new currency bonds, and because without reportable sales, a business won't be able to get a loan to expand and grow.Gold+silver[Bitcoin] holders will be trapped, either they will pay the tax to convert to new currency, or sit on their gold forever (until the new world order fails and elite lose all their power and gold).

Someone wrote to me:

Again, there is no way, IMO, that electricity use by the BTC system would ever rise to a dominant position.

Then you are effectively arguing that Bitcoin can not continue to rise in price to a sustained $1 million per BTC. Obviously as Bitcoin electric consumption reaches 30% of world’s supply perhaps before 2024, some jurisdictions are going to start rationing/restricting electricity use. But this will increase the profit margins for those miners who can access electricity, meaning for example higher priced electricity in other jurisdictions would become more profitable. Obviously the Bitcoin price appreciation will start to run into additional friction as Bitcoin starts to consume a significant portion of the world’s electricity. So valuation increases may slow down, but I doubt that it will stop. The opportunity cost is too great. So I expect Bitcoin to consume more than 50% of world’s electrical supply before 2032.

Someone wrote to me:

But is it evil?

It is clearly a weapon poised to strike at the heart of our current debt driven inflationary system but that system is clearly flawed and evil.

It will facilitate the rise of global government but that too would happen anyway with or without bitcoin.

So to evaluate its effects you need to look at what would global government and finance have looked like without bitcoin vs what it will be forced become now that bitcoin exists.

Similarly you have to evaluate if the global government formed in the forge of sound money and disciplined by BTC would be superior more honest ethical and long lasting then a government formed by the trajectory of fiat driven currency and debt in a hypothetical world were nothing like bitcoin was ever invented.

Finally if and unfortunately more probably when that global government goes bad hopefully far far into the future you have to model how bitcoin would function as a escape hatch and money not for the world but for the minority exiled from the world and under the pressure of relentless persecution.

I don’t know the answers to all those questions but I am not at all convinced that bitcoin is evil. In fact I tend to think of it more as a bitter but necessary medicine but I am keeping an open mind on the topic.

I’m not claiming that the creation of Bitcoin and what that spawned is evil. The idolization of a 21 million coin limit without ongoing non-shrinking level of debasement — which would otherwise limit the S/F ratio and limit the electrical consumption, valuation gains and provide a stable value analogous to physical gold — was probably necessary to create the critical mass for the cryptocosm sector and to start the ball rolling on these changes to the world’s order.

I’m claiming it’s evil (if you claim to be moral and follow the Bible) to continue hodling such Bitcoins knowing what you know now about the S/F model and how Bitcoin is designed to be more greedy than gold and attempt to sequester an unlimited amount of electricity. The pushback against this will be much more totalitarian than if Bitcoin had been designed to stabilize at some fixed S/F ratio similar to gold. The (obviously intentional) design error is that Bitcoin doesn’t self-limit its electrical usage because the higher the S/F ratio, the higher the valuation (thus the more electrical consumption) and Bitcoin was designed to halve the flow until it ceases in 2141. Then transaction fees will fund the mining. The problem is that Bitcoin aims for too high of a valuation. It wants to be the sole metric of value in the world and sequester all capital into itself. That is too excessive and will stimulate a massively totalitarian response by the people and nations of the world.

An inflationary money system is absolutely necessary for human prosperity. And the nations (and world government) will still be providing one. The ying yang is that gold should be available to humanity as a hedge against top-down abuse of those inflationary systems by the banksters. But realize the banksters are the only ones who will be profiting on Bitcoin in the end, because they will make sure the totalitarianism does not apply to them. How can you possibly think such an outcome is not evil?

Bitcoin is not sound money! That is the entire reason I cited Roy Sebag despite some errors in his argumentation. Bitcoin is a thief in the night! Sound money like gold must be sustainable and not attempt to extract guaranteed usury (e.g. 78% annually compounded) by sequestering all the world’s energy opportunity cost.

Why are you only considering Bitcoin as a hedge? What about other altcoins that might be designed to not be as evil as Bitcoin, as I have suggested the design details for this blog and comments? What about physical gold?

You are not convinced Bitcoin is evil? Are you even paying attention to all the details? Seems you must be missing some of what is my head. What I have failed to write down in this very extensive blog and comments?

That someone wrote again:

Remember that @anonymint is talking about something that is still decades off assuming it plays out exactly as predicted.

I assume your longer timeline is because you presume that world government must form before selling/spending cryptocurrencies and physical gold will become politically problematic.

