One of the most important things analyzing the economy and the markets is to wonder what is the liquidity tide direction. Liquidity is the ease of liquidating an asset, a product or a service. By liquidating I mean transforming into money.

There are times in which new money is flowing into the economy. This means the liquidity tide is rising. Expectations of rising prices due to the new money accelerate the rate of inflow as businessmen and speculators take loans to leverage their business.

The Liquidity Tide has been toggled in 2015

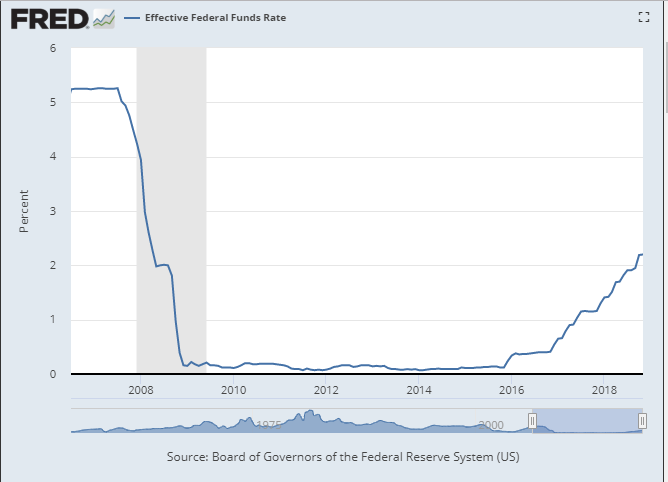

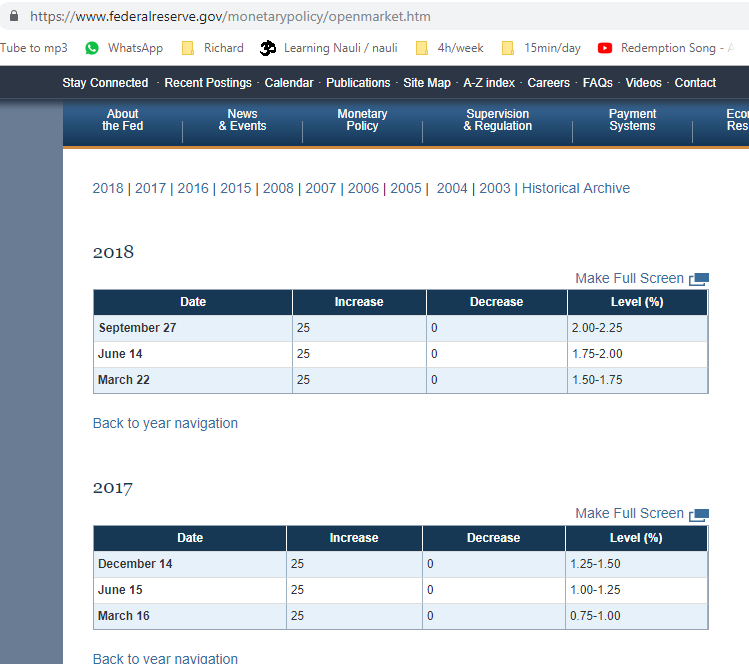

Since December 2015, after 6 years near the zero level, the interest rates have risen to 2-2.25% and will probably be risen again this week. To be announced on December 19th

According to google the last fed meeting did not raise the rates but highlighted the positive situation in the labor market and inflation rate.

These comments are clues for a rate rise that would reinforce the falling liquidity tide.

The liquidity tide is first felt in the safest markets: the bonds. As investors can't get enough yield from bonds they move from the bond market to the stock market seeking capital growth. The change comes at the cost of higher risk.

We can see how bonds have toped in summer 2016 . While the stock market and other risky assets like cryptocurrencies have soared by draining the abundant liquidity of the bond market.

Both stocks and bitcoin have soared from the 2015 fall to the winter starting in December 2017 (See yellow background on charts). The prices of these assets have been rising not because of a rise in intrinsic value but in a speculative manner. It is not that the corporations have not increased their profits since 2015. But the increase has been mild and would not justify the rising in stock prices.

The same for bitcoin, there has been an increase in adoption and it has been the main medium of financing blockchain related startups. But the system is still far from the expectations that have been put on it a lot of development and learning curve adoption has to occur before the intrinsic value really rises to the highest level it reached close to 20000$/BTC.

An ending liquidity tide is often characterized by bubbles popping, like the cryptocurrency bubble. Bitcoin has lost more than 80% from its top and Ethereum has lost more than 90%.

The stock market has only lost 10% from its market top and counting with the rise in interest rates next week the stock market should be slumping in 2019. It is difficult to estimate how much and for how long but chances are that the drop will range from 60 to 95% from top depending on the index. And that the duration of the bear market will be longer than last time as the central banks do not have as much room for maneuver as last crisis in 2008 when the fed funds was twice the current rate.

Please feel free to let your comments, questions or suggestions below.

Congratulations @attiecyril! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @attiecyril! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Thank you so much for sharing this amazing post with us!

Have you heard about Partiko? It’s a really convenient mobile app for Steem! With Partiko, you can easily see what’s going on in the Steem community, make posts and comments (no beneficiary cut forever!), and always stayed connected with your followers via push notification!

Partiko also rewards you with Partiko Points (3000 Partiko Point bonus when you first use it!), and Partiko Points can be converted into Steem tokens. You can earn Partiko Points easily by making posts and comments using Partiko.

We also noticed that your Steem Power is low. We will be very happy to delegate 15 Steem Power to you once you have made a post using Partiko! With more Steem Power, you can make more posts and comments, and earn more rewards!

If that all sounds interesting, you can:

Thank you so much for reading this message!

Congratulations @attiecyril! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!