Hello! This is my first post on Steemit.

Everybody likes conspiracy theories, almost everything. Though, someone will decide that this post is not a theory. But I still want to share some observations with you.

For the past few years, the Chinese authorities have been struggling with the outflow of capital from the country. As of the end of 2016, $725 billion had been withdrawn from the country and, in 2017, the outflow could increase if United States companies, which were decent in China, would face political pressure to repatriate profits. Briefly explain what it means to those who didn't hear about it.

American companies hold a lot of revenue overseas where it will not need to pay the 35% corporate tax. However, Donald Trump wants to return part of the profit home. He suggested that the repatriation of earnings-kind tax holidays: earned abroad revenue, which will return to the USA, will impose a tax only once, and then at a rate of 10%. $20 billion of profits in offshore companies will have to pay $2 billion, but it's still better than the $7 billion that they would have to pay corporate tax.

And this is a further blow to the yuan. You need to understand that the people's Bank of China (PBOC) maintains the yuan at a certain price range and, if necessary, spend their reserves and artificially strengthens the exchange rate. Let's see a devaluation of the Yuan on the chart.

But to sense from it a little. Money continues displays, the PBOC spent more than $1 trillion to maintain the course, and all in vain. You need to find other ways. And the Chinese monetary authorities find them.

From 1 January in the country stricter controls over the purchase by citizens of the country foreign exchange. Now the Chinese are willing to exchange yuan will have to provide additional information both about yourself and about the origin of money.

But here, residents of China have found a way out. Came to the aid of Bitcoin and other cryptocurrencies. On this wave of growing volumes on the Chinese exchanges, and then the exchange rate for bitcoin.

At the end of January, the people's Bank of China has started checking the Shanghai Bourse BTCC and the Beijing OKCoin and Huobi. That's what said monetary authorities of China: "These exchanges allow violations since participated in margin financing, which added to the abnormal volatility in the market. Checks also showed that these exchanges there is no control over money-laundering, which would meet international requirements."

And after all this backstory, let's get down to ICO EOS. The Chinese are always looking for new ways to withdraw capital from the country, and the monetary authorities cover the old holes. And now look at the time frame for ICO EOS. It stretched for a whole year! What could be better? Imagine You need to quietly withdraw from China, a very large sum of money. How to be? It's very simple! Can the whole year to buy the EOS, tokens, transfer them to the exchange and cash out. Indirectly this idea is confirmed by the trading volumes.

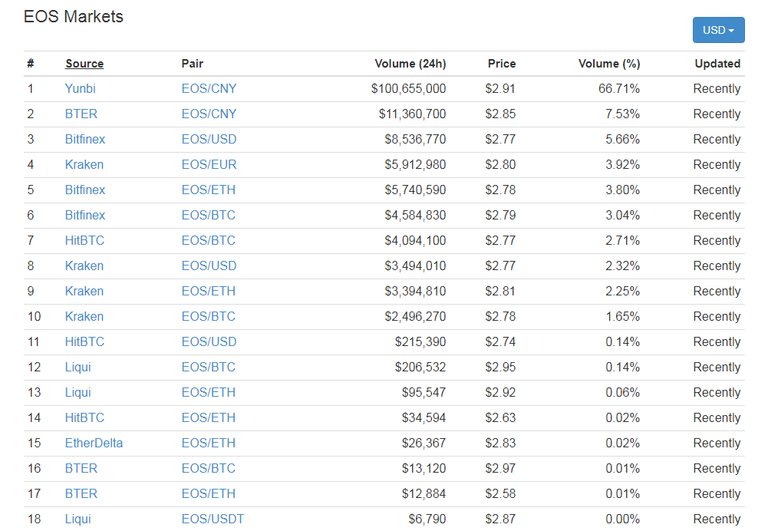

According to the site coinmarketcap.com almost 67% of the volume of trades in the EOS token is in the Chinese cryptocurrency exchange Yunbi.

As I said, after the above, ICO EOS is simply a great tool for capital withdrawal from China. What do you think? Is there any logic in it, or is it just a coincidence?

I apologize for my English. It's not my native language.

super