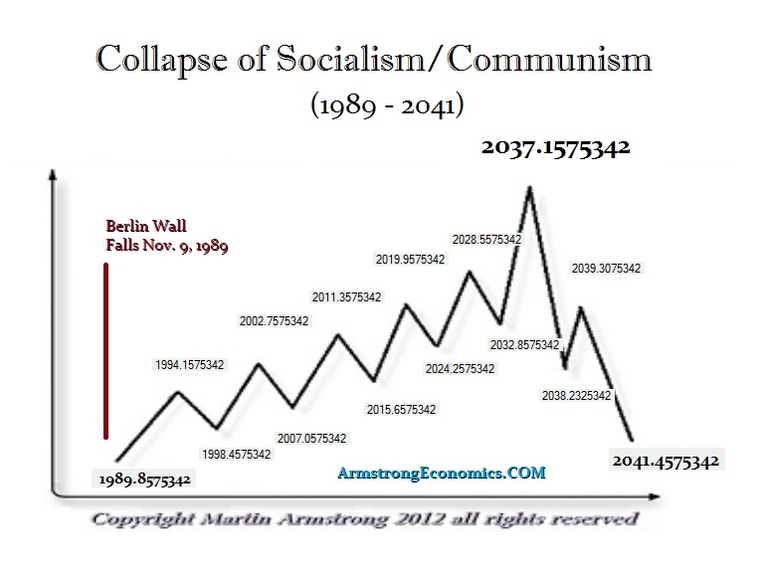

I disagree. Political pressure can start as soon as 2024, when presumably the Leftists will oust Trump in the USA, because we will have been in a couple of years of stagflation by then already:

And by 2024 presuming the BTC price is 10X higher than $20k by then, Bitcoin could be consuming 30% of the world’s electricity.

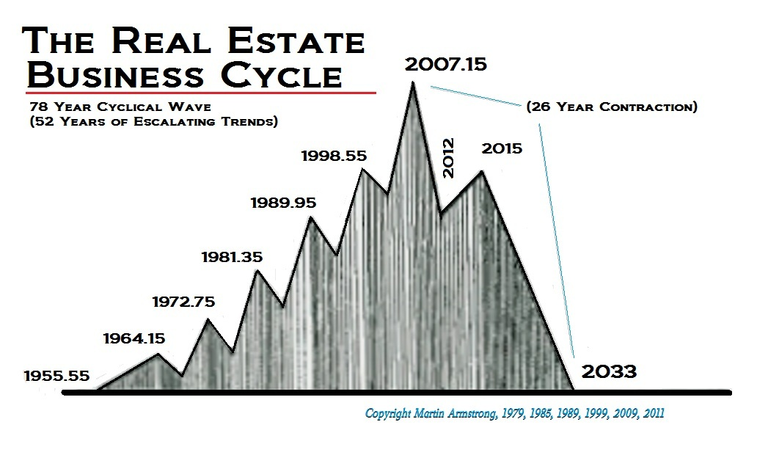

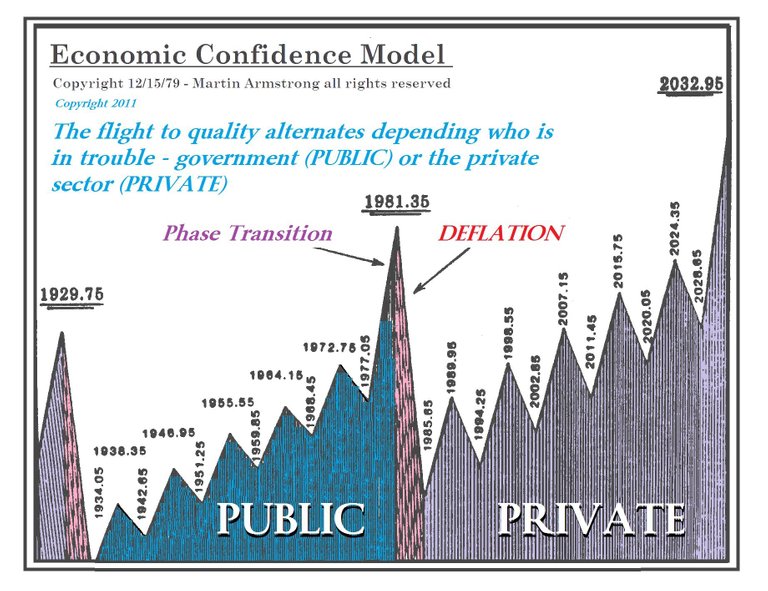

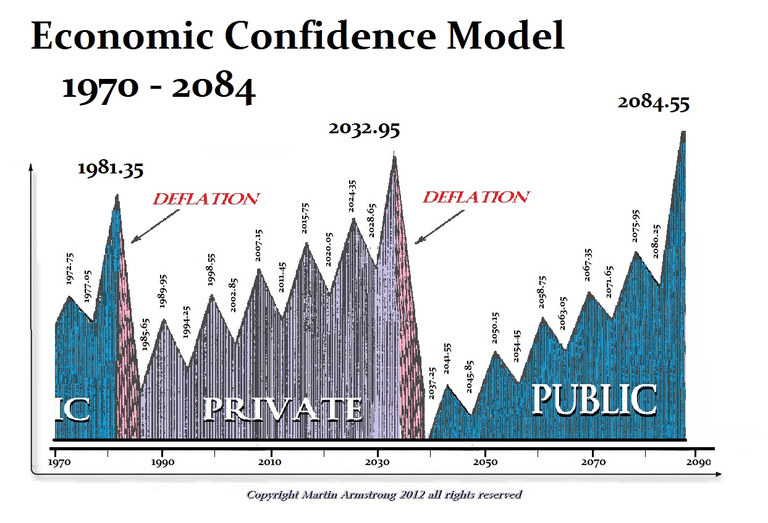

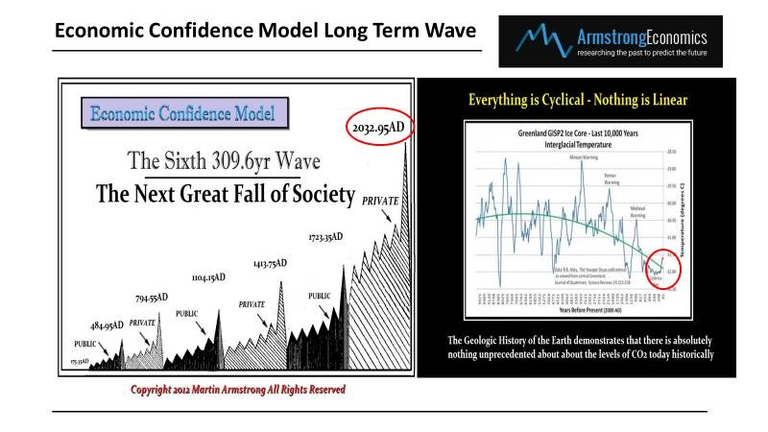

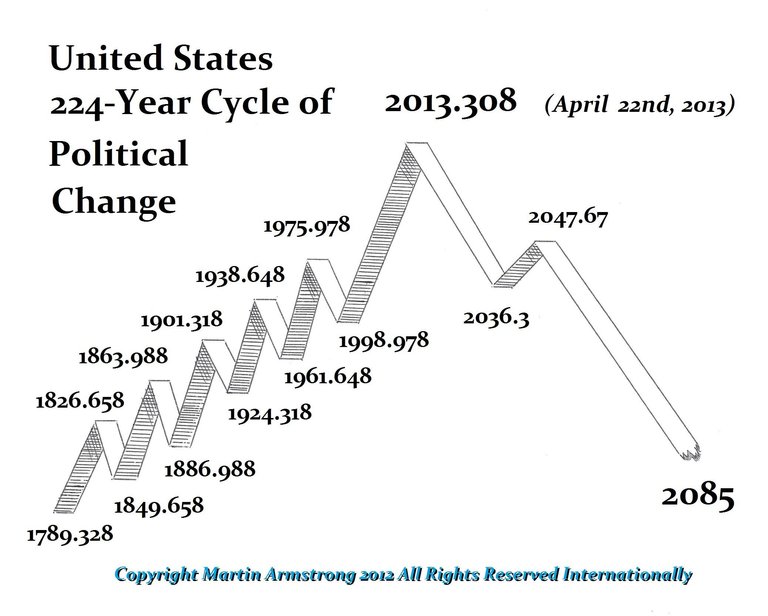

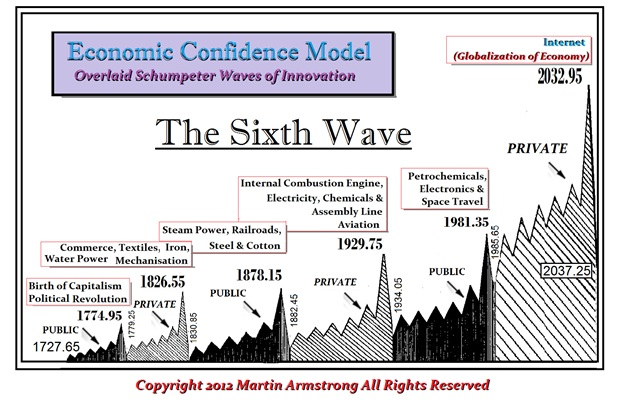

From 2024 – 2028 will be period of increasing “public” (i.e. government) control (which corresponds with the timing of another cryptowinter):

From 2028 to 2032 will be a monumentous crescendo of the move away from governments towards private assets, so presumably Bitcoin could be consuming perhaps 50 – 80+% of the world’s electricity by 2032:

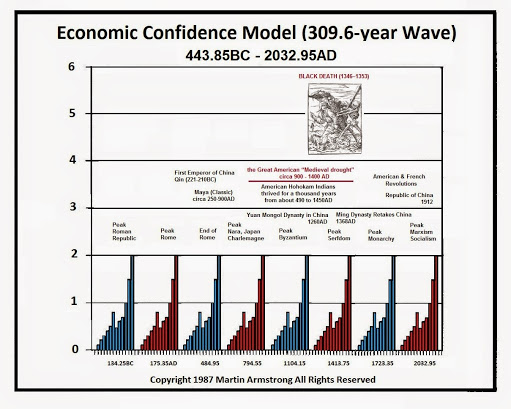

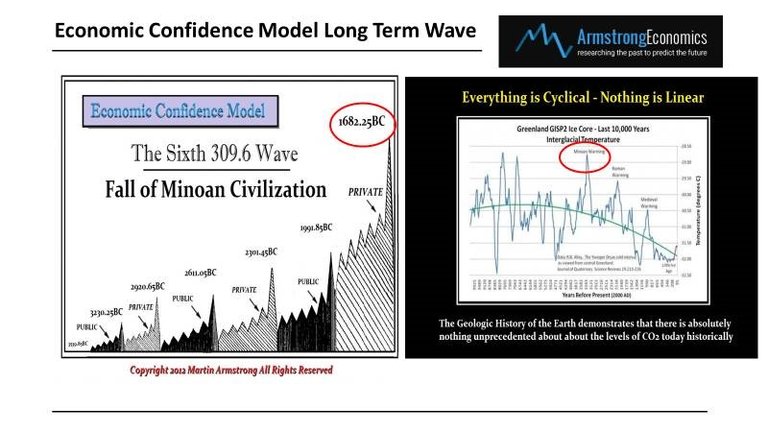

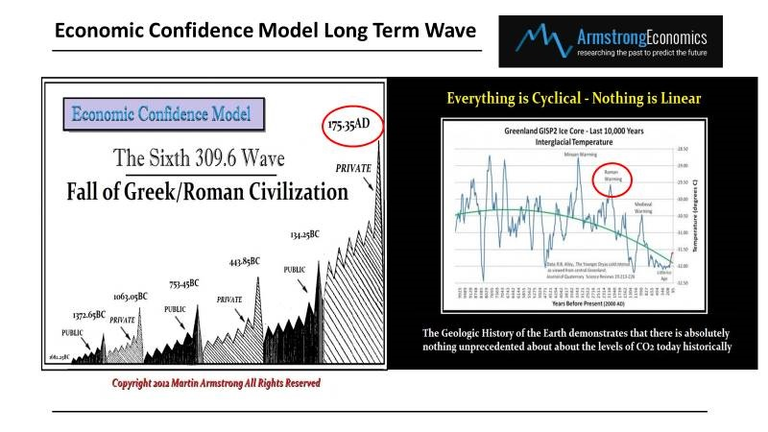

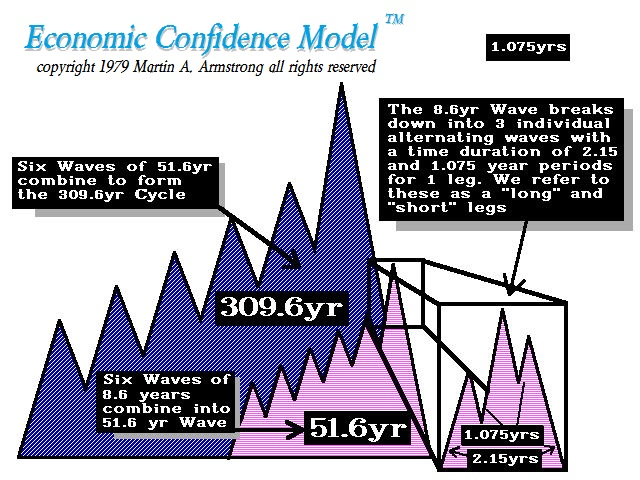

Note above that Armstrong’s model above predicted in advance April 22, 2013, which was the date Snowden made his final move from which he could no longer back-out of whistle blowing on the NSA. Thus the decline of the USA will likely involve a police state and totalitarianism.

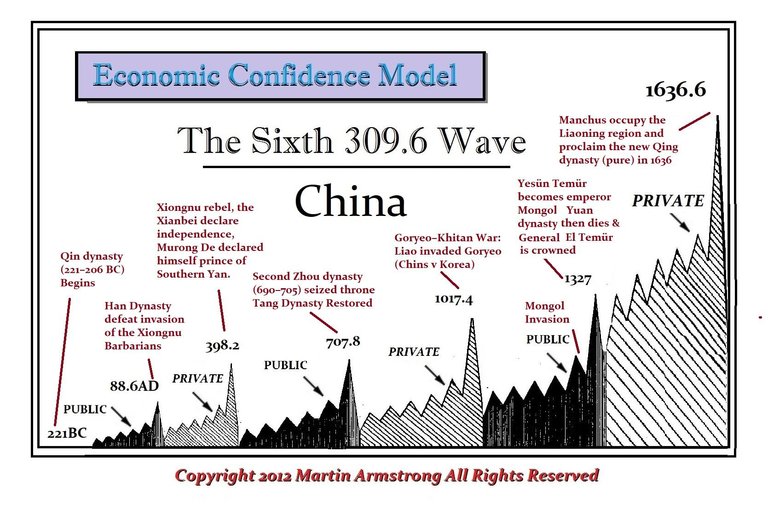

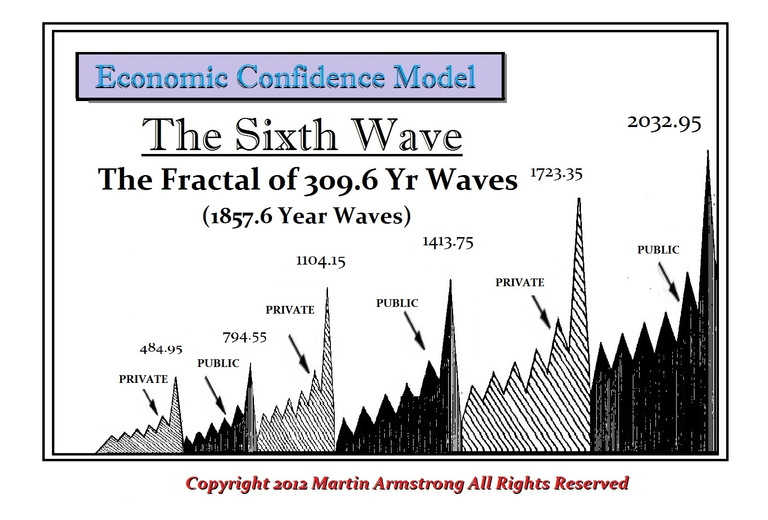

Note the 666 in the 6 waves of the 309.6 year wave (8.6 × 6 × 6 × 6).

The massive deflation after 2032 entails totalitarian government control on a wide-scale. Not necessarily world government, but very intense capital controls by national governments and alliances of them (as they try in vain to arrest Bitcoin’s march, which will eventually force them to turn to a world government solution).

Also as long as you have proof of funds you will be fine selling BTC and taking the tax hit for the foreseeable future.

You might even be able to sell and only pay tax even as late as perhaps 2028, but the clawbacks after 2032 can come even if you did show “proof of funds” and paid your taxes. Being at all associated with (what the politics will characterize as) “ill-gotten gains” is going to be a problem when society will desperately hate the wealthy that stole everything and ran away into private assets.

Rather I assert that any significant wealth gained from the appreciation of private assets is going to confiscated even ex post facto a decade hence. We are headed into a dystopian world.

Officially recorded “ill-gotten gains” could be an albatross. Trusting society at the juncture where it will turn insane, seems not very astute to me.

If Bitcoin wasn’t going to consume 50% of the world’s electricity by 2032, I would give some odds to your stance. But I just don’t fathom how the world won’t fight back quickly to a massive stagflation (due to rising interest rates) with this poster boy Bitcoin to blame their frustrations on. Besides before the government gets their claws on BTC profiteers who dutifully report gains, perhaps they’ll be extorted or tortured, if IRS is “hacked” (in the way that Rothschild arranged the hacking of Hillary’s emails).

I suggest reading the verse in Revelation about putting salve on the eyes so one can see more clearly. Profiting on the enslavement of humanity never works out well, except for those at the very top.

Being right but far too early is often just as bad as being wrong.

Tell that to the Jews in Europe in the 1930s. Who by the way had “ill-gotten gains”.

There's much to digest here. Brings back some things that I haven't thought about in years (secondary intentionality that Robert Schmidt used to talk about) and Bacon's insistence that nature had to be tortured to release its secrets.